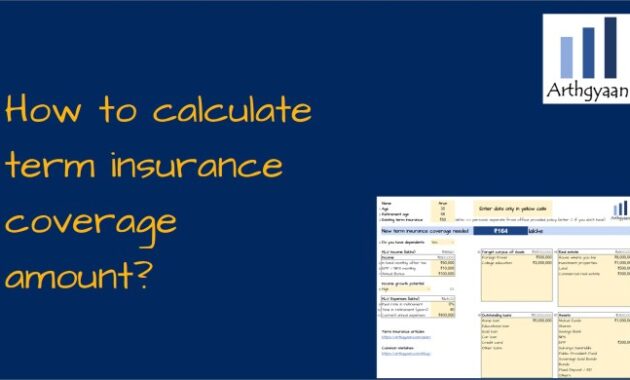

Securing your family’s financial well-being is a paramount concern, and understanding life insurance is a crucial step in that process. A term insurance calculator emerges as an invaluable tool, simplifying the often-complex world of life insurance planning. This guide delves into the functionality, benefits, and limitations of these calculators, empowering you to make informed decisions about your future. We will explore how these calculators work, the key factors influencing premium calculations, and the various types of term insurance policies available. Through illustrative examples and visualizations, we aim to demystify the process of selecting the right life insurance coverage, enabling Read More …