Securing your family’s financial future is a paramount concern, and life insurance plays a crucial role in achieving this. This guide delves into the intricacies of term life insurance, a vital tool for managing risk and providing financial security. We’ll explore its core features, comparing it to whole life insurance, and examining the factors that influence premiums. We’ll also uncover the application process, discuss valuable riders, and illustrate real-world scenarios to highlight its practical applications.

From understanding the nuances of policy durations and death benefit payouts to navigating the complexities of choosing the right provider, this guide aims to equip you with the knowledge necessary to make informed decisions about your life insurance needs. We’ll examine the various factors influencing premium costs, such as age, health, and lifestyle choices, and provide practical examples to clarify these concepts.

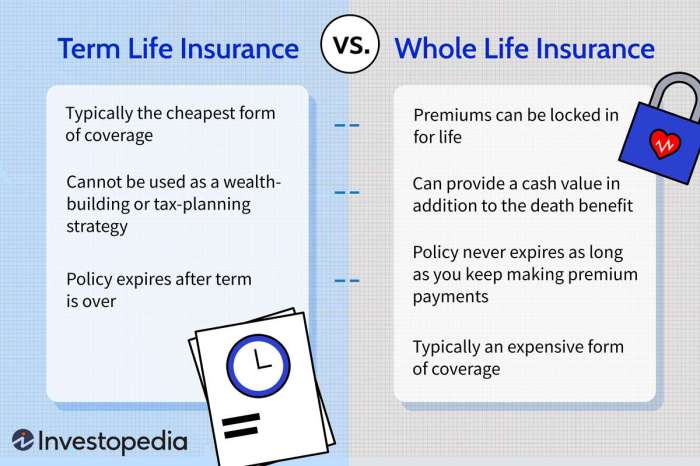

Defining Term Life Insurance vs. Whole Life Insurance

Choosing between term life insurance and whole life insurance is a significant financial decision. Understanding the key differences between these two types of policies is crucial to selecting the coverage that best aligns with your individual needs and financial goals. Both offer a death benefit to your beneficiaries, but their structures and features differ considerably.

Understanding the core differences between term and whole life insurance involves examining their duration, cost, and the nature of the death benefit. This comparison will clarify which type of policy is most suitable for various life stages and financial situations.

Term Life Insurance vs. Whole Life Insurance: A Feature Comparison

The following table highlights the key distinctions between term and whole life insurance policies. Consider these factors carefully when making your choice.

| Feature | Term Life | Whole Life | Key Differences |

|---|---|---|---|

| Policy Duration | Specific term (e.g., 10, 20, 30 years) | Lifelong coverage | Term life provides coverage for a defined period, while whole life offers lifelong protection. |

| Premiums | Generally lower premiums | Higher premiums | Term life premiums are significantly lower due to the limited coverage period. Whole life premiums remain constant throughout the policy’s duration. |

| Cash Value | No cash value | Builds cash value over time | Whole life policies accumulate a cash value component that can be borrowed against or withdrawn, while term life policies do not offer this feature. |

| Death Benefit | Pays a death benefit only if the insured dies within the policy term. | Pays a death benefit upon the insured’s death, regardless of when it occurs. | The death benefit payout is contingent upon the policy term in term life, whereas it’s guaranteed with whole life. |

| Renewal/Conversion Options | May offer renewal options at higher premiums or conversion to whole life. | No renewal necessary; coverage lasts a lifetime. | Term life policies often allow for renewal or conversion, while whole life policies are continuous. |

Typical Duration of Term Life Insurance Policies

Term life insurance policies are typically offered in durations ranging from 10 to 30 years, although shorter and longer terms may be available. The chosen duration reflects the insured’s anticipated need for coverage. For example, a 30-year term policy might be suitable for someone with young children, providing coverage until they reach adulthood. The implication of this finite duration is that the coverage expires at the end of the term, unless renewed (often at a higher premium) or converted to a different policy type. Failure to renew or convert leaves the insured without life insurance coverage.

Death Benefit Payout Structures

Both term and whole life insurance policies offer a death benefit, a predetermined sum paid to the beneficiaries upon the insured’s death. In term life insurance, the death benefit is paid only if death occurs within the specified policy term. Whole life insurance guarantees a death benefit payout regardless of when the insured passes away. The amount of the death benefit is typically a fixed sum, although some policies may offer features like increasing death benefits over time, though this is more common with whole life policies. For instance, a $500,000 term life policy will only pay out if the insured dies within the 20-year term. A whole life policy with a similar death benefit will pay out whenever the insured dies.

Factors Affecting Term Life Insurance Premiums

Understanding the factors that influence the cost of your term life insurance premium is crucial for making an informed decision. Several key elements contribute to the final price you pay, and being aware of these can help you find the most suitable and affordable policy. This section will Artikel those key factors and illustrate their impact.

Several key factors determine the cost of your term life insurance premiums. These factors are assessed by insurance companies to evaluate your risk profile. A higher-risk profile generally translates to higher premiums.

- Age

- Health Status

- Smoking Habits

- Occupation

- Policy Length

- Coverage Amount

Age’s Influence on Term Life Insurance Premiums

Age is a significant factor in determining term life insurance premiums. As you get older, your risk of death increases, leading to higher premiums. For example, a 30-year-old typically pays significantly less than a 50-year-old for the same coverage amount and policy length, reflecting the increased mortality risk associated with aging. Insurance companies use actuarial tables that reflect the average lifespan and mortality rates for different age groups to calculate these premiums.

Health Status’s Influence on Term Life Insurance Premiums

Your health status plays a critical role in premium calculations. Individuals with pre-existing conditions, such as heart disease, diabetes, or cancer, are generally considered higher risk and will pay higher premiums. Conversely, those in excellent health with no significant medical history typically qualify for lower rates. Insurance companies assess your health through medical questionnaires, sometimes including medical examinations, to accurately assess your risk. For instance, someone with a history of high blood pressure might pay considerably more than someone with a clean bill of health.

Smoking Habits’ Influence on Term Life Insurance Premiums

Smoking significantly increases the risk of various health problems, including lung cancer, heart disease, and stroke. As a result, smokers typically pay substantially higher premiums for term life insurance compared to non-smokers. The difference can be substantial, often amounting to hundreds or even thousands of dollars annually. This is because smokers have a statistically shorter life expectancy and a higher likelihood of making a claim on the policy.

Occupation’s Influence on Term Life Insurance Premiums

Certain occupations are considered more hazardous than others, leading to higher premiums for those in those professions. For example, individuals working in high-risk jobs like construction, mining, or firefighting will often pay more for life insurance than those in less hazardous professions, such as office work. The increased risk of injury or death associated with these jobs is factored into the premium calculation. A skydiver, for example, would likely pay significantly more than a librarian for the same coverage.

Policy Length and Coverage Amount’s Influence on Term Life Insurance Premiums

Both the length of the policy and the coverage amount significantly influence premium costs. Longer term policies generally cost more per year than shorter-term policies because they cover a longer period of risk. Similarly, higher coverage amounts lead to higher premiums because the insurer is taking on a larger financial obligation.

| Policy Length (Years) | Coverage Amount ($) | Approximate Annual Premium ($) |

|---|---|---|

| 10 | 250,000 | 500 |

| 20 | 250,000 | 750 |

| 10 | 500,000 | 1000 |

| 20 | 500,000 | 1500 |

Note: These are illustrative examples only and actual premiums will vary depending on individual circumstances and the specific insurer.

Understanding Term Life Insurance Riders and Add-ons

Term life insurance, while offering straightforward death benefit protection, can be enhanced with various riders and add-ons. These optional features provide additional coverage or benefits, tailoring the policy to better meet individual needs and circumstances. Understanding these riders is crucial for making an informed decision about your life insurance coverage.

Accidental Death Benefit Rider

This rider provides an additional death benefit payout if the insured dies as a result of an accident. The payout amount is typically a multiple of the base policy’s death benefit, often doubling or tripling it. The benefit is paid only if the death is directly attributable to an accident, and the policy’s definition of “accident” will specify the types of events covered. For example, a policy might exclude deaths caused by pre-existing conditions or self-inflicted injuries. Adding this rider offers peace of mind, knowing that a larger sum would be available to beneficiaries in the event of an accidental death. However, it comes with an increased premium. The cost will depend on factors such as the insured’s age, health, and the chosen multiple of the death benefit.

Terminal Illness Benefit Rider

A terminal illness benefit rider allows the insured to access a portion or all of the death benefit while still alive if diagnosed with a terminal illness. This provides financial assistance to cover medical expenses, end-of-life care, or other needs during the final stages of life. The definition of “terminal illness” is usually specified in the policy and often requires a prognosis of a limited life expectancy (e.g., six months or less). The benefit disbursement may be subject to specific requirements, such as medical certification. This rider offers significant value for individuals who wish to alleviate financial burdens associated with terminal illness, but it increases the premium cost. The additional premium reflects the higher risk assumed by the insurer.

Waiver of Premium Rider

The waiver of premium rider waives future premiums if the insured becomes totally disabled and unable to work. This prevents the policy from lapsing due to an inability to pay premiums, ensuring continued coverage. The definition of “total disability” is crucial and is usually defined in the policy. The rider typically requires proof of disability, often through medical documentation. While offering valuable protection against unforeseen circumstances, this rider adds to the overall cost of the insurance policy. The cost is determined by factors including the insured’s age and health.

Comparison of Riders

Understanding the value proposition of each rider requires considering individual circumstances and financial priorities. The following table summarizes the key aspects:

| Rider | Benefit | Cost | Value Proposition |

|---|---|---|---|

| Accidental Death Benefit | Increased death benefit in case of accidental death | Increased premium | Provides additional financial security for beneficiaries in case of accidental death. Best suited for individuals who perceive a higher risk of accidental death or want to maximize benefits for their families in such circumstances. |

| Terminal Illness Benefit | Access to death benefit during terminal illness | Increased premium | Offers financial assistance for medical expenses and end-of-life care. Most valuable for individuals concerned about the financial burden of a terminal illness. |

| Waiver of Premium | Waives premiums upon total disability | Increased premium | Protects policy coverage in case of disability and inability to pay premiums. Beneficial for individuals who want to ensure continuous coverage even if they become disabled. |

The Application and Approval Process for Term Life Insurance

Securing term life insurance involves a straightforward application process, but understanding the steps involved can help you prepare and expedite the approval. The process typically includes completing an application, undergoing medical underwriting (if required), and receiving a final decision from the insurer. The time it takes can vary depending on the complexity of your application and the insurer’s processes.

The application process begins with completing a detailed application form. This form will gather extensive personal information, including your health history, lifestyle choices, and financial details. Accuracy is crucial here, as any misrepresentation can lead to policy denial or even later disputes.

Information Required During the Application Process

The insurer needs comprehensive information to assess your risk. This typically includes personal details like your age, gender, occupation, and contact information. More importantly, they require a thorough medical history, including any pre-existing conditions, current medications, and family medical history. Lifestyle factors such as smoking habits, alcohol consumption, and hobbies (especially high-risk ones) are also considered. Finally, the application will request information about the desired coverage amount and policy term length. Depending on the coverage amount, the insurer may also require financial information to verify your ability to pay premiums.

Medical Underwriting and its Implications

Medical underwriting is a crucial part of the application process. It involves the insurer assessing your health risks to determine your eligibility for coverage and the associated premium. This typically involves providing medical records and, in some cases, undergoing a paramedical exam, where a nurse or technician collects blood and urine samples and measures your blood pressure and weight.

Types of Underwriting Processes

Insurers employ different underwriting processes, affecting both approval times and premiums. Simplified issue policies require minimal medical information and often offer quicker approval, but usually come with higher premiums and lower coverage limits. Standard underwriting involves a more thorough review of your medical history and may include a paramedical exam. This process is more comprehensive but allows for potentially lower premiums and higher coverage limits. Finally, some high-risk applicants may undergo further underwriting scrutiny, which may involve additional medical tests and a longer approval time. The specific underwriting process employed will depend on several factors, including your age, health history, requested coverage amount, and the insurer’s risk assessment. For example, a younger, healthy applicant applying for a smaller coverage amount might qualify for simplified issue, while an older applicant with pre-existing conditions seeking significant coverage might undergo standard or even more extensive underwriting.

Illustrating Term Life Insurance Scenarios

Understanding term life insurance is best done through real-world examples. These scenarios demonstrate how term life insurance can protect families and contribute to comprehensive financial planning, while also highlighting the potential negative consequences of insufficient coverage.

A Young Family’s Protection with Term Life Insurance

Imagine Sarah and Mark, a young couple with a one-year-old child, Lily. Sarah is a teacher earning $50,000 annually, and Mark is a software engineer earning $100,000 annually. They have a mortgage of $300,000, a $20,000 car loan, and approximately $10,000 in savings. They purchase a 20-year term life insurance policy with a death benefit of $750,000. The annual premium is approximately $1,500. If Mark were to pass away unexpectedly, the death benefit would cover the mortgage, car loan, and provide a substantial financial cushion for Lily’s education and living expenses, mitigating the devastating financial impact on Sarah and Lily. The $750,000 payout would significantly reduce the family’s financial strain during a difficult time. Without the insurance, Sarah would face significant financial hardship.

Term Life Insurance as Part of a Larger Financial Plan

John, a 35-year-old entrepreneur, is building his business and has significant assets, including his company, a home valued at $500,000, and investments totaling $200,000. He understands that his business is his primary asset and that his family’s financial future depends on its success. As part of his comprehensive financial plan, John secures a $1 million term life insurance policy for 20 years. This policy acts as a safety net, ensuring that his family would receive a substantial sum to manage debts, maintain their lifestyle, and allow his business time to stabilize or be sold if he were to pass away prematurely. The policy provides peace of mind, allowing him to focus on building his business without the constant worry of leaving his family vulnerable. This insurance functions as a crucial component of his risk management strategy.

Consequences of Inadequate Life Insurance Coverage

The absence of adequate life insurance can have severe repercussions. Consider the case of a family without life insurance where the primary breadwinner unexpectedly dies. The potential consequences include:

The following points illustrate the potential ramifications of insufficient life insurance coverage:

- Significant Debt Accumulation: Outstanding mortgage, loans, and credit card debts may become insurmountable, potentially leading to foreclosure or bankruptcy.

- Loss of Income and Lifestyle: The surviving family members may face a drastic reduction in their standard of living, struggling to meet basic needs.

- Financial Instability for Children: Children may be deprived of educational opportunities and a stable upbringing.

- Emotional Distress: The added stress of financial hardship exacerbates the emotional trauma of bereavement, negatively impacting the entire family’s well-being.

- Forced Sale of Assets: Valuable assets like homes or businesses may need to be sold hastily and potentially at a loss to meet financial obligations.

Comparing Term Life Insurance Providers

Choosing the right term life insurance provider is crucial, as policies can vary significantly in price and features. A thorough comparison is essential to secure the best coverage at a competitive rate. This section will explore how to effectively compare providers and identify key factors beyond just cost.

Provider Feature Comparison

Several major insurance companies offer term life insurance, each with its own strengths and weaknesses. The following table illustrates examples of differences in features and benefits. Note that specific offerings and pricing are subject to change and depend on individual circumstances.

| Provider | Features/Benefits | Potential Drawbacks |

|---|---|---|

| Company A (Example) | Competitive pricing, online application process, good customer service ratings. Offers optional riders like accidental death benefit. | May have limited underwriting flexibility for individuals with pre-existing health conditions. |

| Company B (Example) | Wide range of coverage options, including longer term lengths. Strong financial ratings. | Potentially higher premiums compared to some competitors. May require a medical exam for all applicants. |

| Company C (Example) | Offers simplified issue policies (no medical exam required for certain applicants), flexible payment options. | Coverage amounts may be limited compared to other providers. Potentially higher premiums for simplified issue policies. |

The Importance of Comparing Multiple Quotes

Obtaining quotes from multiple term life insurance providers is paramount. Different companies utilize varying underwriting criteria and pricing models, leading to substantial differences in premiums for seemingly identical coverage. Failing to compare quotes risks overpaying significantly for the same level of protection. For example, an individual seeking a $500,000, 20-year term policy might find a premium difference of hundreds of dollars annually between providers.

Factors Beyond Price in Provider Selection

While price is a significant factor, several other considerations are equally important when choosing a term life insurance provider. These include the financial strength and stability of the company, the quality of customer service, the ease of the application process, and the availability of beneficial riders and add-ons. A financially sound company is more likely to pay out claims reliably. Excellent customer service can prove invaluable during the claims process. A streamlined application process can save time and effort. Finally, riders such as accidental death benefits or critical illness coverage can enhance policy value.

Epilogue

Ultimately, choosing the right life insurance policy is a personal decision that requires careful consideration of your individual circumstances and financial goals. By understanding the key features of term life insurance, the factors influencing premiums, and the application process, you can confidently navigate the complexities of life insurance and secure a stable financial future for your loved ones. Remember to compare quotes from multiple providers and consider your long-term financial plan when making your selection. Protecting your family’s well-being is an investment worth making.

FAQ Guide

What is the difference between a beneficiary and a policy owner?

The policy owner is the person who purchases and maintains the life insurance policy, while the beneficiary is the designated individual(s) or entity who receives the death benefit upon the policy owner’s death.

Can I change my beneficiary after the policy is issued?

Yes, generally you can change your beneficiary at any time by submitting a written request to your insurance provider. However, there might be specific procedures Artikeld in your policy.

What happens if I miss a premium payment?

Missing a premium payment can result in your policy lapsing, meaning the coverage terminates. Most policies have a grace period (typically 30 days) to make the payment before lapse. Contact your insurer immediately if you anticipate difficulties making a payment.

How long does the application process typically take?

The application process can vary depending on the insurer and the complexity of the underwriting process. It can range from a few days to several weeks.

What if my health changes after I purchase a policy?

Your health status at the time of application is a key factor in determining your premiums. Significant changes in health after policy issuance might not affect your existing policy, but future policy changes or new applications may be impacted.