Choosing the right life insurance policy is a crucial decision, impacting your family’s financial security for years to come. Navigating the complexities of the life insurance industry can be daunting, with numerous companies offering a wide array of policies. This guide aims to simplify the process by presenting a detailed analysis of the top 10 life insurance companies, examining their financial strength, policy offerings, customer service, and pricing to help you make an informed choice.

We delve into the key factors to consider when selecting a provider, including financial stability ratings, policy types, customer reviews, and claims processing efficiency. By understanding these elements, you can confidently select a company that aligns with your individual needs and budget, ensuring peace of mind knowing your loved ones are protected.

Financial Strength and Stability

Choosing a life insurance company involves more than just comparing premiums. A critical factor is the insurer’s financial strength and stability, ensuring they can pay out claims when needed. This section examines the financial ratings of top life insurance companies and the implications of choosing a company with a lower rating.

Financial strength ratings from reputable agencies provide a crucial assessment of an insurer’s ability to meet its long-term obligations. These ratings reflect a comprehensive analysis of the company’s financial health, including its assets, liabilities, investment performance, and overall management. Understanding these ratings is essential for making an informed decision.

Financial Strength Rating Agencies and Their Significance

Major rating agencies, such as AM Best, Moody’s, and Standard & Poor’s (S&P), employ rigorous methodologies to evaluate the financial strength of insurance companies. These agencies assess various factors, including the insurer’s reserves, underwriting performance, investment portfolio, and overall management quality. A higher rating indicates a greater likelihood of the company fulfilling its policy obligations. For example, an A++ rating from AM Best signifies exceptional financial strength, while a lower rating, such as a B, suggests a higher risk of the company failing to meet its commitments. These ratings are not guarantees of future performance, but they provide valuable insights into a company’s current financial health.

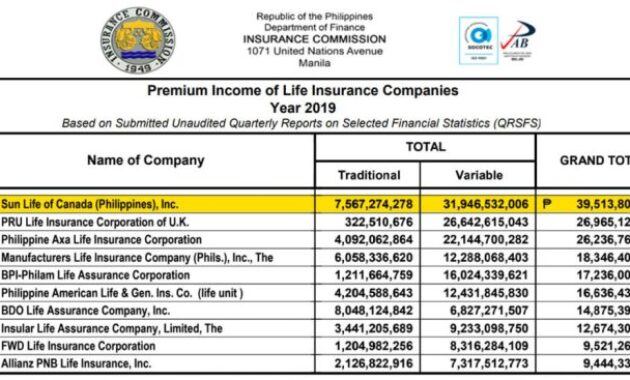

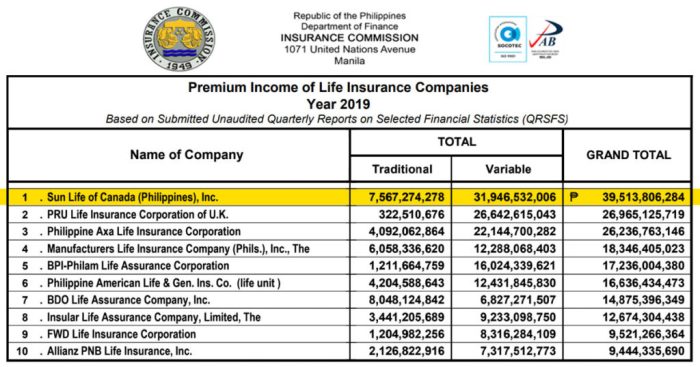

Comparison of Financial Strength Ratings Among Top 10 Companies

A direct comparison of the financial strength ratings of the top 10 life insurance companies requires accessing the most current data from rating agencies like AM Best, Moody’s, and S&P. These ratings can fluctuate, so relying on the most recent reports is crucial. Generally, you would expect the top 10 companies to have high ratings, predominantly in the A or AA range from AM Best, and equivalent ratings from Moody’s and S&P. However, subtle differences in ratings may exist, reflecting nuances in the companies’ financial profiles and risk management strategies. It’s essential to consult the latest reports from these rating agencies to get a precise comparison.

Risks Associated with Lower Financial Strength Ratings

Selecting a life insurance company with a lower financial strength rating presents several potential risks. The most significant risk is the possibility of the insurer’s inability to pay out death benefits or other policy benefits when they are due. This could leave beneficiaries without the financial protection they expected. Additionally, a lower rating may indicate underlying problems within the company, such as poor investment performance or inadequate risk management, which could further impact the insurer’s long-term stability and solvency. In some cases, a poorly rated company might even face insolvency, leading to policy cancellations or significant benefit reductions. While lower premiums might be tempting, the potential financial consequences of choosing a less financially stable insurer significantly outweigh the short-term savings.

Pricing and Affordability

Choosing life insurance involves careful consideration of cost alongside coverage. While financial strength is crucial, the affordability of premiums is equally important for ensuring long-term policy sustainability. This section examines the pricing structures of top life insurance companies and the factors that influence premium calculations.

Premium costs for similar life insurance policies can vary significantly between companies. This variation stems from a multitude of factors, including the company’s operational costs, risk assessment methodologies, and profit margins. A direct comparison of average premiums across all ten companies is difficult due to the lack of publicly available, standardized data encompassing all policy types and individual circumstances. However, general observations suggest that some companies may offer slightly lower premiums for specific policy types or demographic groups, while others prioritize comprehensive coverage features, potentially impacting pricing.

Factors Influencing Life Insurance Premium Costs

Several key factors contribute to the final premium amount. These factors are often intertwined and influence each other, leading to a complex pricing model. Understanding these factors helps consumers make informed decisions when selecting a policy.

- Age: Younger individuals generally receive lower premiums due to their statistically lower risk of mortality. As age increases, so does the premium, reflecting the heightened probability of a claim.

- Health: Pre-existing health conditions and current health status significantly impact premium calculations. Individuals with pre-existing conditions or unhealthy lifestyles typically face higher premiums to offset the increased risk for the insurer.

- Policy Type: Different policy types carry varying levels of risk and therefore different premium costs. Term life insurance, offering coverage for a specific period, is generally less expensive than whole life insurance, which provides lifelong coverage and often includes a cash value component.

- Coverage Amount: The higher the death benefit, the higher the premium. This is a direct correlation; greater coverage necessitates a higher premium to cover the increased potential payout.

- Lifestyle and Occupation: Certain high-risk occupations (e.g., firefighters, police officers) or lifestyles (e.g., smokers, extreme sports enthusiasts) may lead to higher premiums due to increased mortality risk.

- Gender: Historically, premiums have differed based on gender, reflecting statistical differences in life expectancy. However, this practice is becoming less prevalent due to regulatory changes and evolving actuarial models.

How Different Factors Affect Premium Calculations

Let’s illustrate how these factors interact to influence premiums. Consider two individuals applying for a $500,000 20-year term life insurance policy:

Individual A: 30-year-old, non-smoker, excellent health, average-risk occupation.

Individual B: 50-year-old, smoker, history of high blood pressure, high-risk occupation.

Individual A would likely receive a significantly lower premium than Individual B due to their younger age, healthy lifestyle, and lower-risk occupation. Individual B’s age, smoking habit, pre-existing condition, and occupation all contribute to a higher risk profile, resulting in substantially higher premiums. The exact premium difference would vary depending on the specific insurer and their underwriting guidelines. For example, Individual A might pay around $30-$50 per month, while Individual B could pay upwards of $150-$250 per month or even more. These figures are illustrative and should not be considered precise.

Last Recap

Selecting a life insurance provider requires careful consideration of various factors beyond simply the premium cost. This comprehensive review of the top 10 life insurance companies has highlighted the importance of financial stability, diverse policy options, responsive customer service, and efficient claims processing. By weighing these elements against your specific needs and circumstances, you can confidently choose a provider that offers the security and peace of mind you deserve, safeguarding your family’s future well-being.

General Inquiries

What does a financial strength rating signify?

Financial strength ratings, provided by agencies like AM Best, Moody’s, and S&P, assess an insurance company’s ability to pay claims. Higher ratings indicate greater financial stability and lower risk.

How often should I review my life insurance policy?

It’s recommended to review your life insurance policy annually or whenever there are significant life changes (marriage, birth of a child, change in income, etc.) to ensure it still meets your needs.

What is a rider in a life insurance policy?

A rider is an add-on to a life insurance policy that provides additional coverage or benefits, such as accidental death benefit or long-term care coverage. The availability and cost vary by company and policy.

Can I change my life insurance policy after purchasing it?

The possibility of changing your policy depends on the type of policy and the specific company. Some policies allow for adjustments to coverage amounts or premium payments, while others may have stricter limitations. Check your policy documents or contact your insurer.