Choosing the right auto insurance can feel overwhelming. With so many companies vying for your business, how do you determine which offers the best combination of coverage, price, and customer service? This guide delves into the world of “top” auto insurance, exploring what the term truly means and providing a framework to help you make an informed decision. We’ll examine key features, customer reviews, pricing strategies, claims processes, and crucial factors to consider before committing to a policy.

Understanding the nuances of auto insurance is key to protecting yourself and your vehicle. We’ll dissect the various types of coverage, highlighting the benefits and drawbacks of each. We’ll also explore how factors like your driving record, location, and the type of vehicle you own impact your premiums. By the end, you’ll be equipped with the knowledge to confidently navigate the complexities of auto insurance and select a provider that best suits your needs.

Defining “Top Insurance Auto”

The term “top insurance auto” refers to auto insurance companies that consistently excel in key areas important to consumers. This isn’t a single, universally agreed-upon designation, but rather a subjective assessment based on various factors weighed differently by individual consumers. Understanding what constitutes “top” requires examining these factors and how they contribute to an overall ranking.

Defining “top” in the context of auto insurance involves considering several perspectives. Some consumers prioritize comprehensive coverage, seeking the most extensive protection against potential losses. Others may focus on price, aiming for the lowest premiums possible. Still others value exceptional customer service, looking for a responsive and helpful insurer during claims processing and other interactions. Therefore, a “top” insurer isn’t necessarily the same for everyone.

Criteria for Determining Top Auto Insurance Companies

Several criteria are commonly used to determine which auto insurance companies are considered “top.” These include financial strength ratings, which indicate the insurer’s ability to pay claims; customer satisfaction scores, reflecting customer experiences with the company; claims handling efficiency, measuring how quickly and smoothly claims are processed; and the breadth and depth of coverage options offered. These factors, combined with pricing, ultimately determine a company’s overall ranking.

Comparison of Top-Rated Auto Insurance Providers

The following table compares several aspects of top-rated auto insurance providers. Note that these rankings can fluctuate, and individual experiences may vary. This table represents a snapshot in time and should not be considered exhaustive or definitive.

| Insurance Company | Average Premium (Annual) | J.D. Power Customer Satisfaction Score (Example) | Financial Strength Rating (Example) |

|---|---|---|---|

| Company A | $1200 | 850 | A+ |

| Company B | $1500 | 820 | A |

| Company C | $1100 | 880 | A+ |

| Company D | $1350 | 860 | A- |

Key Features of Top Auto Insurance Policies

Choosing the right auto insurance policy can feel overwhelming, given the variety of options and coverage levels available. Top-rated auto insurance policies typically share several key features designed to provide comprehensive protection and peace of mind. Understanding these features and their implications is crucial for making an informed decision.

Top insurers prioritize customer satisfaction and offer policies with a blend of standard and optional coverage designed to cater to diverse needs and budgets. The specific benefits and drawbacks of each coverage option depend heavily on individual circumstances, driving habits, and the value of the insured vehicle. Comparing different policies involves carefully weighing the cost against the level of protection offered.

Coverage Options and Their Benefits and Drawbacks

A wide array of coverage options exists, each with its own advantages and disadvantages. Understanding these nuances is key to selecting a policy that effectively balances cost and protection.

- Liability Coverage: This covers damages or injuries you cause to others in an accident. Higher liability limits offer greater protection against significant financial losses, but come with a higher premium. Lower limits might seem cheaper initially, but leave you vulnerable to substantial personal liability if you’re involved in a serious accident.

- Collision Coverage: This pays for repairs to your vehicle regardless of fault. While more expensive, it’s crucial for protecting your investment in case of an accident, even if you’re at fault. Dropping collision coverage on an older vehicle might be cost-effective, but leaves you responsible for repair costs if an accident occurs.

- Comprehensive Coverage: This covers damage to your vehicle from non-collision events like theft, vandalism, or weather damage. Similar to collision coverage, the cost-benefit analysis depends on the age and value of your vehicle and your risk tolerance. A newer, more expensive car warrants comprehensive coverage, while an older car might not.

- Uninsured/Underinsured Motorist Coverage: This protects you if you’re involved in an accident with an uninsured or underinsured driver. It’s highly recommended, as it mitigates the financial risk associated with accidents caused by drivers without sufficient insurance.

- Medical Payments Coverage (Med-Pay): This covers medical expenses for you and your passengers, regardless of fault. While often included in many policies, its value depends on your existing health insurance coverage. If you have robust health insurance, Med-Pay might be less crucial.

Comparison of Different Auto Insurance Policy Types

Several types of auto insurance policies cater to different needs and risk profiles. A clear understanding of these distinctions is essential for choosing the right fit.

| Policy Type | Description | Benefits | Drawbacks |

|---|---|---|---|

| Full Coverage | Includes liability, collision, and comprehensive coverage. | Maximum protection for your vehicle and financial liability. | Higher premiums. |

| Liability-Only | Covers only liability for damages to others. | Lower premiums. | No coverage for damage to your own vehicle. |

| State Minimum Coverage | Meets the minimum requirements set by your state. | Lowest premiums. | Limited protection in case of an accident. |

Key Features of Top Auto Insurance Policies: A Summary

The features highlighted above contribute significantly to the overall value and effectiveness of a top-rated auto insurance policy. Consider these points when comparing policies:

- Competitive Pricing: Top insurers offer competitive rates while maintaining high-quality coverage.

- Strong Financial Stability: Choosing a financially sound insurer ensures they can meet their obligations in case of a claim.

- Excellent Customer Service: Responsive and helpful customer service is essential for a smooth claims process.

- Comprehensive Coverage Options: A wide range of coverage options allows for customization to individual needs.

- Discounts and Rewards Programs: Many insurers offer discounts for safe driving, bundling policies, or other factors.

Customer Reviews and Ratings of Top Auto Insurers

Choosing the right auto insurance provider is a crucial decision, impacting your financial well-being in the event of an accident. Beyond comparing prices and coverage options, understanding customer experiences offers invaluable insight into the reliability and overall quality of service provided by different insurers. Analyzing customer reviews and ratings allows you to form a comprehensive picture of an insurer’s performance beyond the marketing materials.

Reliable sources for assessing customer satisfaction include independent rating agencies and review platforms. These sources offer a more objective perspective compared to company-sponsored testimonials.

Sources of Reliable Customer Reviews and Ratings

Several reputable sources provide aggregated customer reviews and ratings for auto insurance companies. These include J.D. Power, the Consumer Reports Auto Insurance Survey, and independent review websites like Yelp and Google Reviews. Each source employs its own methodology, but generally, they collect data through surveys, online reviews, and customer feedback forms. The volume of reviews and the consistency of feedback are crucial indicators of reliability. For instance, a company with a large number of overwhelmingly positive reviews is generally considered more trustworthy than one with a few scattered positive comments amidst many negative ones. It is also important to consider the time frame of the reviews; recent reviews provide a more current perspective on a company’s performance.

Methodology of Rating Agencies

Rating agencies like J.D. Power utilize sophisticated methodologies to assess auto insurers. These typically involve large-scale surveys sent to a statistically significant sample of policyholders. The surveys gather data on various aspects of the customer experience, including claims handling, customer service responsiveness, policy clarity, and overall satisfaction. The data is then analyzed using statistical methods to generate numerical scores and rankings. Weighting is often applied to different aspects of the customer experience, reflecting their relative importance to overall satisfaction. For example, claims handling speed and fairness might receive higher weighting than the ease of accessing the insurer’s website. This ensures the scores accurately reflect the aspects of customer experience that matter most to consumers.

Interpreting Customer Reviews and Ratings

Interpreting customer reviews and ratings requires a critical approach. While overall scores provide a useful summary, it’s crucial to examine the individual components contributing to the score. A high overall score might mask negative feedback in specific areas. For example, an insurer might receive high marks for pricing but low marks for claims processing. Examining detailed reviews helps to identify recurring themes and potential problems. Look for patterns in negative feedback; if multiple reviews mention slow claims processing or unhelpful customer service representatives, this indicates a potential systemic issue. Pay attention to the specifics of the reviews, not just the star rating. A five-star review detailing a minor inconvenience might be less valuable than a three-star review providing detailed information about a significant problem. The sheer volume of reviews also matters. A company with thousands of reviews offers a more robust data set than one with only a few dozen.

Customer Satisfaction Scores of Top-Rated Insurers

| Insurer | J.D. Power Score (Example) | Consumer Reports Score (Example) | Average Online Review Score (Example) |

|---|---|---|---|

| Insurer A | 850 | 4.5 | 4.2 |

| Insurer B | 820 | 4.2 | 3.9 |

| Insurer C | 790 | 4.0 | 3.7 |

| Insurer D | 800 | 3.8 | 3.5 |

Pricing and Affordability of Top Auto Insurance

Securing affordable yet comprehensive auto insurance is a crucial aspect of responsible car ownership. Understanding the factors that influence pricing and employing effective strategies to minimize costs without sacrificing necessary coverage is key. This section will delve into the complexities of auto insurance pricing, offering insights into cost comparisons and strategies for finding affordable options.

Factors Influencing Auto Insurance Premiums

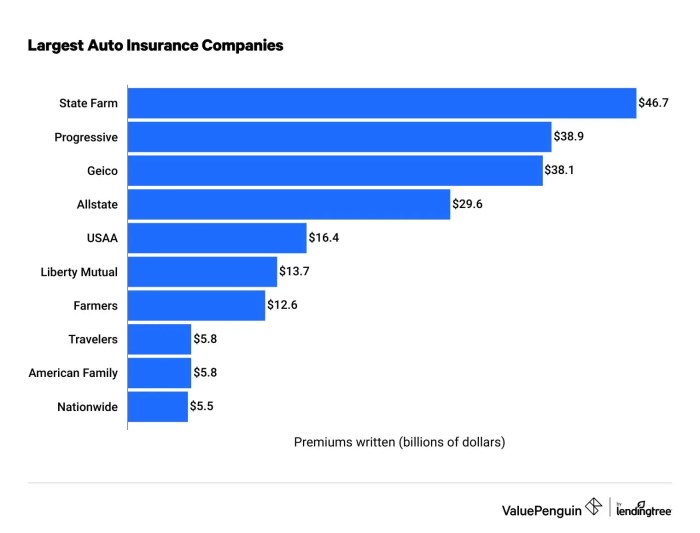

Several factors significantly impact the price of auto insurance policies. These include the driver’s age and driving history (younger drivers and those with accidents or violations typically pay more), the type of vehicle (sports cars and luxury vehicles are generally more expensive to insure), the coverage level selected (higher coverage limits result in higher premiums), the location of the driver (urban areas often have higher rates due to increased accident frequency), and the driver’s credit score (in many states, credit history is a factor in determining premiums). Furthermore, insurers use sophisticated algorithms considering numerous data points to assess risk and set premiums.

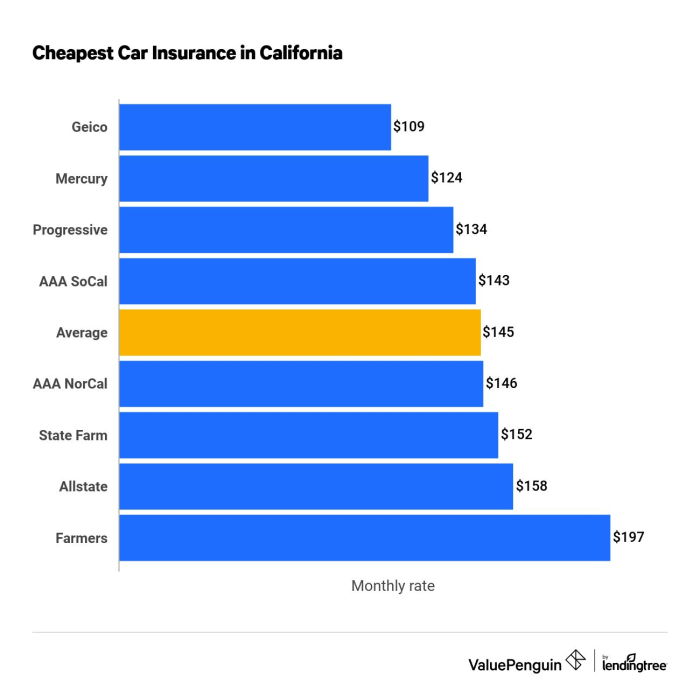

Average Premiums Across Different States/Regions

Average auto insurance premiums vary substantially across different states and regions due to factors such as traffic density, accident rates, and the cost of vehicle repairs. For example, states with high population density and frequent accidents, such as California and Florida, tend to have higher average premiums compared to states with lower population density and fewer accidents. Similarly, urban areas within a state typically have higher rates than rural areas. Precise figures require referencing recent data from insurance comparison websites or state-level regulatory bodies, as these rates fluctuate regularly. A hypothetical illustration: Assume State A has an average annual premium of $1200, while State B, with lower accident rates, averages $900. This difference highlights the significant regional variations in cost.

Strategies for Finding Affordable Auto Insurance

Finding affordable auto insurance involves a multi-pronged approach. One key strategy is to compare quotes from multiple insurers. Using online comparison tools can streamline this process. Drivers can also explore ways to improve their driving record by taking defensive driving courses, which may lead to premium discounts. Increasing the deductible amount (the amount the driver pays out-of-pocket before insurance coverage begins) can lower premiums, although this increases the financial risk for the driver. Bundling auto insurance with other types of insurance, such as homeowners or renters insurance, can often result in discounts. Maintaining a good credit score, where applicable, is also crucial as it can positively influence premium calculations. Finally, carefully evaluating the coverage levels needed, choosing only necessary coverages, can help control costs.

Premium Cost vs. Coverage Level Visualization

Imagine a graph with the x-axis representing different levels of coverage (e.g., liability limits, collision, comprehensive) and the y-axis representing the premium cost. Several lines would represent different insurers, each showing how their premium cost increases as the coverage level increases. For instance, Insurer A might have a steeper slope than Insurer B, indicating that Insurer A’s premiums increase more rapidly with higher coverage levels. This visual would clearly illustrate the trade-off between cost and coverage, allowing consumers to compare the value proposition offered by different insurers at various coverage levels. The graph would show that while higher coverage provides greater protection, it comes at a higher cost, and the rate of increase varies across insurers.

Claims Process and Customer Service of Top Insurers

Navigating an auto insurance claim can be stressful, but understanding the process and knowing what to expect from top-rated insurers can significantly ease the burden. The claims process, customer service responsiveness, and overall efficiency vary considerably among providers, impacting the policyholder’s experience. This section will delve into the typical claims process, compare handling speeds, and offer insights into both positive and negative customer service encounters.

The typical claims process for most top-rated auto insurance companies generally follows these steps: reporting the accident, initial investigation, damage assessment, claim settlement, and payment. However, the speed and efficiency at which each step is completed can vary dramatically. Some insurers utilize advanced technology and streamlined processes, leading to faster claim resolutions, while others may have more cumbersome procedures, resulting in delays.

Claims Handling Speed and Efficiency

The speed and efficiency of claim handling are crucial factors in determining an insurer’s overall quality. Some companies boast same-day or next-day claim processing for minor incidents, while more complex claims involving significant damage or liability disputes may take several weeks or even months to resolve. For instance, Company A, known for its technologically advanced claims system, often settles uncomplicated claims within a week, while Company B, with a more traditional approach, may take considerably longer. This difference stems from varying levels of automation, staff training, and claims adjuster availability. The efficiency also depends on factors such as the clarity and completeness of the information provided by the policyholder during the initial claim report.

Examples of Customer Service Experiences

Positive experiences often involve prompt responses to inquiries, clear communication throughout the process, and fair claim settlements. For example, a policyholder with Company C reported a positive experience, highlighting the insurer’s proactive communication and the adjuster’s empathy in handling their accident claim. In contrast, negative experiences frequently involve long wait times for responses, unclear communication, and disputes over claim settlements. A policyholder with Company D described a frustrating experience involving multiple unanswered calls and a protracted dispute over the valuation of their vehicle’s damage. These contrasting experiences emphasize the significant variation in customer service quality across different insurers.

Tips for Navigating the Claims Process

To ensure a smoother and more efficient claims process, policyholders should: document the accident thoroughly (including photos and witness information), report the accident promptly to the insurer, cooperate fully with the investigation, and keep detailed records of all communication with the insurer. Understanding your policy coverage and knowing your rights are also essential. Promptly gathering all necessary documentation – police reports, medical records, repair estimates – can significantly expedite the process. Maintaining clear and concise communication with your insurer and asking clarifying questions when needed can prevent misunderstandings and delays. Finally, if dissatisfied with the insurer’s response, understanding your options for appealing a claim decision is crucial.

Factors to Consider When Choosing an Auto Insurer

Choosing the right auto insurance provider is a crucial decision impacting your financial well-being and peace of mind. A seemingly small difference in premiums can translate into significant savings over the long term, while inadequate coverage could leave you financially vulnerable in the event of an accident. Therefore, a thorough evaluation of various insurers is essential before committing to a policy.

Policy Details and Coverage

Carefully reviewing the specifics of an auto insurance policy is paramount. Don’t just focus on the price; understand the extent of coverage provided. This includes liability limits, collision and comprehensive coverage, uninsured/underinsured motorist protection, and roadside assistance. Pay close attention to deductibles, as a higher deductible typically means lower premiums but also a larger out-of-pocket expense in the event of a claim. Comparing policies side-by-side, using a standardized comparison sheet, will help highlight key differences and ensure you’re making an informed decision. For example, one policy might offer superior roadside assistance, while another might provide better liability coverage for the same price.

Implications of Price-Based Decisions

While price is undoubtedly a factor, basing your choice solely on the cheapest option can be risky. The lowest premium might reflect limited coverage, high deductibles, or a less reputable insurer with a history of slow claim processing or poor customer service. Consider the potential cost of inadequate coverage compared to the seemingly small premium difference. A cheaper policy that leaves you underinsured could result in far greater financial losses in the event of a serious accident. For instance, a lower premium policy with a $2,000 deductible could mean you pay a significant amount out of pocket even for minor repairs, while a slightly more expensive policy with a $500 deductible would reduce this burden substantially.

Checklist for Evaluating Auto Insurance Options

Before committing to an auto insurance provider, use this checklist to ensure you’ve considered all the relevant factors:

- Coverage Levels: Compare liability limits, collision, comprehensive, uninsured/underinsured motorist, and roadside assistance.

- Deductibles: Evaluate the impact of different deductible amounts on your premiums and out-of-pocket expenses.

- Premium Costs: Obtain quotes from multiple insurers to compare prices and coverage options.

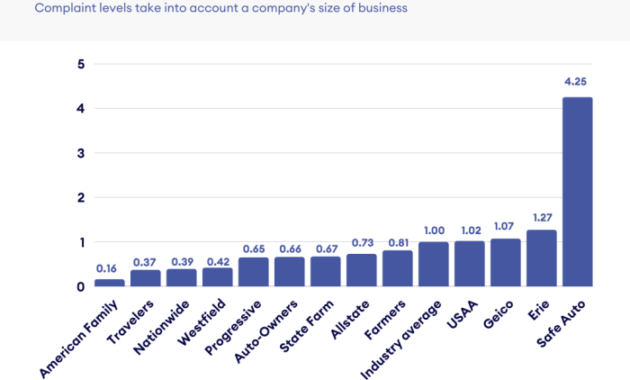

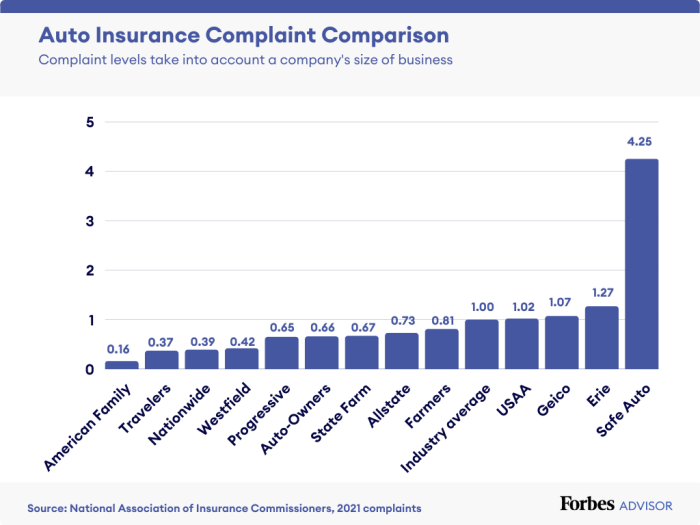

- Customer Reviews and Ratings: Research the insurer’s reputation for claim processing speed, customer service responsiveness, and overall satisfaction.

- Financial Stability: Check the insurer’s financial strength rating to ensure they can meet their obligations in the event of a claim.

- Discounts: Inquire about available discounts, such as those for safe driving, bundling policies, or paying in full.

Final Conclusion

Selecting the right auto insurance provider is a crucial financial decision. By carefully considering factors such as coverage, pricing, customer reviews, claims processes, and your individual needs, you can confidently choose a policy that provides adequate protection without breaking the bank. Remember to compare multiple quotes, read policy details thoroughly, and don’t hesitate to ask questions before making a commitment. Empowering yourself with knowledge is the first step toward securing the best possible auto insurance for your circumstances.

Questions Often Asked

What is the difference between liability and collision coverage?

Liability coverage pays for damages you cause to others’ property or injuries you inflict on others in an accident. Collision coverage pays for damage to your own vehicle, regardless of fault.

How often can I expect my insurance rates to change?

Rates can change annually, or even more frequently, depending on your driving record, claims history, and changes in the insurer’s risk assessment.

What factors affect my auto insurance premium besides driving record?

Your age, location, credit score, type of vehicle, and the amount of coverage you choose all influence your premium.

Can I bundle my auto and homeowners insurance?

Yes, many insurers offer discounts for bundling multiple policies.

What should I do immediately after a car accident?

Ensure everyone is safe, call emergency services if needed, exchange information with the other driver, and contact your insurance company to report the accident.