Finding the right term life insurance can feel overwhelming. With so many providers and policies, understanding what constitutes “top-rated” is crucial. This guide navigates the complexities, exploring the factors that determine a policy’s ranking, highlighting key features of top-performing options, and empowering you to make an informed decision that aligns with your specific needs and budget.

We’ll delve into the intricacies of policy ratings, comparing different sources and criteria. We’ll also examine the essential features – death benefit, premiums, riders – and how they impact the overall value. By the end, you’ll possess a clear understanding of how to select a top-rated term life insurance policy that offers robust protection at a price you can comfortably afford.

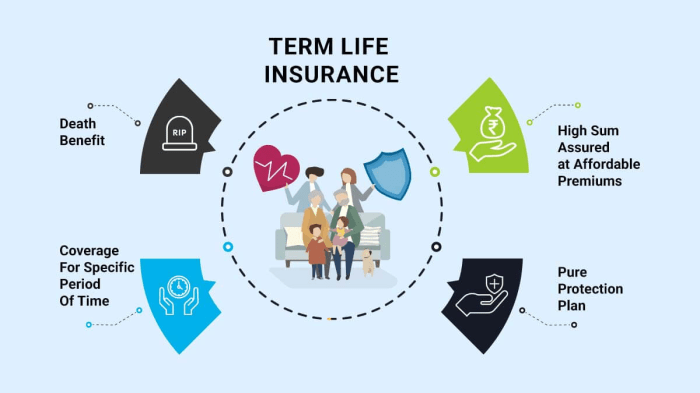

Key Features of Top-Rated Policies

Choosing a term life insurance policy can feel overwhelming, given the numerous options available. Understanding the key features of top-rated policies is crucial to securing the best coverage for your needs and budget. This section will compare and contrast several highly-rated policies, highlighting common characteristics and the significance of specific policy elements.

Top-rated term life insurance policies consistently share several key features. These features are not merely marketing points but reflect the insurer’s commitment to providing comprehensive and reliable coverage at a competitive price. Analyzing these commonalities helps consumers make informed decisions when selecting a policy.

Death Benefit Amounts and Payout Options

The death benefit is the core of any life insurance policy; it’s the sum paid to your beneficiaries upon your death. Top-rated policies offer a wide range of death benefit options, allowing you to tailor the coverage to your family’s specific financial needs. Some policies may offer accelerated death benefits, allowing a portion of the death benefit to be accessed while you’re still alive for specific critical illnesses. Conversely, a drawback in some policies might be limited options for payout structures, potentially hindering flexibility in how the benefit is distributed among beneficiaries. For example, Policy A might offer a lump-sum payout only, while Policy B provides options for lump-sum, installment payments, or a combination thereof. The choice depends on your beneficiaries’ needs and financial planning.

Premium Costs and Payment Flexibility

Premiums are the regular payments made to maintain your life insurance coverage. Top-rated policies often balance affordability with comprehensive coverage. Competitive premiums are a significant factor in a policy’s rating. However, a lower premium might sometimes come with limitations, such as a shorter coverage term or fewer riders. Payment flexibility, such as annual, semi-annual, or monthly payment options, is another crucial factor contributing to a policy’s overall appeal. For instance, Policy C might offer a lower annual premium but only allow annual payments, while Policy D offers a slightly higher premium but provides monthly payment options for greater flexibility.

Policy Riders and Additional Coverage

Riders are add-on features that enhance the core policy. Top-rated policies often offer a range of riders to address specific needs. Common riders include accidental death benefit riders (doubling the death benefit in case of accidental death), critical illness riders (providing a payout upon diagnosis of a critical illness), and long-term care riders (covering long-term care expenses). The availability and cost of these riders vary across policies. A policy with a comprehensive suite of affordable riders is generally considered more attractive than one with limited options or expensive add-ons. For example, Policy E might offer a waiver of premium rider (waiving future premiums if the policyholder becomes disabled), while Policy F may not include this option.

Financial Strength and Company Reputation

The financial stability of the insurance company is paramount. Top-rated policies are offered by companies with strong financial ratings from reputable agencies like A.M. Best and Moody’s. These ratings reflect the insurer’s ability to pay claims reliably. A policy from a financially unstable company, regardless of other attractive features, carries a significant risk. Choosing a policy from a highly-rated insurer provides peace of mind, knowing your beneficiaries are protected. Consider that a company with a lower rating might offer a lower premium, but this lower cost might reflect a higher risk of not being able to pay out claims in the future.

The Application and Underwriting Process

Applying for term life insurance might seem daunting, but understanding the process can make it significantly smoother. It generally involves completing an application, undergoing medical underwriting, and receiving a policy offer. The specific steps may vary slightly depending on the insurer, but the core elements remain consistent.

The application process hinges on providing accurate information to the insurance company. This allows them to assess your risk profile and determine your eligibility for coverage and the associated premium. Medical underwriting plays a crucial role in this assessment.

The Application Steps

The application typically begins with an online or phone inquiry, followed by completing a detailed application form. This form requests personal information, health history, lifestyle details (like smoking habits), and beneficiary information. Be prepared to provide accurate and comprehensive answers; inaccuracies can delay the process or even lead to policy denial. Following the application submission, the insurer will initiate the underwriting process.

Medical Underwriting: Assessing Risk

Medical underwriting is the process by which the insurance company assesses your health and risk profile to determine your eligibility for coverage and the appropriate premium. This involves reviewing your application, potentially requesting additional medical information (such as medical records or lab results), and possibly requiring a paramedical exam. A paramedical exam involves a nurse visiting your home or workplace to collect basic health information and perform non-invasive tests like blood pressure and blood sample collection. The results of this process directly impact your premium; individuals with better health profiles typically qualify for lower premiums. For example, a non-smoker with a clean bill of health will generally receive a lower premium than a smoker with pre-existing conditions.

Navigating the Application Process Efficiently

To efficiently navigate the application process, gather all necessary information beforehand. This includes your medical history, employment details, and contact information for your doctor(s). Be honest and thorough in your responses. Any omissions or inaccuracies can delay the process and potentially lead to complications later. If you have any questions or concerns, don’t hesitate to contact the insurer’s customer service department for clarification. Maintaining clear and open communication throughout the process can help ensure a smooth and efficient experience. Remember to keep copies of all submitted documents for your records. Finally, comparing quotes from multiple insurers can help you find the best coverage at the most competitive price.

Closure

Choosing top-rated term life insurance is a significant financial decision, but with careful consideration of your individual circumstances and a thorough understanding of policy features, the process can be streamlined and simplified. Remember to compare quotes from multiple providers, review policy details meticulously, and don’t hesitate to seek professional advice when needed. By following the guidelines Artikeld in this guide, you can confidently secure a policy that provides peace of mind and financial security for your loved ones.

Q&A

What is the difference between term and whole life insurance?

Term life insurance provides coverage for a specific period (term), while whole life insurance offers lifelong coverage and builds cash value.

How long does the application process take?

Application processing times vary depending on the insurer and the applicant’s health. It can range from a few days to several weeks.

Can I increase my coverage amount later?

Some policies allow for an increase in coverage, often requiring a new medical underwriting process. This option may not be available after a certain age.

What happens if I miss a premium payment?

Missing a premium payment can lead to a lapse in coverage. Most insurers offer grace periods, but contacting them immediately is crucial to avoid policy cancellation.

What are the tax implications of term life insurance?

Death benefits paid to beneficiaries are generally tax-free. However, it’s advisable to consult a tax professional for personalized advice.