The thrill of travel often overshadows the potential for unforeseen circumstances. A sudden illness, a delayed flight, or lost luggage can quickly transform a dream vacation into a costly nightmare. This is where travel insurance for a trip steps in, offering a safety net that protects your investment and peace of mind. Understanding the nuances of various travel insurance plans, coverage options, and the claims process is crucial for ensuring a smooth and worry-free journey, regardless of your destination or travel style.

This guide delves into the essential aspects of travel insurance, providing a detailed breakdown of different plan types, crucial coverage components, and factors influencing costs. We’ll explore the purchasing and claims process, address specific trip types and their unique insurance needs, and illustrate scenarios where travel insurance proves invaluable—or where it might not apply. By the end, you’ll be well-equipped to make informed decisions and choose the right travel insurance to suit your individual needs.

Types of Travel Insurance

Choosing the right travel insurance plan can significantly impact your trip’s peace of mind and financial protection. Understanding the different types available and their respective coverage is crucial for making an informed decision. This section Artikels several common travel insurance plan categories, highlighting their key features and suitability for various travelers.

Single Trip Travel Insurance

Single trip insurance covers a specific journey with defined start and end dates. This is ideal for those traveling for a short period, such as a week-long vacation or a business trip. Coverage typically includes medical emergencies, trip cancellations, lost luggage, and other unforeseen circumstances within the specified travel dates. The policy is void once the trip concludes. Premiums are usually calculated based on the trip’s duration, destination, and the level of coverage selected.

Annual Multi-Trip Travel Insurance

Annual multi-trip insurance provides coverage for multiple trips within a year. This option is cost-effective for frequent travelers, offering protection on several journeys, each with its own set of dates. The policy usually specifies a maximum number of days per trip and the total number of trips covered within the annual period. This type of policy is particularly beneficial for business travelers or those who undertake several leisure trips throughout the year. The overall cost can be lower than purchasing individual single-trip policies for each journey.

Backpacker Travel Insurance

Backpacker insurance caters specifically to the needs of long-term travelers, often including extended adventure activities. It typically offers broader coverage than standard plans, encompassing activities such as hiking, trekking, and other adventurous pursuits often excluded from regular policies. These policies often include higher coverage limits for medical emergencies and repatriation, acknowledging the increased risks associated with extended travel and adventurous activities. Premiums are usually higher to reflect the greater level of risk and extended coverage period.

Luxury Travel Insurance

Luxury travel insurance is designed for high-net-worth individuals undertaking high-end trips. This type of insurance provides extensive coverage, often including higher limits for medical expenses, lost or damaged valuables, and concierge services. It might also cover cancellations due to reasons not typically included in standard policies, such as inclement weather impacting a luxury resort stay. Premiums are significantly higher than standard plans, reflecting the increased coverage and services offered.

| Plan Type | Coverage Highlights | Cost Factors | Ideal Traveler Profile |

|---|---|---|---|

| Single Trip | Medical emergencies, trip cancellations, lost luggage, limited adventure activities | Trip duration, destination risk, coverage level | Individuals or families traveling for a short, specific trip |

| Annual Multi-Trip | Multiple trips within a year, medical emergencies, trip cancellations, lost luggage | Number of trips, trip duration, destination risk, coverage level | Frequent travelers, business travelers |

| Backpacker | Extended coverage duration, higher limits for medical emergencies, coverage for adventure activities | Trip duration, destination risk, activities covered, coverage level | Long-term travelers, backpackers, adventure travelers |

| Luxury | High coverage limits, concierge services, coverage for high-value items, broader cancellation reasons | Trip cost, destination, coverage level, additional services | High-net-worth individuals, luxury travelers |

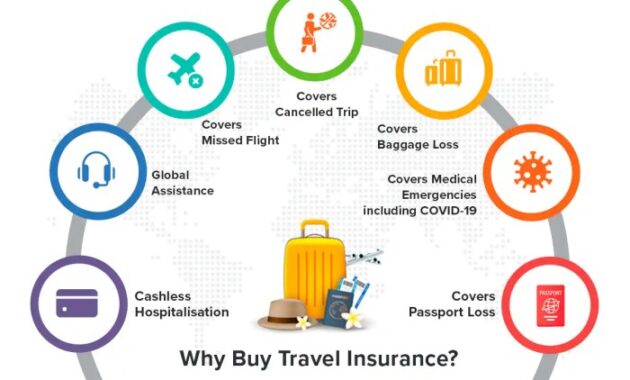

Essential Coverage Components

Choosing the right travel insurance policy involves understanding the core components that offer crucial protection during your trip. A comprehensive policy goes beyond basic coverage, providing peace of mind and financial security in unforeseen circumstances. Let’s explore the essential elements that should be considered.

Medical Emergency Coverage, Evacuation, and Repatriation

Medical emergencies can arise unexpectedly, and the costs associated with treatment abroad can be exorbitant. Medical emergency coverage is vital for covering expenses related to illness or injury while traveling, including doctor visits, hospital stays, and necessary medications. Equally important are evacuation and repatriation services. Evacuation covers the cost of transporting you from a remote location to a facility with adequate medical care, while repatriation covers the cost of bringing you back home if your condition requires it. Consider a scenario where you’re hiking in a remote area and suffer a serious injury. Evacuation coverage would ensure your safe transport to a hospital, and repatriation would cover your return home for continued treatment if needed. The costs associated with such events can easily reach tens of thousands of dollars, making this coverage a crucial investment.

Trip Cancellation and Interruption Insurance

Unforeseen events can disrupt travel plans, leading to significant financial losses. Trip cancellation insurance protects you against the costs of canceling your trip due to covered reasons such as illness, severe weather, or family emergencies. Trip interruption insurance covers the additional expenses incurred if your trip is cut short due to similar unforeseen circumstances. For example, if a sudden family emergency requires you to return home early, trip interruption insurance would help reimburse you for non-refundable flights, accommodation, and other prepaid expenses. Similarly, if a natural disaster forces the cancellation of your trip, trip cancellation insurance will protect your investment.

Baggage Loss or Delay Coverage

Losing or experiencing a significant delay of your luggage can disrupt your trip and cause considerable inconvenience. Baggage loss or delay coverage helps reimburse you for the cost of replacing essential items or covering expenses incurred while waiting for your luggage to arrive. Imagine arriving at your destination only to discover your luggage has been lost. This coverage can help you purchase necessary clothing, toiletries, and other essentials until your luggage is recovered. Similarly, if your luggage is significantly delayed, this coverage can assist with purchasing temporary replacements. The specific details of what is covered and the reimbursement limits vary depending on the policy.

Travel Accident and Personal Liability Coverage

Travel accident coverage provides financial support in case of accidental death or injury during your trip. Personal liability coverage protects you against claims of injury or damage to property caused by you to others. For example, if you accidentally injure someone while skiing, personal liability coverage would help cover the legal and medical expenses associated with the incident. Similarly, if you accidentally damage someone else’s property, this coverage can protect you from significant financial liability. The extent of coverage varies across policies, so it’s important to understand the specifics.

Factors Influencing Insurance Costs

The price you pay for travel insurance isn’t arbitrary; several factors contribute to the final premium. Understanding these factors allows you to make informed decisions and potentially secure more affordable coverage. These factors interact in complex ways, meaning a small change in one area can significantly impact the overall cost.

Several key elements determine the cost of your travel insurance policy. These range from readily apparent aspects like trip length to more nuanced factors such as your pre-existing health conditions. The insurer assesses risk, and that assessment directly translates to the premium you’ll pay.

Destination Risk

The inherent risks associated with your travel destination significantly influence the cost of your insurance. Destinations with higher rates of crime, political instability, natural disasters, or health concerns (e.g., outbreaks of infectious diseases) will generally command higher premiums. For example, a trip to a remote area with limited medical facilities will be more expensive to insure than a trip to a major city with readily available healthcare. The insurer needs to account for the potential for increased claims in higher-risk areas.

Trip Length

The longer your trip, the higher the likelihood of something unexpected occurring. This increased exposure to potential incidents directly translates into a higher premium. A two-week trip will typically cost more to insure than a weekend getaway. The insurer’s risk increases proportionally with the duration of your travel.

Age of Traveler

Age is a significant factor because older travelers statistically have a higher risk of needing medical attention. Insurance companies use actuarial data to assess this risk, resulting in higher premiums for older travelers. This is not age discrimination but rather a reflection of the increased probability of health issues arising during travel. A 70-year-old’s premium will likely be higher than a 30-year-old’s, all other factors being equal.

Pre-existing Conditions

Pre-existing medical conditions significantly impact the cost of travel insurance. If you have a pre-existing condition, the insurer will assess the potential for that condition to require medical attention or evacuation during your trip. This assessment may result in a higher premium or even a denial of coverage for related issues. It is crucial to disclose all pre-existing conditions accurately when applying for insurance. Failing to do so could lead to claim denials.

Level of Coverage

The extent of coverage you choose directly affects the premium. Comprehensive plans that cover a wider range of events (e.g., trip cancellations, medical emergencies, lost luggage, and emergency evacuation) will naturally cost more than basic plans with limited coverage. Choosing a plan with higher coverage limits for medical expenses will also increase the cost. Weigh the potential costs of unforeseen events against the cost of the insurance premium when selecting your coverage level.

Tips for Securing Affordable Travel Insurance

Choosing the right travel insurance can significantly impact your trip budget. Here are some tips to help you secure affordable yet adequate coverage:

- Compare quotes from multiple insurers: Don’t settle for the first quote you receive. Shopping around ensures you find the best price for the coverage you need.

- Consider a higher deductible: Opting for a higher deductible can significantly lower your premium. This strategy requires careful consideration of your risk tolerance and financial capacity.

- Purchase insurance early: Booking your travel insurance early can often lead to better rates. Waiting until the last minute can limit your options and potentially increase the cost.

- Travel during the off-season: Traveling during the off-season can sometimes lead to lower insurance premiums due to reduced overall risk.

- Be aware of exclusions and limitations: Carefully review the policy document to understand any exclusions or limitations on coverage before purchasing the insurance.

Purchasing and Claiming Process

Securing travel insurance is straightforward, and making a claim, while hopefully unnecessary, is also a manageable process. Understanding the steps involved in both purchasing and claiming can significantly reduce stress should the unexpected occur. This section details the process from policy purchase to claim settlement.

Online Purchase of Travel Insurance

Purchasing travel insurance online typically involves a series of simple steps. First, you’ll need to provide details about your trip, including your destination, travel dates, and the number of travelers. Next, you’ll select the level of coverage that best suits your needs and budget. This often involves choosing from various plan options with different levels of benefits and premiums. Finally, you’ll provide your personal and payment information to complete the purchase. After payment confirmation, you’ll receive your policy documents electronically, usually via email. It’s crucial to review these documents carefully to understand your coverage and policy limitations.

Filing a Travel Insurance Claim

Filing a claim involves promptly notifying your insurance provider of the incident, gathering necessary documentation, and completing the claim form accurately and completely. The claim process generally begins with reporting the incident to your insurer within the timeframe specified in your policy. Failure to do so promptly might affect your claim’s eligibility. The insurer will then guide you through the next steps, which typically involve submitting supporting documentation.

Necessary Documentation for a Successful Claim

Supporting documentation is vital for a successful claim. The specific documents required vary depending on the nature of the incident. However, some common documents include a copy of your travel insurance policy, a detailed account of the incident, and any relevant medical reports, police reports, or receipts for expenses incurred. For example, if you need to claim for lost luggage, you’ll need a police report and receipts for replacement items. If you require medical coverage, you’ll need medical bills and doctor’s reports. Providing comprehensive documentation streamlines the claims process and increases the chances of a successful outcome.

Travel Insurance Claim Process Flowchart

Step 1: Incident Occurs

Step 2: Contact your insurer within the specified timeframe (e.g., 24-48 hours).

Step 3: Complete and submit the claim form.

Step 4: Gather and submit supporting documentation (e.g., medical reports, police reports, receipts).

Step 5: Insurer reviews the claim and supporting documents.

Step 6: Insurer approves or denies the claim.

Step 7: If approved, payment is processed.

Travel Insurance and Specific Trip Types

Travel insurance needs vary significantly depending on the nature of your trip. Understanding these differences is crucial for securing adequate protection and avoiding costly surprises. The type of trip you’re taking directly impacts the level and type of coverage you should consider.

Adventure Travel Insurance Needs

Adventure travel, encompassing activities like extreme sports, mountaineering, and trekking in remote areas, presents unique risks. Standard travel insurance policies often exclude or limit coverage for such high-risk activities. Therefore, travelers engaging in adventure activities need specialized policies that explicitly cover medical emergencies, evacuation, and potential equipment damage in challenging environments. These policies typically come at a higher premium but offer the necessary protection for potentially life-threatening situations. For instance, a policy might cover helicopter rescue from a remote hiking trail or medical repatriation following a skiing accident. It’s vital to carefully review the policy’s activity list and ensure your planned activities are explicitly covered.

Business Trip Insurance versus Leisure Travel Insurance

Business trips and leisure trips differ significantly in their insurance needs. Business trips often involve higher-value items (laptops, business documents), greater potential for liability (professional errors or accidents), and possibly more stringent cancellation policies. Business travel insurance typically covers trip cancellations due to work-related reasons, provides broader liability coverage for professional activities, and may offer higher limits for lost or stolen belongings. Leisure travel insurance, on the other hand, usually focuses on medical emergencies, trip cancellations due to unforeseen circumstances (illness, natural disasters), and lost luggage. The cost of business travel insurance is often higher to reflect the increased risks and coverage provided.

International Travel Insurance and Local Laws

International travel requires careful consideration of local laws and regulations when choosing travel insurance. Healthcare systems and legal frameworks vary widely across countries. Some countries may require specific types of insurance or have mandatory medical evacuation protocols. For example, certain countries may not recognize your home country’s health insurance, necessitating the purchase of supplemental international coverage. Understanding these local requirements is vital to ensure adequate protection and avoid unexpected costs or legal complications. It is advisable to research the destination country’s healthcare system and legal requirements before selecting a policy.

Insurance for Cruises and Group Tours

The following table summarizes the specific risks, recommended coverage, and example providers for cruises and group tours:

| Trip Type | Specific Risks | Recommended Coverage | Example Providers |

|---|---|---|---|

| Cruise | Seasickness, medical emergencies onboard, trip cancellations due to weather, lost luggage | Medical evacuation, trip cancellation, baggage loss, personal liability | World Nomads, Allianz Global Assistance, Travel Guard |

| Group Tour | Trip cancellation due to group member illness, baggage loss, medical emergencies during activities, liability for accidents during group activities | Trip cancellation, medical expenses, baggage loss, personal liability, emergency assistance | Travel Insured International, Squaremouth, AIG Travel |

Final Conclusion

Travel insurance, while often overlooked, is a crucial component of responsible travel planning. By carefully considering your trip’s specifics, understanding the different coverage options available, and choosing a plan that aligns with your needs and budget, you can significantly reduce the financial and emotional burden of unexpected events. Remember, the peace of mind provided by adequate travel insurance is an invaluable investment, ensuring you can focus on enjoying your trip without the constant worry of unforeseen circumstances.

Expert Answers

What is the difference between single trip and annual multi-trip travel insurance?

Single trip insurance covers a single journey, while annual multi-trip insurance provides coverage for multiple trips within a year.

Does travel insurance cover pre-existing medical conditions?

Coverage for pre-existing conditions varies by policy. Some policies may offer limited coverage, while others may exclude them entirely. It’s crucial to disclose any pre-existing conditions when applying.

What should I do if my luggage is lost or delayed?

Immediately report the loss or delay to the airline and your travel insurance provider. Retain all relevant documentation, such as baggage claim tags and airline reports. Your insurance provider will guide you through the claims process.

How long does it typically take to process a travel insurance claim?

Processing times vary depending on the insurer and the complexity of the claim. It can range from a few days to several weeks.

Can I purchase travel insurance after my trip has already started?

Generally, no. Travel insurance must typically be purchased before your trip commences. However, some limited coverage options may be available in certain circumstances; check with your provider.