USAA Life Insurance Company, a name synonymous with reliability and service for military members and their families, offers a range of life insurance products designed to meet diverse needs and financial goals. Understanding the intricacies of their offerings, from term life to whole life policies, is crucial for making informed decisions about securing your family’s future. This guide delves into the history, offerings, and processes associated with USAA life insurance, providing a clear and comprehensive overview.

We’ll explore USAA’s financial strength, examine the application and claims processes, and compare their offerings to those of competitors. This detailed examination aims to empower you with the knowledge needed to determine if USAA life insurance is the right choice for your specific circumstances. We will also address frequently asked questions to provide a complete and informative resource.

USAA Life Insurance Company Overview

USAA Life Insurance Company, a subsidiary of USAA, provides a range of life insurance products specifically tailored to the needs of military members, veterans, and their families. Its history is deeply intertwined with the organization’s commitment to serving those who have served their country.

USAA Life Insurance Company’s history is rooted in the founding of USAA itself in 1922. Initially focused on providing auto insurance to military officers, USAA expanded its services over the years to encompass a wide variety of financial products, including life insurance, reflecting a growing understanding of the unique financial needs of its membership base. The company’s steady growth and expansion are a testament to its enduring commitment to its members and the trust it has built over nearly a century.

USAA Life Insurance Company Mission and Core Values

USAA’s mission is to facilitate the financial security of its members, providing exceptional service and value. This mission statement underpins all aspects of the company’s operations, from product development to customer service. Core values consistently emphasized include integrity, loyalty, and a deep commitment to serving the military community. These values are not simply stated; they are actively demonstrated through the company’s actions and its long-standing reputation for fair and ethical business practices.

USAA Life Insurance Products

USAA offers a variety of life insurance products designed to meet diverse needs and financial situations. These options allow members to select a policy that aligns with their individual circumstances and long-term goals. The specific product offerings may vary over time, but generally include term life insurance, whole life insurance, and universal life insurance. Term life insurance provides coverage for a specified period, while whole life insurance offers lifelong coverage and a cash value component. Universal life insurance offers flexibility in premium payments and death benefit amounts. Additional riders and options are often available to customize policies further.

USAA’s Financial Strength Ratings

USAA Life Insurance Company consistently receives high financial strength ratings from reputable agencies such as A.M. Best, Moody’s, and Standard & Poor’s. These ratings reflect the company’s strong financial position, its ability to meet its obligations to policyholders, and its overall stability. High ratings from these independent agencies provide assurance to policyholders regarding the security and reliability of their life insurance policies. The specific ratings can vary slightly depending on the rating agency and the time of assessment, but generally reflect a very strong financial standing.

Target Audience and Customer Base

USAA Life Insurance, a member-owned company, focuses its services on a specific and highly loyal customer base: current and former members of the U.S. military, their families, and eligible employees. This targeted approach allows USAA to cultivate a deep understanding of its members’ needs and tailor its offerings accordingly.

USAA’s customer base possesses unique characteristics that distinguish it from the broader life insurance market. Members are often highly disciplined, financially responsible individuals with a strong sense of community and shared values. This shared background fosters trust and loyalty towards the organization. Furthermore, the transient nature of military life necessitates reliable and accessible financial services, a need USAA consistently addresses. The company’s long history of serving the military community has built a reputation for trustworthiness and dependability.

USAA’s Advantages for Members

USAA leverages its deep understanding of its members’ financial needs to offer several key advantages. These include competitive pricing reflecting the lower risk associated with its responsible and financially stable membership base. Furthermore, USAA offers a range of life insurance products tailored to the specific needs of military families, including term life, whole life, and supplemental insurance options. The company also provides comprehensive educational resources and tools to help members make informed decisions about their life insurance coverage. Access to financial advisors specializing in military family needs is another significant benefit. The overall experience is designed to be straightforward and transparent, minimizing the complexity often associated with life insurance purchasing and management.

Comparison of Customer Service Approaches

USAA’s customer service is often cited as a key differentiator. Its commitment to personalized service, readily available support channels, and rapid response times sets it apart from many competitors. The following table compares USAA’s customer service features to those of three other major life insurance providers. Note that response times and accessibility can vary depending on specific circumstances and the chosen method of contact.

| Competitor | Response Time | Accessibility | Contact Methods |

| USAA | Generally within 24 hours, often much faster | 24/7 via phone, online chat, and email; in-person appointments in some locations | Phone, email, online chat, mobile app, mail, in-person appointments |

| State Farm | Varies depending on method of contact; phone calls may have longer wait times | Generally available during business hours; online resources available 24/7 | Phone, email, online chat, mobile app, mail |

| MetLife | Response times can vary widely depending on the issue and method of contact | Online resources available 24/7; phone support during business hours | Phone, email, online chat, mail |

| Prudential | Response times are generally good, but can be longer during peak periods | Online resources and phone support available during business hours | Phone, email, online chat, mail, in-person appointments (limited locations) |

Policy Features and Benefits

USAA offers a range of life insurance products designed to meet diverse financial needs and security goals. Understanding the features and benefits of their term and whole life policies is crucial for making an informed decision about the type of coverage that best suits individual circumstances. This section details the key characteristics of each, facilitating a comparison to aid in decision-making.

Term Life Insurance Policy Features and Benefits

USAA’s term life insurance provides affordable coverage for a specified period, typically ranging from 10 to 30 years. The primary benefit is a substantial death benefit paid to your beneficiaries should you pass away within the policy term. This offers peace of mind knowing your loved ones will receive financial support during a difficult time. Premiums remain level throughout the term, offering predictable budgeting. Some USAA term life policies may include optional riders, such as accidental death benefits, which increase the payout under specific circumstances. However, it’s important to note that the coverage expires at the end of the term, requiring renewal or the purchase of a new policy for continued protection.

Whole Life Insurance Policy Advantages and Disadvantages

USAA’s whole life insurance offers lifelong coverage, providing a death benefit payable whenever death occurs. A key advantage is the cash value component that builds over time. This cash value can be borrowed against or withdrawn, offering financial flexibility. Whole life insurance also provides a guaranteed death benefit, offering predictable long-term financial security. However, whole life insurance premiums are typically higher than term life insurance premiums due to the lifelong coverage and cash value accumulation. The cash value growth may also be slower than other investment options, and policy fees and expenses can impact the overall return.

Cost and Coverage Options Comparison

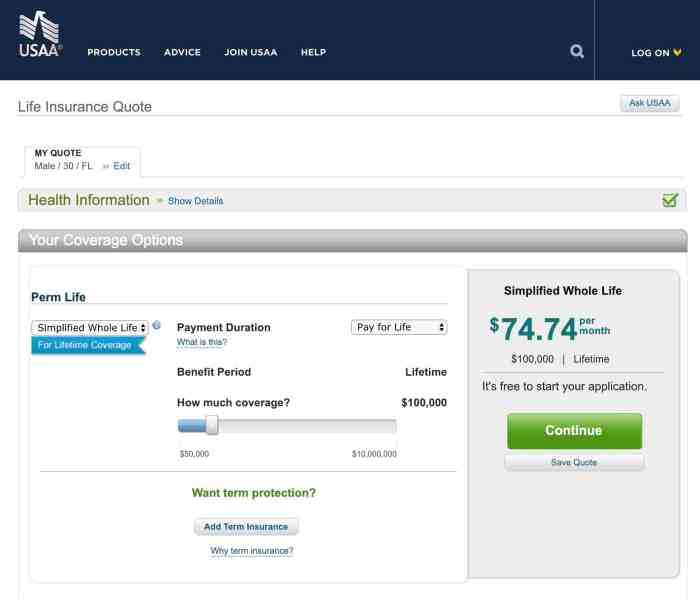

USAA offers various coverage amounts and premium options for both term and whole life insurance, allowing for customization based on individual needs and budgets. The cost of a policy depends on several factors, including age, health, coverage amount, and the type of policy chosen. Term life insurance generally offers lower premiums than whole life insurance for the same coverage amount due to its limited duration. However, whole life insurance provides lifelong coverage and the added benefit of cash value accumulation. Obtaining personalized quotes from USAA is essential to determine the precise cost and coverage options available.

Term Life vs. Whole Life Policy Comparison Chart

| Feature | Term Life | Whole Life |

| Coverage Duration | Specified term (e.g., 10, 20, 30 years) | Lifelong |

| Premiums | Generally lower, level throughout term | Generally higher, potentially increasing over time depending on policy type |

| Death Benefit | Paid only if death occurs within the term | Paid whenever death occurs |

| Cash Value | None | Accumulates over time |

| Flexibility | Limited flexibility | Greater flexibility due to cash value |

Application Process and Underwriting

Applying for USAA life insurance involves a straightforward process designed for ease and efficiency. The application itself is relatively simple, but the underwriting process, which assesses your risk profile, can take some time depending on the complexity of your application. Understanding the steps involved and the factors considered will help you prepare effectively and expedite the process.

The application process aims to gather comprehensive information to determine your eligibility for coverage and to set appropriate premiums. This involves providing personal details, health information, and lifestyle factors, all of which are carefully reviewed by underwriters to assess your risk profile.

Application Steps

The application process is designed to be user-friendly, typically completed online or via phone with a USAA representative. Completing the application accurately and thoroughly is crucial for a smooth and efficient process. Incomplete applications can lead to delays.

- Initial Information Gathering: You’ll begin by providing basic personal information such as your name, address, date of birth, and contact details. This stage sets the foundation for the application.

- Policy Selection: Choose the type of life insurance policy that best suits your needs and budget (term life, whole life, etc.). Understanding the differences between policy types is essential to making an informed decision.

- Health and Lifestyle Questionnaire: You’ll be asked detailed questions about your health history, including any existing medical conditions, medications, and family history of illness. Accuracy in this section is paramount, as it directly influences the underwriting process.

- Beneficiary Designation: Specify who will receive the death benefit upon your passing. Clearly identifying your beneficiaries is a crucial step in ensuring the smooth distribution of funds.

- Application Review and Submission: Review your application thoroughly for accuracy before submitting it. Errors or omissions can lead to delays.

Underwriting Process and Required Documentation

The underwriting process is a comprehensive assessment of your risk profile. This involves a review of your application, along with potentially additional medical information and background checks. The goal is to determine the appropriate premium based on your individual risk.

Commonly required documentation includes:

- Completed application form.

- Medical records (may include physician’s statements, lab results, and medical history).

- Driver’s license or other form of identification.

- In some cases, a paramedical exam (a brief physical examination conducted by a nurse or paramedic).

Factors Influencing Approval and Pricing

Several factors influence the approval and pricing of a life insurance application. These factors are carefully weighed by underwriters to ensure fair and accurate risk assessment. Transparency in this process is key to building trust with customers.

- Age: Older applicants generally face higher premiums due to increased mortality risk.

- Health History: Pre-existing conditions or a history of serious illnesses can impact both approval and premium costs.

- Lifestyle Factors: Smoking, excessive alcohol consumption, and dangerous hobbies can increase premiums.

- Occupation: High-risk occupations may result in higher premiums.

- Amount of Coverage: Larger death benefit amounts typically result in higher premiums.

Claims Process and Customer Support

Filing a life insurance claim with USAA is designed to be a straightforward process, aiming to provide support and guidance to beneficiaries during a difficult time. The company strives to make the experience as smooth and efficient as possible, minimizing bureaucratic hurdles and maximizing transparency.

The process begins with the notification of USAA about the death of the insured individual. This notification initiates the claims process, triggering a series of steps designed to verify the claim and process the benefit payment. Throughout this process, USAA provides dedicated support to guide claimants through each stage.

Required Documentation for Life Insurance Claims

Submitting the correct documentation is crucial for a timely claim processing. Incomplete or missing documentation can lead to delays. USAA typically requires the following documents:

- A certified copy of the death certificate. This legally confirms the death and provides essential details.

- The original or a certified copy of the life insurance policy. This document Artikels the coverage details and beneficiary information.

- Completed claim form. This form gathers necessary information from the claimant and is provided by USAA.

- Proof of the claimant’s relationship to the insured. This may include marriage certificates, birth certificates, or other relevant documents.

- In some cases, additional documentation may be requested, depending on the specifics of the claim. Examples might include medical records or police reports.

Life Insurance Claim Processing Timeframe

The time it takes to process a life insurance claim with USAA can vary, depending on the complexity of the claim and the completeness of the documentation provided. While USAA aims for efficiency, a reasonable timeframe to expect is between several weeks to a few months. Faster processing is generally achieved with complete and accurate documentation submitted promptly. For instance, a straightforward claim with all necessary documentation provided might be processed within a few weeks, whereas a more complex claim requiring additional verification could take longer.

USAA’s Customer Support During the Claims Process

USAA provides several avenues of support to guide customers through the claims process. This includes dedicated claims representatives who are available by phone, email, and mail. These representatives are trained to answer questions, provide updates, and address any concerns claimants may have. The company also utilizes online tools and resources, providing claimants with access to their claim status and relevant information. For example, claimants can track their claim’s progress online, and access frequently asked questions (FAQs) to address common queries. USAA’s commitment is to provide compassionate and efficient support, recognizing the sensitive nature of filing a life insurance claim.

Competitor Analysis (Limited)

Understanding USAA’s competitive landscape requires examining its strengths and weaknesses against other major players in the life insurance market. This analysis will briefly compare USAA’s offerings with those of two prominent competitors, focusing on specific product features and pricing to highlight key differentiators. It is important to note that specific pricing and product details are subject to change and should be verified directly with the respective insurance providers.

This section will compare USAA Life Insurance with two competitors, focusing on term life insurance policies as a common product offering. We will analyze pricing structures, policy features, and the overall value proposition offered by each company. The selection of competitors is based on their market share and prominence in the life insurance industry.

Term Life Insurance Product Comparison

The following table compares USAA’s term life insurance offerings with those of hypothetical competitors, Competitor A and Competitor B. Note that the data presented is for illustrative purposes only and may not reflect current market conditions or specific product offerings. Actual prices and benefits will vary based on individual factors such as age, health, and the specific policy details selected.

| Feature | USAA | Competitor A | Competitor B |

| Pricing (example: $250,000, 20-year term, 35-year-old male) | $35/month | $40/month | $30/month |

| Death Benefit | Variable, depending on policy | Fixed, depending on policy | Variable, depending on policy |

| Policy Features (e.g., level premiums, guaranteed renewability) | Level premiums for the term, guaranteed renewability option | Level premiums, guaranteed renewability option | Level premiums, option for term conversion |

| Additional Riders Available | Accidental death benefit, critical illness rider | Accidental death benefit, waiver of premium rider | Accidental death benefit, long-term care rider |

| Underwriting Process | Generally straightforward, may require medical exam | May require medical exam and extensive paperwork | Simplified application process, may not require medical exam |

| Customer Service | Highly rated, known for excellent customer service | Average customer service ratings | Customer service ratings vary |

Strengths and Weaknesses of USAA Relative to Competitors

USAA’s primary strength lies in its focus on serving military members and their families. This niche market allows for a strong brand loyalty and a reputation for excellent customer service tailored to the specific needs of its target demographic. However, USAA’s limited market reach may mean it lacks the breadth of product offerings and competitive pricing that larger, more diversified insurers offer. Competitor A, for example, might offer a wider range of riders and policy options, while Competitor B may boast a more streamlined application process. USAA’s pricing may be competitive within its niche but might not be the most affordable across the broader insurance market. Conversely, a weakness for Competitor A could be less personalized customer service, and for Competitor B, a less robust selection of riders.

Illustrative Example

This example illustrates a hypothetical scenario involving a USAA life insurance policy application, policy details, and a subsequent death claim. The scenario focuses on a 35-year-old USAA member to demonstrate the process from application to claim settlement. Remember, specific policy details and claim processes can vary.

Application and Policy Details

Sarah, a 35-year-old USAA member, decides to apply for a $500,000 term life insurance policy. She completes the online application, providing necessary personal and health information. After a brief medical review (which may involve answering health questions or providing medical records), USAA approves her application. Her policy is issued with a 20-year term, meaning coverage lasts for 20 years. Her monthly premium is calculated based on her age, health status, and coverage amount, estimated at $75 per month. The policy includes a waiver of premium rider, meaning that if Sarah becomes totally disabled, her premiums will be waived for the duration of the disability.

Hypothetical Death Claim

Tragically, after 10 years, Sarah passes away unexpectedly. Her beneficiary, her husband John, files a claim with USAA. He provides the necessary documentation, including Sarah’s death certificate and a copy of the insurance policy. USAA reviews the claim, verifying the information provided. After a short review period, USAA approves the claim and disburses the full $500,000 death benefit to John, as per the terms of the policy. The claim process is streamlined and efficient due to the pre-existing relationship between Sarah and USAA and the clear documentation provided. This efficient process is a key feature of USAA’s customer service focus.

Final Summary

Securing your family’s financial well-being is a critical responsibility, and choosing the right life insurance provider is a significant step in that process. USAA Life Insurance Company, with its long history of serving military members and their families, presents a compelling option for those seeking dependable coverage and exceptional customer service. By understanding the details of their policies, application process, and claims procedures, you can confidently make a decision that aligns with your individual needs and financial goals. This guide has provided a framework for understanding USAA’s offerings; however, always consult directly with USAA for personalized advice and policy specifics.

FAQ Compilation

What types of life insurance does USAA offer beyond term and whole life?

USAA may offer other specialized life insurance products, such as universal life or variable universal life insurance. It’s best to check directly with USAA for the most current and complete list of available policies.

What is USAA’s underwriting process like for those with pre-existing health conditions?

USAA’s underwriting process considers pre-existing health conditions. Applicants may be required to provide additional medical information or undergo a medical exam, which could affect premiums or eligibility. The specifics will depend on the individual’s health history and the policy applied for.

How does USAA’s claims process compare to other insurers in terms of speed and ease?

While USAA aims for a smooth and efficient claims process, the specific timeframe varies depending on the complexity of the claim. Compared to other insurers, their speed and ease of processing are generally well-regarded, but individual experiences may differ. It’s crucial to carefully review the policy documents and follow the Artikeld procedures for a timely resolution.

Can I adjust my USAA life insurance policy after it’s been issued?

Policy adjustments, such as increasing or decreasing coverage amounts or changing payment options, are usually possible but may involve additional fees or underwriting requirements. Contact USAA directly to discuss potential modifications to your existing policy.