Securing the right vehicle insurance in Florida is crucial for every driver. The Sunshine State presents a unique landscape of insurance regulations, coverage options, and potential risks. This guide delves into the intricacies of Florida’s vehicle insurance system, providing clear explanations and practical advice to help you make informed decisions and protect yourself financially.

From understanding the different types of coverage available, such as liability, collision, and comprehensive, to navigating Florida’s no-fault law and finding affordable options, we’ll equip you with the knowledge necessary to confidently manage your vehicle insurance needs. We’ll explore factors influencing premiums, strategies for reducing costs, and the process of filing a claim, ensuring you’re well-prepared for any eventuality.

Types of Vehicle Insurance in Florida

Choosing the right car insurance in Florida can seem overwhelming, given the various coverage options available. Understanding the different types of coverage and their benefits is crucial to ensuring you have adequate protection for yourself and your vehicle. This section will Artikel the key types of vehicle insurance commonly offered in Florida, providing clarity on their functionalities and the situations where they prove most beneficial.

Liability Coverage

Liability insurance is the most basic and legally required type of car insurance in Florida. It covers damages or injuries you cause to others in an accident that is your fault. This includes bodily injury liability, which covers medical expenses and lost wages for injured individuals, and property damage liability, which covers repairs or replacement of damaged property. For example, if you rear-end another car and cause $5,000 in damages and $10,000 in medical bills for the other driver, your liability insurance would cover these costs, up to your policy limits. Failing to carry liability insurance in Florida can result in significant penalties.

Collision Coverage

Collision coverage pays for repairs or replacement of your vehicle if it’s damaged in an accident, regardless of who is at fault. This means that even if you cause the accident, your collision coverage will help pay for the repairs to your car. For instance, if you hit a deer or are involved in a single-car accident where you hit a tree, your collision coverage would assist with the costs of repairing or replacing your vehicle. The deductible you choose will determine your out-of-pocket expense before the insurance kicks in.

Comprehensive Coverage

Comprehensive coverage protects your vehicle against damage caused by events other than collisions. This includes things like theft, vandalism, fire, hail damage, and damage caused by animals. For example, if your car is broken into and your stereo is stolen, or if a tree falls on your car during a storm, comprehensive coverage would help cover the repair or replacement costs. Like collision coverage, a deductible applies.

Uninsured/Underinsured Motorist Coverage

This coverage protects you if you’re involved in an accident caused by an uninsured or underinsured driver. Many drivers in Florida carry minimal liability coverage, and this type of coverage becomes especially important in the event of an accident with a driver who lacks sufficient insurance to cover your medical bills or vehicle damage. For example, if you are seriously injured by an uninsured driver, your uninsured/underinsured motorist bodily injury coverage would help pay for your medical expenses and lost wages. Similarly, if your vehicle is severely damaged by an underinsured driver whose liability limits are insufficient to cover the repair costs, your uninsured/underinsured motorist property damage coverage would help.

| Coverage Type | What it Covers | Example | Typical Cost Range (Annual) |

|---|---|---|---|

| Liability | Damages and injuries you cause to others | Damages to another vehicle and medical bills for the other driver after an at-fault accident. | $300 – $800+ |

| Collision | Damage to your vehicle in an accident, regardless of fault | Repairing your car after a fender bender or a single-car accident. | $200 – $600+ |

| Comprehensive | Damage to your vehicle from non-collision events | Replacing your windshield after a rock chip or repairing your car after a tree falls on it. | $150 – $400+ |

| Uninsured/Underinsured Motorist | Damages and injuries caused by an uninsured or underinsured driver | Medical bills and vehicle repair costs after an accident caused by an uninsured driver. | $100 – $300+ |

Note: Cost ranges are estimates and can vary significantly based on factors like your driving record, age, vehicle type, location, and the amount of coverage selected. It’s always best to obtain quotes from multiple insurers to compare prices and coverage options.

Factors Affecting Insurance Premiums in Florida

Understanding the factors that influence your car insurance premiums in Florida is crucial for securing affordable coverage. Several key elements contribute to the final cost, and knowing these factors can empower you to make informed decisions and potentially lower your expenses. Insurance companies utilize a complex algorithm to assess risk, and this assessment directly impacts your premium.

Several key aspects are considered when determining your car insurance premium. These factors are interconnected and often influence each other, resulting in a personalized rate for each driver.

Driving Record

Your driving history significantly impacts your insurance premium. A clean driving record, free of accidents and traffic violations, generally results in lower premiums. Conversely, accidents, especially those deemed your fault, and traffic violations like speeding tickets or DUIs, will substantially increase your rates. The severity of the offense and the frequency of incidents are also considered. For example, a single speeding ticket might lead to a modest increase, while multiple accidents and a DUI conviction could result in a significantly higher premium or even policy cancellation. Insurance companies view these incidents as indicators of higher risk, justifying the increased cost to cover potential future claims.

Age and Driving Experience

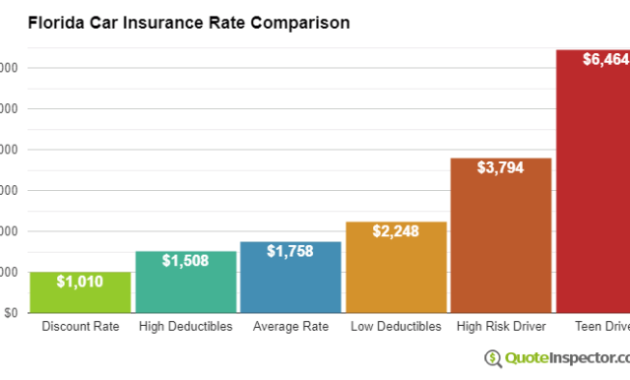

Age is a critical factor in determining insurance rates. Younger drivers, particularly those under 25, are statistically more likely to be involved in accidents, leading to higher premiums. This is due to a combination of factors including lack of experience, higher risk-taking behavior, and a higher propensity for accidents. As drivers gain experience and reach a certain age (typically mid-20s to 30s), their premiums generally decrease because they’re considered lower-risk drivers. Insurance companies base these assessments on extensive statistical data gathered over many years.

Vehicle Type

The type of vehicle you drive plays a significant role in your insurance cost. High-performance vehicles, sports cars, and luxury cars are generally more expensive to insure due to higher repair costs, increased likelihood of theft, and potentially higher repair costs in the event of an accident. Conversely, smaller, less expensive vehicles often have lower insurance premiums. The vehicle’s safety features, such as airbags and anti-lock brakes, also influence the premium; vehicles with advanced safety features might qualify for discounts.

Location

Your location in Florida significantly impacts your insurance premium. Areas with higher crime rates, more accidents, and higher rates of vehicle theft typically have higher insurance premiums. Insurance companies analyze claims data for specific zip codes and adjust rates accordingly. Living in a high-risk area increases the likelihood of your vehicle being involved in an accident or stolen, resulting in a higher premium to reflect that increased risk.

Strategies for Reducing Insurance Premiums

Maintaining a clean driving record is paramount to keeping your insurance costs low. Avoiding accidents and traffic violations is the most effective way to reduce your risk profile.

- Maintain a clean driving record.

- Consider a vehicle with good safety features and a lower repair cost.

- Explore different insurance providers and compare quotes.

- Bundle your insurance policies (home and auto).

- Maintain a good credit score (as credit history is often a factor in determining rates).

- Increase your deductible (this will lower your premium but increase your out-of-pocket expense in case of a claim).

- Take a defensive driving course (some insurers offer discounts for completing these courses).

Florida’s No-Fault Insurance Law

Florida operates under a no-fault insurance system, meaning that after a car accident, drivers primarily seek compensation from their own insurance companies, regardless of who caused the crash. This system is designed to expedite the claims process and reduce the number of lawsuits. However, it has specific limitations and nuances that drivers should understand.

Florida’s no-fault system hinges on two key coverages: Personal Injury Protection (PIP) and Property Damage Liability (PDL). These coverages dictate how and when you can recover compensation for injuries and vehicle damage following an accident. Understanding these coverages is crucial for navigating the aftermath of a car accident in Florida.

Personal Injury Protection (PIP) Coverage

PIP coverage pays for your medical bills and lost wages, regardless of fault. It covers you, your passengers, and anyone else in your vehicle who is injured in an accident. The amount of PIP coverage is typically determined at the time you purchase your insurance policy, often ranging from $10,000 to $25,000. It’s important to note that PIP coverage also includes a death benefit in case of a fatality. For example, if you are involved in a collision and sustain injuries requiring medical treatment and time off work, your PIP coverage will help pay for those expenses. Similarly, if a passenger in your car is injured, their medical bills and lost wages would also be covered under your PIP policy, up to the policy limits.

Property Damage Liability (PDL) Coverage

PDL coverage pays for the damage to other people’s vehicles or property if you are at fault for an accident. It does not cover damage to your own vehicle. The amount of PDL coverage is also determined when you purchase your insurance policy and varies depending on your needs and risk assessment. For instance, if you rear-end another car and cause damage to their bumper and tail lights, your PDL coverage would pay for the repairs to their vehicle. The amount paid would be up to your PDL policy limit. If the damage exceeds your PDL limit, you could be held personally liable for the remaining costs.

Implications of Florida’s No-Fault Law for Drivers

Florida’s no-fault law significantly impacts drivers involved in accidents. While it simplifies the initial claims process by focusing on your own insurance, it also limits your ability to sue the at-fault driver for pain and suffering unless certain thresholds are met. Specifically, you generally cannot sue the other driver unless your medical bills exceed a certain amount (often $8,000 or more), or if you sustain a permanent injury, such as a broken bone or significant scarring. This means that even if someone else caused the accident, you might only be able to recover medical bills and lost wages through your PIP coverage, unless you meet the requirements for suing the at-fault driver for additional damages. Understanding these limitations is vital to protecting your rights after an accident.

Filing a Claim in Florida

Filing a vehicle insurance claim in Florida can seem daunting, but understanding the process can make it significantly less stressful. Prompt and accurate reporting is crucial for a smooth claims experience. This section Artikels the steps involved in reporting an accident and filing a claim with your insurance provider.

Reporting an Accident and Initial Claim Filing

After a car accident in Florida, your first priority should be ensuring everyone’s safety. Call emergency services (911) if needed. Once the immediate danger has passed, begin documenting the accident. This involves contacting your insurance company as soon as possible, ideally within 24 hours. You’ll typically provide details such as the date, time, location, and circumstances of the accident, along with the names and contact information of all involved parties and witnesses. Your insurer will then provide you with a claim number and guide you through the next steps. Failure to promptly report an accident can jeopardize your claim.

Gathering Necessary Documentation for a Claim

Comprehensive documentation is vital for a successful insurance claim. This documentation supports your claim and aids in the efficient processing of your claim. The specific documents required may vary depending on the circumstances of the accident and your insurance policy, but generally include:

- Police Report: Obtain a copy of the police report from the accident scene. This official record provides an objective account of the incident.

- Photos and Videos: Take numerous pictures and videos of the accident scene, including damage to vehicles, injuries, and any visible evidence. This visual record is crucial for assessing the extent of the damage and supporting your claim.

- Witness Information: Gather contact information from any witnesses to the accident. Their statements can corroborate your account of events.

- Medical Records: If injuries were sustained, obtain copies of all medical records, bills, and receipts related to treatment. This documentation supports claims for medical expenses.

- Vehicle Repair Estimates: Secure repair estimates from reputable mechanics to determine the cost of vehicle repairs. These estimates will help substantiate your claim for property damage.

- Insurance Policy Information: Have your insurance policy information readily available, including your policy number and coverage details. This ensures your insurer can quickly access your policy details.

Claim Processing and Settlement

Once you’ve submitted your claim and all necessary documentation, your insurance company will begin investigating the accident. This involves reviewing the provided information, possibly contacting involved parties, and potentially conducting an independent investigation. The claims adjuster will assess the liability for the accident and determine the amount payable under your policy. This process can take several weeks or even months depending on the complexity of the claim. You may be required to provide additional information or documentation throughout this process. Open communication with your adjuster is key to ensuring a timely and fair settlement. If you disagree with the initial settlement offer, you have the right to negotiate or pursue other legal avenues.

Understanding Florida’s Insurance Regulations

Navigating the world of vehicle insurance in Florida requires understanding the regulatory framework that governs it. The state’s insurance landscape is shaped by a complex interplay of laws and agencies designed to protect both consumers and the insurance industry. This section will explore the key regulatory bodies and consumer protection laws in place.

The Florida Department of Financial Services (DFS) plays a central role in overseeing the vehicle insurance industry within the state.

The Role of the Florida Department of Financial Services

The Florida Department of Financial Services (DFS) is the primary regulatory body responsible for overseeing the insurance industry in Florida, including vehicle insurance. Its responsibilities encompass licensing insurers, monitoring their financial stability, investigating consumer complaints, and enforcing state insurance laws. The DFS works to ensure fair practices, prevent fraud, and protect consumers from unfair or deceptive insurance practices. This includes setting minimum coverage requirements, approving insurance rates, and ensuring that insurers comply with state regulations. They achieve this through a variety of methods including regular audits, investigations of complaints, and the imposition of penalties for violations.

Key Consumer Protection Laws in Florida

Florida has several laws designed to protect consumers in the vehicle insurance market. These laws aim to ensure fair treatment, transparent practices, and access to dispute resolution mechanisms. Understanding these laws empowers consumers to navigate insurance interactions effectively.

Summary of Key Regulations and Consumer Rights

| Regulation/Right | Description | Impact on Consumers | Enforcement |

|---|---|---|---|

| Minimum Coverage Requirements | Florida mandates minimum liability coverage for bodily injury and property damage. | Protects other drivers and their property in case of an accident caused by the insured. | Enforced by the DFS through licensing and penalties. |

| Right to Choose Your Insurer | Consumers are free to select their vehicle insurance provider from a range of licensed insurers. | Provides choice and competition in the marketplace. | Protected by state laws prohibiting unfair discrimination by insurers. |

| Fair Claims Settlement Practices | Insurers are required to handle claims fairly and promptly. | Ensures timely and equitable compensation for covered losses. | Monitored and enforced by the DFS through investigations and penalties for violations. |

| Consumer Complaint Process | The DFS provides a mechanism for consumers to file complaints against insurers for unfair or deceptive practices. | Offers a formal avenue for resolving disputes with insurers. | The DFS investigates complaints and takes appropriate action, including mediation and potential penalties. |

Vehicle Insurance for High-Risk Drivers in Florida

Securing affordable auto insurance in Florida can be a significant challenge for drivers considered high-risk. This designation often stems from factors like a poor driving record, numerous accidents, traffic violations, or even the type of vehicle driven. The higher risk profile translates directly into substantially increased premiums, making insurance unaffordable for many.

High-risk drivers in Florida face difficulties finding insurers willing to offer them coverage at competitive rates. Many standard insurance companies may refuse coverage altogether, leaving these drivers with limited options and potentially forcing them to pay significantly more than drivers with clean records. This financial burden can be substantial, especially for those already struggling financially.

Options for High-Risk Drivers

Finding insurance as a high-risk driver requires exploring alternative avenues. Several options exist, although they may come with higher premiums than standard policies.

- High-Risk Insurance Companies: Specialized insurers focus on providing coverage for high-risk drivers. While premiums are generally higher, these companies are more likely to accept applications than standard insurers. It is crucial to compare quotes from multiple providers in this category.

- State-Funded Programs: In some instances, state-funded programs may offer a safety net for drivers who struggle to obtain private insurance. These programs often have specific eligibility requirements and may come with restrictions on coverage.

- Non-Standard Auto Insurance: This type of insurance is designed for drivers with less-than-perfect driving records. While more expensive than standard insurance, it offers a pathway to coverage when traditional options are unavailable.

Strategies for Improving Driving Records

Improving a driving record is the most effective long-term strategy for reducing insurance premiums. By demonstrating responsible driving habits, high-risk drivers can significantly lower their future costs.

- Defensive Driving Courses: Completing a state-approved defensive driving course can often result in a reduction in insurance premiums. Many insurers offer discounts for completing these courses, which demonstrate a commitment to safer driving practices. The course typically involves classroom instruction and sometimes online components, covering various aspects of safe driving.

- Maintaining a Clean Driving Record: This is paramount. Avoiding accidents and traffic violations is crucial. Even minor infractions can lead to increased premiums. Practicing safe driving habits, such as maintaining a safe following distance, obeying traffic laws, and avoiding distractions, is essential.

- Vehicle Modifications: Installing safety features, such as anti-theft devices, can sometimes result in insurance discounts. Insurers may view these modifications as reducing the risk of theft or accidents, leading to lower premiums.

Illustrative Examples of Insurance Scenarios

Understanding how Florida’s insurance system works in practice can be challenging. The following scenarios illustrate how different types of coverage might apply in various accident situations, highlighting the claims process and potential compensation. Remember that these are examples, and actual outcomes can vary based on the specifics of each case and the insurance company’s interpretation of the policy.

Scenario 1: Rear-End Collision with Property Damage Only

A driver, let’s call him Alex, is stopped at a red light when another car, driven by Brenda, rear-ends him. Brenda’s negligence is clear. Alex’s car sustains $5,000 in damage. Alex’s collision coverage will pay for the repairs to his vehicle, minus his deductible. Brenda’s liability coverage will likely cover the damages to Alex’s car, but Alex might need to file a claim with Brenda’s insurer to receive payment. The process involves filing a claim with Brenda’s insurance company, providing documentation of the accident (police report, photos of the damage), and receiving an adjuster’s assessment. If Brenda’s policy limits are insufficient, Alex may need to pursue additional recovery through his uninsured/underinsured motorist coverage, if he carries it.

Scenario 2: Accident Resulting in Injuries and Property Damage

Carlos is involved in a multi-vehicle accident caused by another driver’s recklessness. Carlos suffers a broken leg and his car is totaled. The other driver’s liability insurance will cover Carlos’s medical bills (up to policy limits) and the value of his totaled vehicle. Carlos would file a claim with the at-fault driver’s insurance company, providing medical records, repair estimates, and other documentation. The claim process may involve negotiations with the insurance adjuster to reach a settlement. If the other driver’s liability coverage is insufficient to cover all of Carlos’s medical expenses and vehicle replacement, Carlos could pursue additional recovery through his uninsured/underinsured motorist coverage and potentially through a personal injury lawsuit.

Scenario 3: Hit and Run Accident

David’s car is damaged in a hit-and-run accident. There are no witnesses and no identifying information about the at-fault driver. David’s uninsured/underinsured motorist (UM) coverage, if he carries it, would cover the damages to his vehicle and any medical expenses. David would file a claim with his own insurance company. The claim process would involve providing a police report, photos of the damage, and any other relevant evidence. The UM coverage functions as if the at-fault driver had insurance, providing compensation even when the responsible party is unidentified.

Scenario 4: Accident Involving a Distracted Driver

Emily is injured in an accident caused by a distracted driver who runs a red light. The at-fault driver admits fault. Emily’s medical bills exceed $10,000. Emily’s personal injury protection (PIP) coverage will pay for her medical expenses and lost wages (up to her policy limits), regardless of fault. Emily would file a claim with her own insurance company for PIP benefits. Additionally, she could file a claim with the at-fault driver’s liability insurance company to recover further damages, such as pain and suffering, exceeding her PIP coverage. This process would likely involve a longer claim process and potentially legal representation.

Scenario 5: Single-Vehicle Accident

Frank loses control of his car on a rain-slicked road and crashes into a tree. There is no other party involved. If Frank has collision coverage, it will pay for the repairs to his vehicle, less his deductible. His PIP coverage would cover his medical expenses and lost wages, up to policy limits. He would file claims with his own insurance company for both collision and PIP benefits. The claim process would involve providing documentation of the accident and his medical expenses.

Final Thoughts

Understanding Florida’s vehicle insurance landscape empowers drivers to make informed choices that protect their financial well-being. By carefully considering coverage options, factors affecting premiums, and the claims process, you can navigate the complexities of insurance and secure the best protection for yourself and your vehicle. Remember to regularly review your policy and adjust coverage as needed to ensure ongoing peace of mind.

FAQ Explained

What is the minimum required car insurance coverage in Florida?

Florida requires a minimum of $10,000 in Personal Injury Protection (PIP) and $10,000 in Property Damage Liability (PDL).

Can I get my car insurance cancelled in Florida?

Yes, your insurance can be cancelled for various reasons, including non-payment, multiple accidents, or fraudulent claims. Review your policy for specific cancellation clauses.

How long do I have to report an accident to my insurance company in Florida?

You should report an accident to your insurance company as soon as possible, ideally within 24-48 hours.

What if I’m involved in a hit and run accident in Florida?

Report the accident to the police immediately and then contact your insurance company. You may need to file a claim under your uninsured/underinsured motorist coverage.

How can I dispute a car insurance rate increase in Florida?

Contact your insurance company to understand the reasons for the increase. You can also shop around for different quotes and consider appealing the increase based on specific factors like improved driving record.