Navigating the world of car insurance can feel like driving through a dense fog. One crucial element, often overlooked until it’s too late, is vehicle liability insurance. This isn’t just about ticking a box; it’s about safeguarding your financial future and protecting others in the event of an accident. Understanding its nuances is key to making informed decisions and ensuring adequate protection.

This guide delves into the core components of vehicle liability insurance, exploring different coverage types, factors influencing premiums, claims processes, and the legal ramifications of inadequate coverage. We’ll demystify complex terminology and provide practical advice to help you navigate this essential aspect of car ownership.

Defining Vehicle Liability Insurance

Vehicle liability insurance is a crucial component of responsible vehicle ownership. It protects you financially if you’re at fault in a car accident that causes injury or damage to another person or their property. Essentially, it covers the costs associated with the other party’s losses, not your own. Understanding its components is key to ensuring adequate coverage.

Core Components of Vehicle Liability Insurance

Liability insurance typically consists of two main coverage types: bodily injury liability and property damage liability. Bodily injury liability covers medical bills, lost wages, and pain and suffering for anyone injured in an accident you caused. Property damage liability covers the cost of repairing or replacing the other person’s damaged vehicle or property. The policy will specify limits for each type of coverage, usually expressed as a three-number combination (e.g., 25/50/25), which represents the maximum amount the insurer will pay per person for bodily injury, the maximum amount per accident for bodily injury, and the maximum amount for property damage, all in thousands of dollars.

Types of Liability Coverage

Bodily injury liability coverage compensates individuals injured in an accident for which you are at fault. This can include medical expenses, lost wages, rehabilitation costs, and pain and suffering. Property damage liability coverage pays for the repair or replacement of the other driver’s vehicle or other damaged property. This could encompass damage to a car, fence, building, or other property.

Situations Requiring Liability Insurance

Liability insurance is essential in numerous scenarios. For example, if you cause a collision that results in another driver sustaining injuries requiring extensive medical treatment and rehabilitation, your liability coverage would help pay for those costs. Similarly, if you back into a parked car and cause significant damage, your property damage liability coverage would cover the cost of repairs. Even a seemingly minor accident could lead to substantial expenses if injuries or property damage are more extensive than initially apparent. Failing to have adequate liability insurance could result in significant personal financial liability.

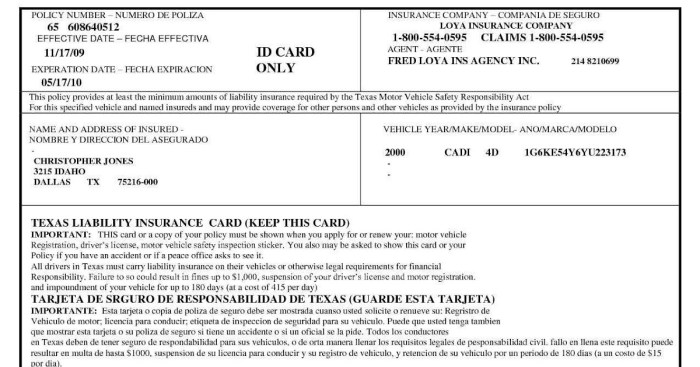

Comparison of Basic Liability Coverage Limits Across States

It’s important to note that minimum liability coverage requirements vary significantly by state. The following table provides a simplified comparison; actual limits may vary and should be verified with your state’s Department of Insurance.

| State | Bodily Injury per Person | Bodily Injury per Accident | Property Damage |

|---|---|---|---|

| California | $15,000 | $30,000 | $5,000 |

| Florida | $10,000 | $20,000 | $10,000 |

| New York | $25,000 | $50,000 | $10,000 |

| Texas | $30,000 | $60,000 | $25,000 |

Claims Process and Dispute Resolution

Understanding the claims process and dispute resolution mechanisms for vehicle liability insurance is crucial for policyholders. Navigating these procedures efficiently can significantly impact the outcome of a claim. This section Artikels the steps involved in filing a claim and resolving any subsequent disputes.

Filing a Liability Insurance Claim: A Step-by-Step Guide

Following a car accident where you believe the other driver is at fault, prompt action is vital. Begin by contacting the police to file a report, documenting the accident details, including witness information and photographic evidence of the damage. This police report serves as a critical piece of evidence in your claim. Next, notify your insurance company as soon as possible, usually within 24-72 hours, as specified in your policy. Provide them with all relevant information from the police report, including the date, time, location, and details of the accident. You will then be guided through the claim process, which may include providing further documentation such as medical records, repair estimates, and photos of vehicle damage. Finally, cooperate fully with your insurer’s investigation, providing any requested information promptly and accurately.

Resolving Disputes with Insurance Companies

Disputes with insurance companies can arise from various reasons, such as claim denials, disagreements on compensation amounts, or delays in processing. If you encounter such a situation, maintain thorough documentation of all communication, including emails, letters, and phone calls. Attempt to resolve the issue amicably by contacting your insurance company’s customer service department or your claims adjuster. If informal resolution fails, explore other options, such as filing a formal complaint with your state’s insurance department or seeking legal counsel. Mediation or arbitration may be suitable alternatives to costly litigation.

Common Reasons for Claim Denials

Several factors can lead to claim denials. These often include insufficient evidence to prove liability, failure to meet policy requirements (such as timely reporting of the accident), pre-existing damage to the vehicle, or the accident falling outside the scope of the policy coverage. For example, a claim might be denied if the policyholder was driving under the influence of alcohol or drugs at the time of the accident. Another common reason is the lack of proper documentation, such as a police report or witness statements. Claims can also be denied if the damages are deemed to be the result of normal wear and tear rather than an accident.

Gathering and Presenting Evidence to Support a Claim

Strong evidence is vital to a successful claim. This includes the police report, photos and videos of the accident scene and vehicle damage, witness statements with contact information, medical records documenting injuries, repair bills and estimates, and any other relevant documentation. Organize this evidence systematically, creating a clear and concise presentation for your insurer. Consider using a chronological order to present the information, starting with the accident and progressing through the subsequent events. Accuracy and completeness are paramount. For example, if you have a witness, include their full name, address, and phone number, and a written statement detailing what they saw. Similarly, medical records should clearly show the injuries sustained as a result of the accident.

The Importance of Adequate Coverage

Having sufficient liability insurance coverage is crucial for protecting your financial well-being in the event of an accident. The consequences of inadequate coverage can be severe, potentially leading to significant financial burdens and even bankruptcy. Choosing the right level of coverage requires careful consideration of your assets and potential risks.

Insufficient liability coverage leaves you vulnerable to devastating financial consequences. The cost of medical bills, vehicle repairs, and legal fees associated with even a minor accident can quickly escalate into hundreds of thousands of dollars. If your coverage limits are lower than the damages awarded in a lawsuit, you become personally liable for the difference. This means you could be forced to sell your assets, such as your home or other investments, to pay for the remaining costs.

Real-Life Examples of Inadequate Coverage

Consider these scenarios: A driver with a $25,000 liability policy causes an accident resulting in $100,000 in medical bills for the other driver. The at-fault driver is now responsible for the remaining $75,000. Or, imagine a situation where a driver causes a multi-vehicle accident, resulting in multiple serious injuries. The total cost of damages and legal fees could easily surpass even a high liability limit, leaving the driver with significant personal debt.

Determining Appropriate Liability Coverage

Determining the appropriate level of liability coverage involves evaluating your personal assets and potential risks. Consider the value of your assets (home, savings, investments) that could be at risk if you are sued. Also, consider the cost of living in your area; medical expenses and legal fees vary regionally. Consult with an insurance professional to determine the appropriate level of coverage based on your individual circumstances. Many insurance providers offer higher liability limits at a relatively modest increase in premium cost, providing a cost-effective way to significantly enhance your protection.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist (UM/UIM) coverage is a critical component of your overall liability protection. This coverage protects you and your passengers if you are involved in an accident caused by an uninsured or underinsured driver. Even with adequate liability coverage, you could still face significant financial losses if the other driver lacks sufficient insurance. UM/UIM coverage helps compensate for your medical bills, lost wages, and vehicle repairs, even if the at-fault driver is uninsured or their coverage is insufficient to cover your damages. It is advisable to purchase UM/UIM coverage with limits at least equal to, or even exceeding, your liability coverage limits.

Final Summary

Ultimately, securing adequate vehicle liability insurance isn’t simply a legal requirement; it’s a demonstration of responsible car ownership and a commitment to protecting yourself and others. By understanding the complexities of coverage, premiums, and claims processes, you can make informed decisions to secure the appropriate level of protection. Remember, the peace of mind that comes with knowing you’re adequately covered is invaluable.

Query Resolution

What happens if I’m involved in an accident and don’t have liability insurance?

You could face severe financial consequences, including lawsuits, property damage costs, and medical bills for injured parties. Your driving privileges might also be suspended or revoked.

Can I choose my own repair shop after an accident covered by my liability insurance?

Generally, the insurance company will have preferred repair shops, but you often have the option to choose your own. However, the insurer may have specific requirements or limitations.

How long does it typically take to settle a liability claim?

Settlement times vary widely depending on the complexity of the accident, the extent of damages, and the cooperation of all parties involved. It could range from a few weeks to several months.

What if the other driver is uninsured and at fault?

This is where uninsured/underinsured motorist (UM/UIM) coverage on your policy becomes crucial. It protects you in cases where the at-fault driver lacks sufficient insurance.

Does my liability insurance cover damage to my own vehicle in an accident?

No, liability insurance covers damages to *other* people’s property and injuries to other people. You’ll need collision or comprehensive coverage for damage to your own vehicle.