Securing the right car insurance is a crucial step in responsible vehicle ownership. While the term “full coverage” sounds comprehensive, its meaning can vary significantly between insurance providers. This guide delves into the intricacies of full coverage car insurance, clarifying what it typically includes, the optional extras available, and the factors influencing its cost. Understanding these aspects empowers you to make informed decisions when selecting a policy that best suits your needs and budget.

We’ll explore the core components, such as collision and comprehensive coverage, and explain how they protect you in different accident scenarios. We’ll also examine optional add-ons that can enhance your protection, like roadside assistance or rental car reimbursement. Finally, we’ll discuss how factors like your driving history and the type of vehicle you own impact your premium.

Defining “Full Coverage”

The term “full coverage” car insurance is frequently used, but its meaning isn’t always clear. Most people assume it means complete protection against any and all potential losses related to a car accident. However, the reality is more nuanced. The level of protection offered under a “full coverage” policy can vary significantly depending on the insurer and the specific policy details.

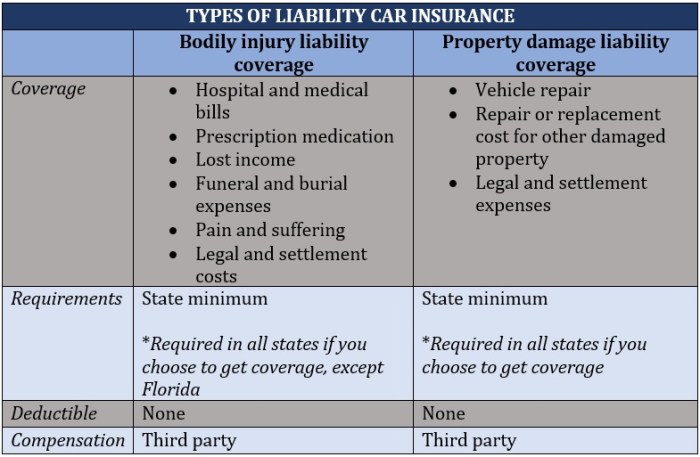

Full coverage generally encompasses more than just the minimum state-required liability insurance. Liability insurance only covers damages you cause to others, not damage to your own vehicle or your own injuries. Full coverage typically includes liability coverage, but also adds other important protections. This makes it a more comprehensive form of insurance compared to liability-only policies.

Variations in “Full Coverage” Policies

Different insurance companies offer varying levels of coverage under the “full coverage” umbrella. Some may include comprehensive and collision coverage as standard, while others might offer these as optional add-ons, potentially impacting the overall cost. Furthermore, the specific limits and deductibles within each coverage type can greatly affect the policy’s overall protection. For example, one insurer’s “full coverage” might offer $100,000 in liability coverage and a $500 deductible for collision, while another might offer $250,000 in liability and a $1,000 deductible. These differences highlight the importance of comparing policies carefully.

Comparison of “Full Coverage” with Other Options

Liability-only insurance, as mentioned earlier, provides the minimum legal requirement in most jurisdictions. It covers injuries or damages you cause to others in an accident but doesn’t cover your vehicle’s repairs or your medical expenses. Uninsured/underinsured motorist coverage, often included in full coverage policies, protects you if you’re involved in an accident with a driver who lacks sufficient insurance or is uninsured. This is a crucial component often missing from basic liability policies. Collision coverage, included in most full coverage policies, pays for damage to your vehicle regardless of fault. Comprehensive coverage, also frequently part of full coverage, covers damage from events other than collisions, such as theft, vandalism, or weather-related incidents.

Examples of “Full Coverage” Policies and Their Differences

Let’s consider two hypothetical examples. Company A’s “Gold Standard” policy might include $100,000 liability, $25,000 uninsured/underinsured motorist, $500 deductible collision, $500 deductible comprehensive, and rental car reimbursement. Company B’s “Ultimate Protection” policy might offer $300,000 liability, $50,000 uninsured/underinsured motorist, $1,000 deductible collision, $1,000 deductible comprehensive, roadside assistance, and accident forgiveness. Both are marketed as “full coverage,” but their coverage limits and additional benefits differ substantially, affecting both the premium and the level of protection offered. These differences illustrate the importance of carefully reading policy details before choosing a plan.

Optional Add-ons and Enhancements

While a standard full coverage car insurance policy provides essential protection, many insurers offer optional add-ons to enhance your coverage and peace of mind. These extras come at an additional cost, but can prove invaluable depending on your individual circumstances and driving habits. Choosing the right add-ons can significantly improve the overall value of your insurance policy.

Adding optional coverage is a personalized process. Consider your lifestyle, driving frequency, and the type of vehicle you own when evaluating the necessity and cost-effectiveness of each enhancement. A careful review of your needs will help you select add-ons that provide the best value for your money.

Roadside Assistance

Roadside assistance coverage provides help with common roadside emergencies such as flat tires, dead batteries, lockouts, and fuel delivery. The benefits include convenience and potentially significant cost savings by avoiding expensive towing or repair bills on the spot. The cost varies by insurer and the level of coverage offered, typically ranging from $10 to $30 per year. For frequent drivers or those who live in areas with limited roadside services, the value proposition is high. For someone who rarely drives or lives in a well-serviced area, this add-on might be less essential.

Rental Car Reimbursement

Rental car reimbursement coverage helps cover the cost of a rental car while your vehicle is being repaired after an accident that’s covered by your insurance. This is particularly beneficial if you rely on your car for daily commutes or essential errands. The cost varies widely, often depending on the daily or total amount reimbursed. The value proposition is high for individuals who depend heavily on their vehicles and would experience significant inconvenience without a replacement. For those with alternative transportation options, the benefit might be less significant.

Other Common Optional Add-ons

The following list Artikels several other common optional add-ons and their typical associated costs. These costs are estimates and can vary significantly based on your location, insurer, and the specific details of the coverage.

- Uninsured/Underinsured Motorist Coverage: This protects you in the event you are involved in an accident with an uninsured or underinsured driver. Costs vary but can range from $20 to $100 annually or more, depending on coverage limits. This is generally considered a valuable add-on, offering crucial protection against potentially devastating financial consequences.

- Gap Insurance: This covers the difference between the actual cash value of your vehicle and the amount you owe on your loan if your car is totaled. Cost depends on the loan amount and vehicle value, often ranging from a few hundred to over a thousand dollars annually. This is particularly valuable for newer vehicles with significant loan balances.

- Towing and Labor Coverage: This covers the cost of towing and on-site repairs. Costs vary significantly depending on the limits and the services included, typically ranging from $20 to $50 per year.

- Emergency Travel Expenses: Covers expenses like lodging and transportation if you are involved in an accident far from home. This can range from $10 to $50 annually, depending on the level of coverage.

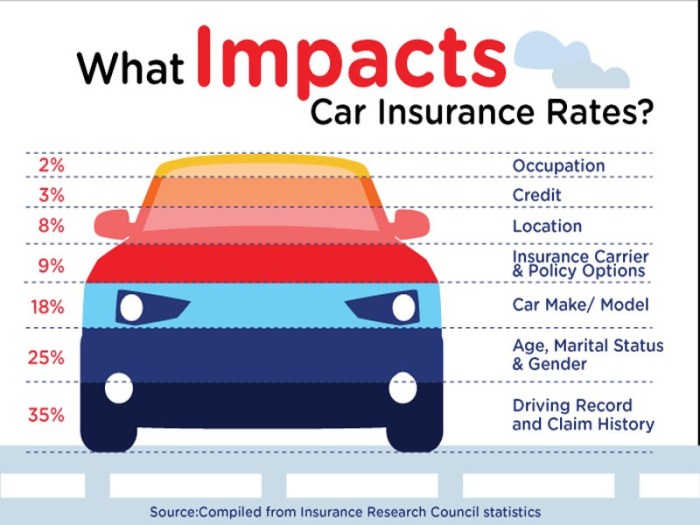

Factors Affecting Full Coverage Cost

Several key factors influence the cost of full coverage car insurance. Understanding these factors can help you make informed decisions about your policy and potentially save money. These factors are often interconnected, meaning a change in one can affect the others.

Your insurance premium is a reflection of the insurer’s assessment of your risk. The more risk you represent, the higher your premium will be. This risk assessment considers a variety of elements, which we will examine below.

Driving Record

A clean driving record significantly reduces your insurance costs. Accidents and traffic violations, particularly serious ones like DUIs, dramatically increase premiums. Insurance companies view these incidents as indicators of higher risk. For example, a driver with three speeding tickets in the past three years will likely pay significantly more than a driver with a spotless record. The severity and frequency of incidents are key factors. A single at-fault accident causing significant damage will raise premiums more than a minor fender bender.

Vehicle Type

The type of vehicle you drive is a major factor in determining your insurance cost. Luxury cars, sports cars, and high-performance vehicles are generally more expensive to insure due to higher repair costs and a greater potential for theft. Conversely, smaller, less expensive vehicles typically have lower insurance premiums. For instance, insuring a new, high-end SUV will cost considerably more than insuring a used, fuel-efficient compact car. The vehicle’s safety features also play a role; cars with advanced safety technology may receive discounts.

Location

Your location significantly impacts your insurance rates. Areas with high crime rates, frequent accidents, and higher vehicle theft rates generally have higher insurance premiums. Insurance companies base their rates on statistical data from the region where you live. A driver residing in a densely populated urban area with a high crime rate will likely pay more than a driver living in a rural area with lower crime rates. This is due to the increased risk of accidents and theft in high-risk areas.

Age and Gender

Statistically, younger drivers (typically under 25) are considered higher-risk drivers and often pay higher premiums. Insurance companies use statistical data on accident rates for different age groups to set premiums. Similarly, gender can sometimes be a factor, though this is becoming less prevalent due to regulations against gender-based discrimination in some regions. However, historical data may still influence pricing in some areas.

Hypothetical Scenario: Impact of Different Factors

Let’s consider two hypothetical drivers:

Driver A: 30-year-old, clean driving record, drives a used Honda Civic, lives in a suburban area.

Driver B: 20-year-old, one at-fault accident and two speeding tickets, drives a new BMW M3, lives in a large city.

Driver B will likely pay significantly more for full coverage insurance than Driver A due to their younger age, less favorable driving record, more expensive vehicle, and higher-risk location. The combination of these factors results in a much higher perceived risk for the insurance company.

Examples of Premium Changes

Adding a driver to your policy, particularly a young, inexperienced driver, can significantly increase your premium. Conversely, completing a defensive driving course might earn you a discount. Switching to a less expensive vehicle can lead to considerable savings, as can moving to a lower-risk area. These changes illustrate how proactive management of these factors can affect your insurance costs.

Understanding Policy Documents and Exclusions

Carefully reviewing your car insurance policy documents is crucial for understanding your coverage and avoiding unexpected financial burdens. While your agent can provide an overview, the policy itself contains the legally binding details of your agreement with the insurance company. Failing to understand these details can lead to disputes and denied claims.

Understanding the specific terms and conditions Artikeld in your policy is paramount. Full coverage, while comprehensive, doesn’t cover everything. Many policies contain exclusions and limitations that restrict coverage under certain circumstances. These are often detailed in the fine print, and it is the policyholder’s responsibility to be aware of them.

Common Exclusions and Limitations

Full coverage policies typically exclude certain types of damage or events. These exclusions are designed to manage risk and prevent abuse of the insurance system. For example, damage caused by wear and tear, regular maintenance neglect, or intentional acts are usually not covered. Likewise, many policies limit coverage for specific types of vehicles or drivers.

Examples of Denied or Limited Coverage

Let’s consider a few scenarios where coverage might be denied or limited. Suppose you’re driving a friend’s car without their permission and get into an accident. Most likely, your own policy won’t cover the damages, and your friend’s insurance might deny coverage due to unauthorized use. Similarly, damage caused by driving under the influence of alcohol or drugs is generally excluded. If you are involved in an accident while racing or engaging in other illegal activities, coverage will likely be denied. Finally, if you fail to report an accident promptly as Artikeld in your policy, this can impact your claim’s approval.

Understanding the fine print of your car insurance policy is not just recommended; it’s essential for protecting yourself financially. A few minutes spent reviewing your policy could save you thousands of dollars in unexpected expenses.

Comparing Full Coverage Policies Across Insurers

Choosing the right full coverage car insurance policy requires careful comparison of offerings from different insurers. Several factors influence the best choice, and a systematic approach is crucial to finding the optimal balance between cost, coverage, and customer service. This involves understanding not only the price but also the specifics of the coverage provided and the reputation of the insurer.

Comparing full coverage car insurance policies from various providers involves a multi-step process. First, obtain quotes from several reputable companies. Then, meticulously examine the policy documents to understand the nuances of each policy’s coverage. Finally, consider the insurer’s reputation for customer service, claims handling, and financial stability.

Key Aspects to Consider When Choosing a Policy

Selecting a full coverage policy requires careful consideration of several key factors. Price is obviously important, but it shouldn’t be the sole determinant. The breadth and depth of coverage are equally critical, as are the insurer’s reputation for customer service and claims processing. Consider also the insurer’s financial strength and stability; a financially sound insurer is less likely to fail to pay out a claim.

A Structured Comparison of Hypothetical Full Coverage Policies

The following table compares hypothetical full coverage policies from three different insurers, highlighting their strengths and weaknesses. Remember that these are hypothetical examples and actual premiums and coverage details will vary based on individual circumstances and location.

| Insurer | Premium (Annual) | Coverage Highlights | Customer Reviews Summary |

|---|---|---|---|

| Insurer A | $1200 | Comprehensive coverage including collision, liability, uninsured/underinsured motorist, and rental car reimbursement. Higher deductible options available for lower premiums. | Generally positive reviews, praising efficient claims processing. Some complaints about customer service wait times. |

| Insurer B | $1500 | Excellent coverage, including roadside assistance and gap insurance. Offers various discounts for safe driving and bundling policies. Higher premiums but more comprehensive coverage. | Mostly positive reviews, highlighting excellent customer service and responsive claims handling. Fewer complaints than Insurer A. |

| Insurer C | $1000 | Basic full coverage, meeting minimum state requirements. Fewer optional add-ons available. | Mixed reviews. Some praise the low premiums, while others cite difficulties in reaching customer service and slow claims processing. |

Final Summary

Choosing the right car insurance policy is a personal decision based on individual risk tolerance and financial capacity. While “full coverage” offers extensive protection, it’s vital to carefully review the policy documents, understand the exclusions, and compare offerings from different insurers. By understanding the components, optional add-ons, and cost-influencing factors, you can confidently select a policy that provides the necessary protection without unnecessary expense. Remember to prioritize clarity and thorough comprehension of your chosen policy’s terms and conditions.

Popular Questions

What is the difference between full coverage and liability-only insurance?

Liability-only insurance covers damages you cause to others, while full coverage adds collision and comprehensive coverage to protect your own vehicle.

Does full coverage cover everything?

No, even “full coverage” has exclusions. Always review your policy documents for specific limitations and exclusions.

How often should I review my car insurance policy?

It’s recommended to review your policy annually, or whenever there’s a significant life change (new car, address change, etc.).

Can I lower my full coverage premiums?

Yes, consider factors like increasing your deductible, improving your driving record, and bundling insurance policies.

What happens if I’m in an accident and my car is totaled?

With full coverage, your insurer will typically pay out the actual cash value of your vehicle, minus your deductible, after an accident deemed a total loss.