The term “full coverage insurance” is often bandied about, but its true meaning remains surprisingly elusive. Many believe a simple “full coverage” policy offers complete protection against all possible scenarios, a misconception that can lead to significant financial hardship. This guide delves into the complexities of auto insurance, clarifying what truly constitutes full coverage and highlighting the crucial distinctions between different policy levels.

Understanding the nuances of auto insurance is vital for responsible financial planning. This guide will explore the core components of full coverage, examining collision and comprehensive coverage in detail, and comparing them to liability insurance. We’ll also analyze factors influencing costs, potential exclusions, and the process of choosing the right level of coverage for your individual needs and risk tolerance.

Defining “Full Coverage” Insurance

The term “full coverage” auto insurance is frequently misunderstood, leading many to believe they have more protection than they actually do. This misconception stems from a lack of understanding of the different types of coverage available and how they interact. A truly comprehensive policy goes beyond the basic requirements, offering broader protection against various risks.

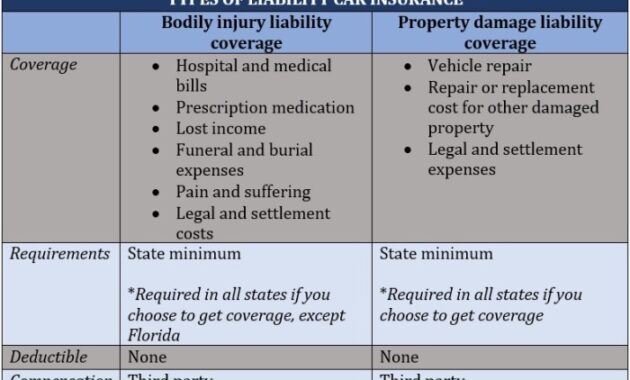

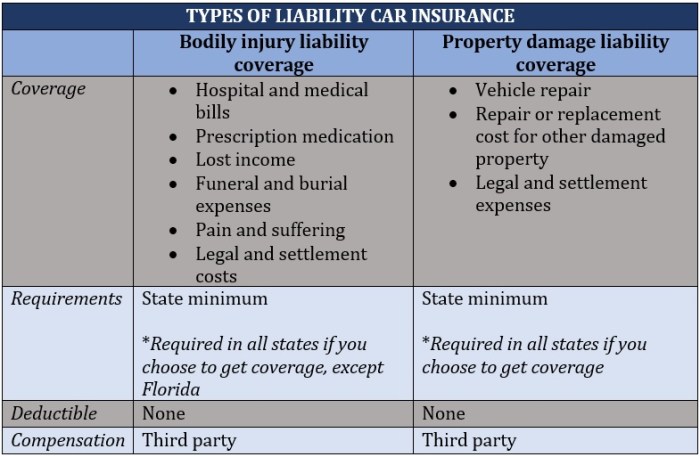

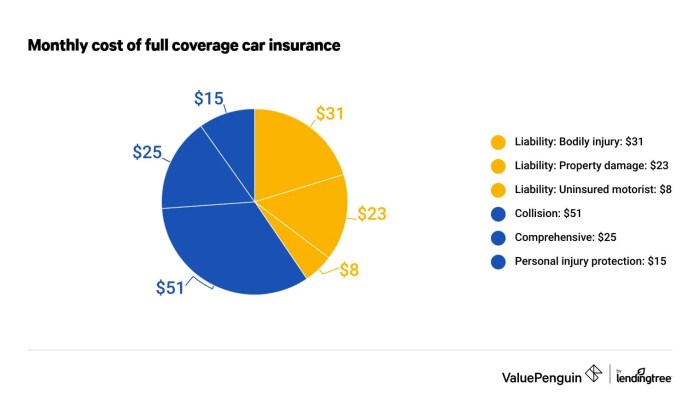

The components typically included in a policy often referred to as “full coverage” are liability coverage, collision coverage, and comprehensive coverage. Liability insurance covers damages you cause to others or their property in an accident. Collision coverage pays for repairs to your vehicle following an accident, regardless of fault. Comprehensive coverage protects against damage to your car from events other than collisions, such as theft, vandalism, or weather-related incidents. Uninsured/underinsured motorist coverage is also often considered part of a full coverage policy; this protects you if you’re involved in an accident with a driver who lacks sufficient insurance or is uninsured. Medical payments coverage, which helps pay for medical expenses for you and your passengers regardless of fault, is another frequent inclusion.

Common Misconceptions About Full Coverage

Many believe that simply purchasing liability and collision coverage constitutes “full coverage.” However, this omits crucial protections like comprehensive coverage, which safeguards against non-collision damage. The addition of uninsured/underinsured motorist coverage is also essential for complete protection. A policy that only covers liability and collision leaves significant gaps in protection against various risks.

Examples of Policies Mistaken for Full Coverage

Liability-only policies are frequently sold as a cheaper alternative, but they only cover damages you cause to others, leaving you responsible for repairing your own vehicle after an accident. Similarly, some policies might include liability and collision, but lack comprehensive coverage, leaving the vehicle vulnerable to damage from events such as hailstorms, fire, or theft. These policies, while offering some protection, are far from “full coverage” in the sense of comprehensive protection.

Comparison of Coverage Levels

| Coverage Type | Description | Example |

|---|---|---|

| Liability | Covers bodily injury and property damage to others caused by you. | Paying for medical bills and car repairs for someone you hit. |

| Collision | Covers damage to your vehicle in an accident, regardless of fault. | Repairing your car after a fender bender, even if you caused it. |

| Comprehensive | Covers damage to your vehicle from non-collision events. | Replacing your windshield after a rock chips it, or repairing your car after a tree falls on it. |

| Uninsured/Underinsured Motorist | Covers damages caused by an uninsured or underinsured driver. | Paying for your medical bills and car repairs after being hit by an uninsured driver. |

Components of Full Coverage Insurance

Full coverage auto insurance, while not truly “full” in the sense of covering every conceivable event, provides a comprehensive suite of protections beyond the legally mandated minimums. Understanding these components is crucial for making informed decisions about your insurance needs and ensuring adequate financial protection in the event of an accident or damage to your vehicle. This section details the key elements typically included in a comprehensive auto insurance policy.

Collision Insurance

Collision insurance covers damage to your vehicle resulting from a collision with another vehicle or object, regardless of fault. This means that even if you are at fault for the accident, your insurance will cover the cost of repairs or replacement of your vehicle, up to the policy’s limits. Deductibles apply, meaning you’ll pay a certain amount out-of-pocket before your insurance coverage kicks in. For example, if you have a $500 deductible and your repairs cost $2,000, you would pay $500, and your insurance would cover the remaining $1,500. The amount of coverage is usually determined by the actual cash value (ACV) or replacement cost of your vehicle at the time of the accident.

Comprehensive Insurance

Comprehensive insurance protects your vehicle against damage caused by events other than collisions. This includes a wide range of incidents such as theft, vandalism, fire, hail damage, flooding, and damage caused by animals. Unlike collision insurance, comprehensive coverage typically doesn’t have a separate deductible from the collision deductible. For instance, if a tree falls on your car during a storm, comprehensive insurance would cover the cost of repairs or replacement, subject to your deductible. It’s important to note that certain exclusions may apply, such as damage caused by wear and tear or intentional acts.

Liability Coverage Limits and Their Implications

The following table compares different liability coverage limits and their potential financial implications. Understanding these limits is critical, as liability coverage protects you against financial responsibility for injuries or damages you cause to others. Higher limits provide greater protection, but also typically result in higher premiums.

| Liability Coverage Limit | Bodily Injury per Person | Bodily Injury per Accident | Property Damage per Accident |

|---|---|---|---|

| 25/50/25 | $25,000 | $50,000 | $25,000 |

| 50/100/50 | $50,000 | $100,000 | $50,000 |

| 100/300/100 | $100,000 | $300,000 | $100,000 |

| 250/500/250 | $250,000 | $500,000 | $250,000 |

Note: These are example limits and actual coverage amounts may vary depending on your insurance provider and policy. It’s crucial to select liability limits appropriate to your risk profile and financial capacity. Serious accidents can easily exceed lower coverage limits, leaving you personally responsible for significant additional costs.

Exclusions and Limitations in Full Coverage

While “full coverage” insurance sounds comprehensive, it’s crucial to understand that no policy truly covers every conceivable event. Several exclusions and limitations exist, impacting the extent of protection offered. Understanding these nuances is vital to avoid unexpected financial burdens in the event of a claim.

Full coverage policies typically exclude certain types of damage or events. These exclusions are often clearly stated within the policy documents, but their implications can be easily overlooked. Limitations further restrict the amount or type of compensation provided, even for covered incidents. The variations between insurers in terms of these exclusions and limitations highlight the importance of carefully comparing policies before making a decision.

Common Exclusions in Full Coverage Policies

Several common events are typically excluded from full coverage auto insurance policies. These exclusions can significantly impact the overall protection provided, leading to unexpected out-of-pocket expenses in specific situations.

- Wear and Tear: Normal wear and tear on your vehicle is generally not covered. This includes things like tire wear, fading paint, or gradual mechanical failure due to age.

- Mechanical Breakdown: Unless explicitly included as an add-on, most full coverage policies won’t cover mechanical failures unrelated to accidents. A sudden engine failure, for instance, might not be compensated.

- Acts of God: Damage caused by events outside human control, such as earthquakes, floods, or hurricanes, may be excluded or have specific limitations. The level of coverage for these events often depends on whether you have purchased additional endorsements or riders.

- Intentional Damage: Damage caused intentionally by the policyholder is usually excluded. This includes self-inflicted damage or vandalism committed by the insured.

Limitations on Coverage for Specific Events

Even when an event is covered, the amount of compensation might be limited. These limitations can significantly affect the financial recovery following an incident. Understanding these restrictions is crucial for making informed decisions about insurance coverage.

- Deductibles: Before the insurance company begins to pay for covered repairs, the policyholder is responsible for paying a deductible. Higher deductibles usually mean lower premiums, but also mean a larger out-of-pocket expense in the event of a claim.

- Caps on Coverage: Policies often have limits on the amount they will pay for specific types of damage or losses. For example, there might be a maximum payout for a totaled vehicle, even if the vehicle’s actual value exceeds that limit.

- Rental Car Reimbursement Limitations: While many policies include rental car reimbursement, there are often daily and overall limits on the amount paid. The duration and type of rental vehicle may also be restricted.

Examples of Insufficient Protection Under Full Coverage

Several scenarios illustrate how “full coverage” might not provide complete financial protection. These examples highlight the importance of carefully reviewing policy details and considering supplemental coverage options.

- Driving an Uninsured Vehicle: If you are driving a vehicle not listed on your policy and are involved in an accident, your coverage may be limited or nonexistent.

- Damage from a Flood in a Non-Flood Zone: While your policy might cover some flood damage, the extent of coverage may be significantly limited if you live in an area not designated as a high-risk flood zone.

- Total Loss with High Vehicle Value: If your vehicle is totaled and its value exceeds the policy’s coverage limit, you’ll have to cover the difference out-of-pocket.

Coverage Limitations Across Different Insurance Providers

Insurance companies vary in their specific exclusions and limitations. Comparing policies from different providers is crucial to identify the best coverage at the most competitive price. This comparison should go beyond simply looking at premiums and should involve a thorough review of policy documents.

| Insurance Provider | Deductible Options | Rental Car Reimbursement Limit (daily) | Coverage Limit for Total Loss |

|---|---|---|---|

| Provider A | $500, $1000, $2500 | $30 | $25,000 |

| Provider B | $250, $500, $1000 | $40 | $30,000 |

| Provider C | $500, $1500 | $25 | $20,000 |

Note: This is a simplified example and actual coverage limits and options will vary significantly based on individual circumstances and policy details.

Choosing the Right Coverage Level

Selecting the appropriate level of car insurance coverage is a crucial decision that balances financial protection with affordability. Understanding your personal circumstances, risk tolerance, and potential financial consequences is paramount to making an informed choice. This process requires careful consideration of your assets, liabilities, and the potential costs associated with accidents or vehicle damage.

Determining the right coverage involves a systematic approach. It’s not simply a matter of choosing the cheapest option; rather, it’s about finding the sweet spot that provides adequate protection without unnecessary expense. Failing to secure sufficient coverage can have significant financial ramifications, potentially leading to substantial personal debt and hardship.

Assessing Personal Needs and Assets

The first step involves a thorough evaluation of your personal financial situation and assets. Consider the value of your vehicle, any outstanding loans associated with it, and other significant personal assets like your home or investments. If you have significant assets at risk, a higher level of liability coverage is generally advisable. For instance, someone with a high-value home and substantial savings would likely benefit from a higher liability limit than someone with fewer assets. Furthermore, consider your income and expenses. A higher income might allow for greater coverage premiums, while a lower income might necessitate a more careful consideration of coverage levels and deductibles.

Understanding Financial Consequences of Insufficient Coverage

Choosing insufficient coverage exposes you to significant financial risks. In the event of an accident where you are at fault, inadequate liability coverage could leave you personally responsible for substantial medical bills, property damage, and legal fees. This could lead to bankruptcy or severe financial strain. For example, if you cause an accident resulting in $200,000 in damages, but your liability coverage is only $50,000, you would be personally responsible for the remaining $150,000. This could easily deplete your savings, force the sale of assets, or even lead to lawsuits. Similarly, insufficient collision or comprehensive coverage could leave you with significant repair bills or the total loss of your vehicle following an accident or damage.

Decision-Making Flowchart for Insurance Coverage

The following flowchart visually represents the decision-making process for selecting insurance coverage:

[Imagine a flowchart here. The flowchart would start with a box labeled “Assess Your Assets and Liabilities.” This would branch to two boxes: “High Net Worth/High Risk Tolerance” and “Low Net Worth/Low Risk Tolerance.” The “High Net Worth” branch would lead to a box recommending “Higher Liability Limits and Comprehensive Coverage.” The “Low Net Worth” branch would lead to a box suggesting “Minimum State-Required Liability and Cost-Effective Deductibles.” Both branches would ultimately converge at a box labeled “Compare Quotes and Choose Policy.”]

Considering Risk Tolerance and Personal Assets

Your risk tolerance plays a critical role in determining the appropriate coverage level. Individuals with a higher risk tolerance might opt for higher deductibles in exchange for lower premiums, while those with a lower risk tolerance might prefer higher premiums for lower deductibles. This is directly linked to your personal assets. Someone with substantial assets might be more willing to accept a higher deductible because they have the financial resources to cover the cost if an incident occurs. Conversely, someone with limited assets might prioritize lower deductibles to minimize out-of-pocket expenses in the event of an accident. It’s essential to find a balance that aligns with both your financial capacity and your comfort level with potential financial risks.

Understanding Policy Documents

Your insurance policy is a legally binding contract. Understanding its contents is crucial to ensuring you receive the coverage you paid for and to avoid disputes later. This section will guide you through the key elements of a typical policy document, helping you decipher the often complex terminology.

Key Sections of an Insurance Policy

A standard insurance policy is structured to present information clearly, though the specific section titles may vary slightly between insurers. Generally, you will find sections dedicated to the following:

- Declarations Page: This is the summary page, providing key information such as your name, address, policy number, coverage details, premiums, and policy period. It’s the quick reference guide to your policy’s essentials.

- Definitions: This section clarifies the meaning of key terms used throughout the policy. Familiarizing yourself with these definitions is vital for accurate interpretation.

- Coverage Details: This Artikels the specific types of coverage you have purchased, including limits of liability, deductibles, and any additional coverages.

- Exclusions and Limitations: This critical section specifies what is *not* covered by your policy. Carefully reviewing these exclusions is essential to avoid misunderstandings about what your insurance will and will not pay for.

- Conditions: This section Artikels the responsibilities and obligations of both the insured and the insurer. It often includes details about reporting claims, cooperating with investigations, and providing accurate information.

- Policy Period: This specifies the duration of your insurance coverage, typically a year, but may vary depending on the type of policy.

Common Policy Terminology

Insurance policies use specific terminology that can be confusing to the average person. Understanding these terms is crucial for effective policy interpretation.

- Premium: The amount you pay to maintain your insurance coverage.

- Deductible: The amount you must pay out-of-pocket before your insurance coverage begins to pay.

- Liability Coverage: Protection against financial losses due to injuries or damages you cause to others.

- Co-insurance: The percentage of covered expenses you are responsible for after meeting your deductible.

- Claim: A formal request for payment under your insurance policy.

- Policyholder: The individual or entity who owns and holds the insurance policy.

- Insured: The person(s) or property covered by the insurance policy.

Glossary of Important Terms

| Term | Definition | Term | Definition |

|---|---|---|---|

| Actuary | A professional who assesses and manages financial risks. | Beneficiary | The person or entity designated to receive insurance benefits. |

| Claimant | The person making a claim under the insurance policy. | Endorsement | An addition or amendment to an existing policy. |

| Exclusion | A specific event or circumstance not covered by the insurance policy. | Incurred But Not Reported (IBNR) | Claims that have occurred but haven’t yet been reported to the insurer. |

| Insurer | The company providing the insurance coverage. | Liability | Legal responsibility for causing harm or damage. |

| Premium | The payment made to maintain insurance coverage. | Rider | An addendum to an insurance policy modifying or extending coverage. |

| Subrogation | The insurer’s right to recover losses from a third party after paying a claim. | Umbrella Coverage | Additional liability insurance beyond the limits of primary policies. |

Interpreting Specific Policy Clauses

Understanding specific clauses requires careful reading and often necessitates seeking professional clarification if needed. For example, a clause might state: “This policy does not cover losses resulting from intentional acts of the insured.” This means that if you deliberately damage your own property, your claim will likely be denied. Another clause might limit coverage for specific types of damage, such as flood damage if you only have standard homeowners insurance. Always thoroughly read and understand each clause, and don’t hesitate to contact your insurer or a qualified insurance professional for clarification on any unclear points.

End of Discussion

Securing adequate auto insurance is a crucial aspect of responsible financial management. While the term “full coverage” often implies complete protection, a thorough understanding of policy components, limitations, and exclusions is essential. By carefully weighing your individual needs, risk tolerance, and financial capabilities against the various coverage options available, you can make an informed decision that safeguards your assets and provides peace of mind. Remember to review your policy documents regularly and consult with an insurance professional to ensure your coverage remains appropriate for your circumstances.

Query Resolution

What happens if I’m at fault in an accident with full coverage?

Your collision coverage will typically cover damage to your vehicle, minus your deductible. However, your liability coverage will handle damages to the other party’s vehicle and any related injuries.

Does full coverage cover damage from a natural disaster?

Comprehensive coverage, a component of full coverage, usually covers damage from events like hail, floods, or fire. Specific exclusions may apply depending on your policy.

Can I customize my full coverage policy?

Yes, you can often adjust coverage limits and choose optional add-ons to tailor your policy to your specific needs and budget.

How often should I review my full coverage policy?

It’s advisable to review your policy annually, or whenever significant life changes occur (e.g., new car, change in driving habits, moving to a new location).