Finding the right car insurance can feel like navigating a maze. With countless providers, coverage options, and jargon, it’s easy to feel overwhelmed. This guide aims to demystify the process, helping you understand the key factors to consider when selecting the best car insurance policy for your individual circumstances. We’ll explore various coverage types, premium determinants, and provider comparisons to empower you to make an informed decision.

From understanding the nuances of liability and collision coverage to navigating the complexities of deductibles and discounts, we’ll equip you with the knowledge to confidently choose a policy that provides adequate protection without breaking the bank. We’ll also examine how factors like your driving history, location, and credit score impact your premiums, enabling you to make strategic choices that optimize your insurance costs.

Defining “Best” Car Insurance

Finding the “best” car insurance isn’t about a single, universally ideal policy. Instead, it’s about identifying the policy that best suits your individual needs and circumstances. Several factors contribute to what constitutes the best option for a particular person, making it a highly personalized decision.

Factors Influencing Individual Preferences for Car Insurance

The ideal car insurance policy is heavily dependent on individual risk profiles and priorities. A young driver with a less-than-perfect driving record will have vastly different needs than a seasoned driver with a spotless history. Similarly, someone living in a high-crime area may prioritize comprehensive coverage over someone residing in a safer neighborhood. Financial stability also plays a significant role; those with limited financial resources might focus on affordable liability coverage, while wealthier individuals may opt for higher coverage limits and additional benefits.

Common Car Insurance Features and Their Relative Importance

Understanding the various features offered by car insurance providers is crucial in making an informed decision. The relative importance of each feature depends on the individual’s circumstances and priorities.

- Liability Coverage: This covers damages or injuries you cause to others in an accident. It’s generally considered the most important coverage, as it protects you from potentially devastating financial consequences. The amount of liability coverage should be chosen carefully, considering the potential costs of accidents and legal fees.

- Collision Coverage: This covers damage to your own vehicle in an accident, regardless of fault. This is valuable for newer vehicles or those with significant loan balances, but may be less critical for older cars.

- Comprehensive Coverage: This covers damage to your vehicle from non-collision events, such as theft, vandalism, or natural disasters. The value of comprehensive coverage is highly dependent on the vehicle’s age and value, as well as the risk of such events in your area.

- Uninsured/Underinsured Motorist Coverage: This protects you if you’re involved in an accident with an uninsured or underinsured driver. It’s particularly important in areas with a high percentage of uninsured drivers.

- Medical Payments Coverage: This covers medical expenses for you and your passengers, regardless of fault. This can be crucial for covering medical bills after an accident, especially if your health insurance has high deductibles or co-pays.

- Rental Reimbursement: This covers the cost of a rental car while your vehicle is being repaired after an accident. This is beneficial for those who rely on their vehicle for daily commuting or other essential activities.

Examples of Different Consumer Profiles and Their Respective Insurance Needs

To illustrate the variability in insurance needs, consider these examples:

- Young, Inexperienced Driver: This individual might prioritize liability coverage, focusing on affordability while gradually building up their driving record to qualify for lower premiums. Collision and comprehensive coverage might be less of a priority initially due to higher costs.

- Middle-Aged Professional with a Family: This individual likely prioritizes comprehensive coverage to protect their family and their vehicle. Higher liability limits might also be considered to safeguard against potential financial burdens.

- Senior Citizen with a Paid-Off Vehicle: This individual might opt for lower coverage limits on collision and comprehensive, focusing primarily on liability coverage. They might also explore discounts available to senior citizens.

Types of Car Insurance Coverage

Choosing the right car insurance involves understanding the different types of coverage available. This ensures you have the appropriate protection for various scenarios, balancing cost and risk. The main types of coverage offer distinct levels of protection and financial responsibility.

Liability Coverage

Liability coverage protects you financially if you cause an accident that injures someone or damages their property. It typically covers bodily injury liability and property damage liability. Bodily injury liability pays for medical expenses, lost wages, and pain and suffering of those injured in an accident you caused. Property damage liability covers the cost of repairing or replacing the other person’s vehicle or property. The limits are usually expressed as three numbers (e.g., 100/300/100), representing the maximum amount the insurance company will pay for bodily injury per person ($100,000), bodily injury per accident ($300,000), and property damage per accident ($100,000). Higher limits offer greater protection but typically result in higher premiums.

Collision Coverage

Collision coverage pays for damage to your vehicle regardless of who is at fault. This means if you hit another car, a tree, or even a pothole, your insurance will cover the repairs or replacement cost, less your deductible. This coverage is optional, but highly recommended, especially for newer vehicles. The cost of collision coverage depends on several factors including your vehicle’s make and model, your driving record, and your location.

Comprehensive Coverage

Comprehensive coverage protects your vehicle from damage caused by events other than collisions. This includes things like theft, vandalism, fire, hail, floods, and animal damage. Like collision coverage, it’s optional but valuable for protecting against unexpected events. The cost is influenced by factors similar to those affecting collision coverage. For example, if you live in an area prone to hailstorms, your comprehensive premiums might be higher.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist (UM/UIM) coverage protects you if you’re involved in an accident caused by an uninsured or underinsured driver. This coverage can pay for your medical bills, lost wages, and vehicle repairs, even if the at-fault driver doesn’t have sufficient insurance. UM coverage addresses your injuries, while UIM covers property damage. It’s crucial to have adequate UM/UIM coverage because many drivers operate without insurance.

Deductible Options and Premium Impact

The deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. Higher deductibles generally result in lower premiums because you’re accepting more financial responsibility. Conversely, lower deductibles mean higher premiums but less out-of-pocket expense in the event of a claim. Choosing a deductible involves balancing the risk of a high out-of-pocket expense against the cost of higher premiums. For example, a $500 deductible might save you money on your monthly premiums compared to a $1000 deductible, but you’ll pay more out-of-pocket if you need to file a claim.

Comparison of Coverage Types

| Coverage Type | What it Covers | Cost Implications | Benefits |

|---|---|---|---|

| Liability | Damages you cause to others | Generally required; cost varies by limits | Protects you from significant financial liability |

| Collision | Damage to your vehicle, regardless of fault | Optional; cost varies by vehicle and deductible | Covers repairs or replacement of your vehicle |

| Comprehensive | Damage to your vehicle from non-collision events | Optional; cost varies by location and deductible | Protects against a wide range of risks |

| Uninsured/Underinsured Motorist | Damages caused by uninsured or underinsured drivers | Optional; cost varies by limits | Essential protection against drivers without adequate insurance |

Finding the Right Car Insurance Provider

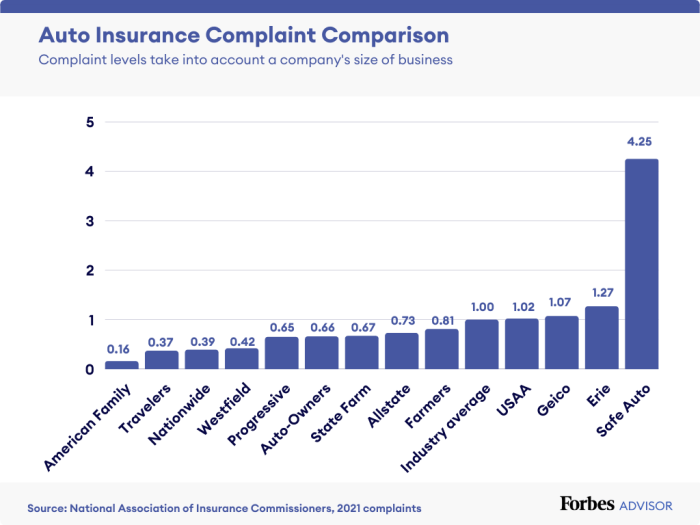

Choosing the right car insurance provider is crucial, as it directly impacts your financial protection and overall experience in case of an accident or other covered incident. A thorough comparison of different providers is essential to ensure you secure the best coverage at a competitive price. Consider factors beyond just the premium to make an informed decision.

Finding the ideal car insurance provider involves careful consideration of several key aspects. This includes not only the price of the premiums but also the quality of customer service, efficiency of claims processing, and the availability of convenient online tools. A provider offering a low premium but poor customer service can lead to significant frustration during a stressful time.

Comparison of Insurance Company Services

Different insurance companies offer varying levels of service. Some excel in customer service, providing readily available representatives and efficient resolution to inquiries. Others prioritize streamlined online tools, allowing policy management and claims filing entirely through a user-friendly website or mobile app. Claims processing speed and transparency also vary significantly. Some companies process claims quickly and keep policyholders well-informed throughout the process, while others may be slower and less communicative. For example, Company A might boast a 24/7 customer service hotline with an average call wait time of under 2 minutes, while Company B may only offer limited online support and longer wait times for phone assistance. Similarly, Company A might process claims within 7 days, while Company B may take up to 30 days.

Reputable Car Insurance Providers and Key Features

Several reputable car insurance providers offer a range of coverage options and features. It’s important to remember that the “best” provider will vary depending on individual needs and preferences.

A list of some well-known providers and their general key features (note that specific offerings and pricing vary by location and individual circumstances):

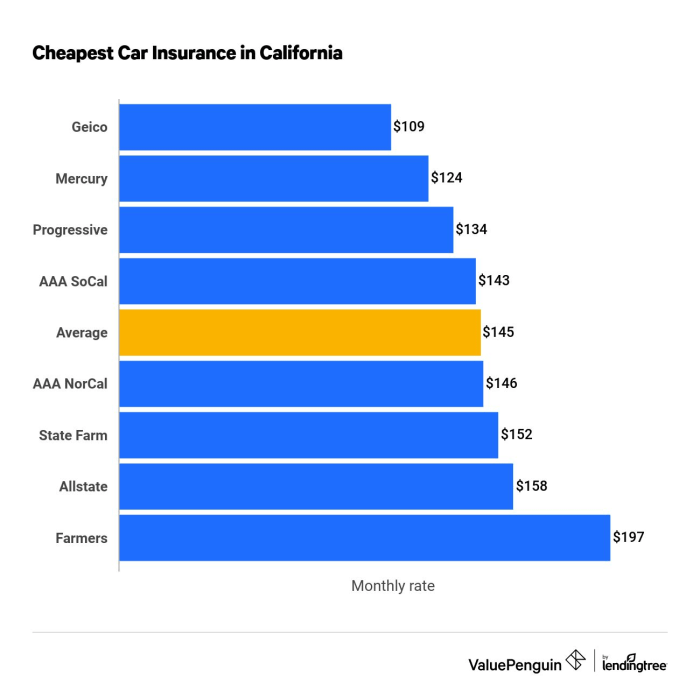

- Geico: Known for its competitive pricing and extensive online tools. Often advertised for its ease of use and quick claims processing.

- State Farm: A large, established company with a wide range of coverage options and a strong reputation for customer service. They often offer bundled discounts for multiple insurance types.

- Progressive: Offers a variety of discounts and personalized pricing options through their “Name Your Price” tool. They also have a strong online presence and mobile app.

- Allstate: Another established company known for its comprehensive coverage and various add-on options. They often emphasize their commitment to customer satisfaction.

- USAA: Primarily serves military members and their families, often offering highly competitive rates and excellent service within their target demographic.

Car Insurance Provider Comparison Chart

The following chart provides a simplified comparison of average premiums and coverage options. Remember that actual premiums will vary based on factors such as driving history, location, vehicle type, and coverage level. This data is for illustrative purposes only and should not be considered a definitive guide.

| Provider | Liability Coverage (Average Premium) | Collision Coverage (Average Premium) | Key Features |

|---|---|---|---|

| Geico | $500/year (estimated) | $600/year (estimated) | Strong online tools, competitive pricing |

| State Farm | $550/year (estimated) | $650/year (estimated) | Wide coverage options, bundled discounts |

| Progressive | $450/year (estimated) | $550/year (estimated) | Personalized pricing, “Name Your Price” tool |

| Allstate | $600/year (estimated) | $700/year (estimated) | Comprehensive coverage, various add-ons |

Filing a Claim

Filing a car insurance claim can seem daunting, but understanding the process can make it significantly less stressful. A prompt and well-documented claim increases your chances of a fair and timely settlement. Remember to always refer to your specific policy documents for detailed instructions and coverage specifics.

The claims process generally involves several key steps, although the specifics might vary slightly depending on your insurance provider and the nature of the accident.

Steps Involved in Filing a Car Insurance Claim

The initial steps are crucial for a smooth claims process. Acting quickly and accurately helps ensure your claim is processed efficiently.

- Report the accident to the police: This is particularly important in cases involving injuries or significant property damage. Obtain a police report number as this will be crucial documentation for your claim.

- Contact your insurance company: Report the accident to your insurer as soon as possible, usually within 24-48 hours. Have your policy information readily available. They will guide you through the next steps.

- Gather information: Collect all relevant information from the accident scene, including contact details of all parties involved, witness information, photos and videos of the damage to all vehicles, and the location of the accident.

- Complete a claim form: Your insurer will provide you with a claim form. Complete it accurately and thoroughly, providing all requested information.

- Provide supporting documentation: Submit all necessary documentation, including the police report, photos, repair estimates, and medical bills (if applicable).

- Cooperate with the investigation: Your insurer might conduct an investigation to verify the details of the accident. Cooperate fully and provide any requested information or documentation.

- Negotiate a settlement: Once the investigation is complete, your insurer will offer a settlement. Review the offer carefully and negotiate if necessary. You may want to seek legal counsel if you disagree with the settlement offer.

Claim Scenarios and Appropriate Actions

Different accident scenarios require slightly different approaches. Understanding these variations can help you navigate the claims process effectively.

- Minor Accident with No Injuries: If the damage is minor and there are no injuries, you can often handle the claim directly with your insurer. Focus on gathering evidence (photos, witness statements) and completing the claim form accurately.

- Accident with Injuries: Seek immediate medical attention. Report the accident to the police and your insurer promptly. Ensure you document all medical expenses and treatment.

- Hit and Run: Report the incident to the police immediately. Provide as much detail as possible about the other vehicle and driver. Your insurer will guide you through the claim process, which might involve working with law enforcement.

- Accident Involving Multiple Vehicles: Gather information from all parties involved, including contact details, insurance information, and license plate numbers. Obtain witness statements and photos of the damage to all vehicles.

Effective Communication with the Insurance Company

Clear and consistent communication is key to a successful claim. Maintain a professional and respectful tone throughout the process.

Be prompt in responding to requests for information. Keep detailed records of all communication, including dates, times, and the names of individuals you spoke with. If you have questions or concerns, don’t hesitate to contact your insurer to clarify. Maintain a paper trail of all correspondence.

Wrap-Up

Ultimately, the “best” car insurance isn’t a one-size-fits-all solution. It’s a personalized choice dependent on your individual risk profile, financial situation, and driving habits. By carefully considering the factors discussed – coverage types, premium influences, and provider offerings – you can confidently select a policy that aligns with your specific needs and provides the peace of mind you deserve. Remember to regularly review your policy and adjust it as your circumstances change to maintain optimal protection.

Popular Questions

What is the difference between liability and collision coverage?

Liability coverage pays for damages you cause to others’ property or injuries you inflict on others in an accident. Collision coverage pays for repairs to your own vehicle, regardless of fault.

How often should I review my car insurance policy?

It’s advisable to review your policy at least annually, or whenever significant life changes occur (new car, address change, marriage, etc.).

Can I get car insurance without a credit check?

Some insurers offer policies that don’t explicitly use credit scores, but your driving history and other factors will still heavily influence your premium.

What should I do if I’m involved in an accident?

Prioritize safety. Call emergency services if needed. Then, exchange information with the other driver(s), take photos of the damage, and report the accident to your insurer as soon as possible.