Whole life insurance, often perceived as a complex financial instrument, offers a unique feature: cash value accumulation. This feature transforms your life insurance policy into a multifaceted tool, providing both death benefit protection and a growing savings component. Understanding how this cash value grows, how you can access it, and when it’s the right financial choice is crucial for making informed decisions about your long-term financial security.

This comprehensive guide will demystify whole life insurance cash value, exploring its mechanics, advantages, disadvantages, and practical applications. We’ll delve into the factors influencing cash value growth, the various methods for accessing funds, and a comparison with term life insurance to help you determine if it aligns with your personal financial goals.

Defining Whole Life Insurance Cash Value

Whole life insurance is more than just a death benefit; it’s a financial tool that builds cash value over time. This cash value represents the accumulation of premiums paid, less expenses and mortality charges, and it grows tax-deferred. Understanding this cash value component is crucial for maximizing the benefits of a whole life policy.

Cash value accumulation in whole life insurance policies functions like a savings account that grows over time. A portion of each premium payment goes towards building this cash value, while another portion covers the death benefit and the insurance company’s operating costs. The cash value grows through interest credited by the insurance company, often based on a fixed or variable rate, depending on the policy type. This growth is tax-deferred, meaning you won’t pay taxes on the earnings until you withdraw them.

Cash Value Accumulation Mechanisms

The growth of cash value is primarily driven by the interest credited by the insurance company. This interest rate can be fixed, meaning it remains constant throughout the policy’s duration, or it can be variable, fluctuating with market conditions. Additionally, the policy’s dividends (if applicable) are also added to the cash value, further enhancing its growth. The insurer uses a portion of the premiums to pay for the death benefit coverage, and any remaining funds are allocated to the cash value account. The speed at which the cash value grows depends on the policy’s design, the interest rate credited, and the premiums paid. The longer the policy is in effect, the greater the opportunity for the cash value to grow substantially.

Factors Influencing Cash Value Growth

Several factors significantly impact the growth rate of whole life insurance cash value. These include the interest rate credited to the policy, the type of whole life policy (e.g., fixed, variable, universal life), the premiums paid, the policy’s fees and expenses, and the insurer’s dividend policy (if applicable). Higher interest rates naturally lead to faster cash value growth, while higher premiums contribute to a larger cash value accumulation. Conversely, higher fees and expenses reduce the net amount available for cash value growth. Dividends, when paid, add to the cash value and can significantly boost its growth over time.

Comparison of Cash Value Growth in Different Whole Life Products

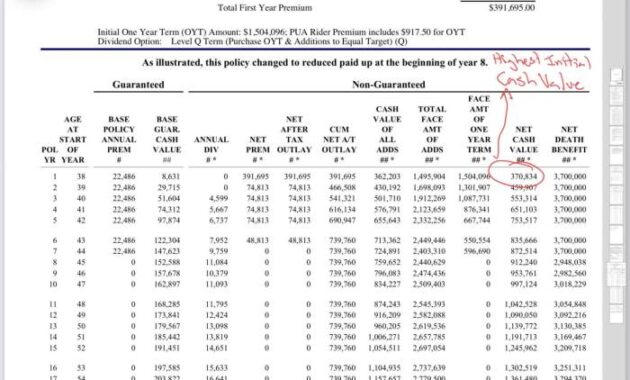

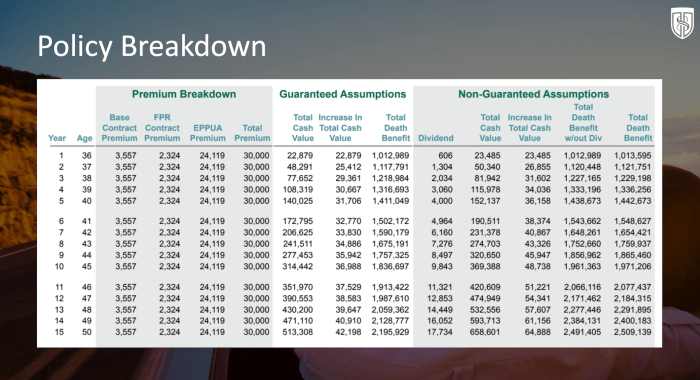

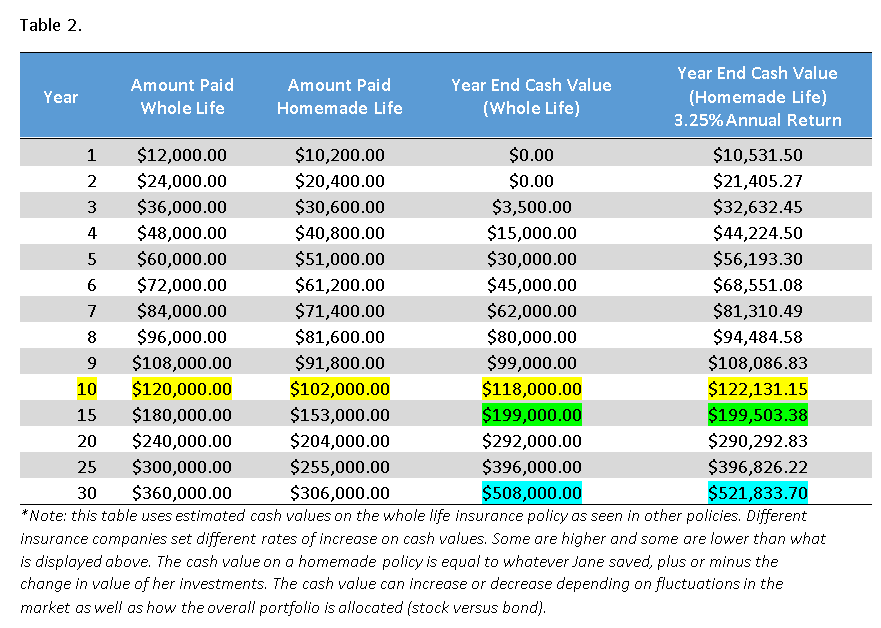

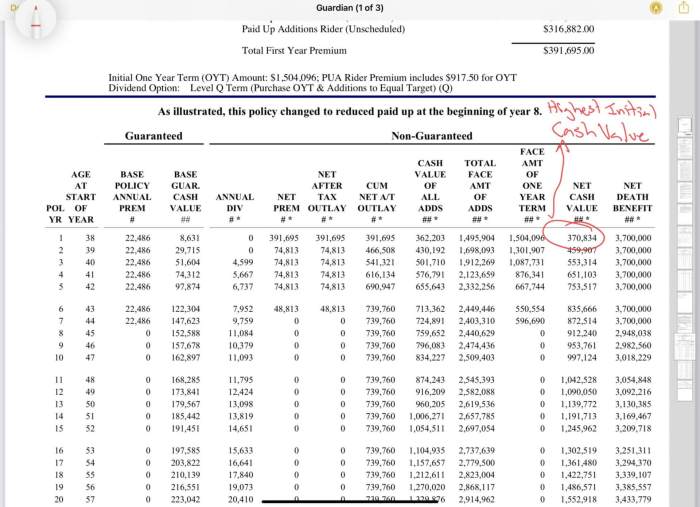

The following table provides a simplified comparison of potential cash value growth across different whole life insurance product types. Note that these are illustrative examples and actual results may vary depending on the specific policy details, market conditions, and the insurer’s performance.

| Policy Type | Interest Rate Type | Typical Growth Rate (Annualized, illustrative) | Notes |

|---|---|---|---|

| Traditional Whole Life | Fixed | 3-5% | Guaranteed minimum interest rate; consistent growth |

| Variable Whole Life | Variable | Potentially higher, but also potentially lower than fixed | Growth depends on the performance of the underlying investment options; higher risk, higher potential reward |

| Universal Life | Variable | Variable; depends on the chosen investment options and credited interest rate | Flexibility in premium payments and death benefit adjustments; growth depends on market performance and interest rates |

Cash Value Accumulation Mechanisms

Whole life insurance policies accumulate cash value over time, essentially building a savings component alongside the death benefit. This accumulation is driven by several factors, primarily the interest credited to the cash value account and, in some cases, the distribution of dividends. Policy fees and charges, however, can significantly impact the overall growth of this cash value. Understanding these mechanisms is crucial for evaluating the long-term value of a whole life insurance policy.

Interest Credited to Cash Value Accounts

The cash value in a whole life insurance policy earns interest. The rate of interest is typically not fixed and can vary annually. Insurance companies determine this rate based on several factors, including prevailing market interest rates, the company’s investment performance, and the specific policy’s design. While some policies might guarantee a minimum interest rate, the actual rate earned can fluctuate, potentially exceeding or falling short of the minimum. For example, a policy might guarantee a 2% minimum rate, but in a year with strong market performance, the credited rate could reach 3.5%. Conversely, during periods of economic downturn, the credited rate may remain at the minimum. It is important to note that the interest credited is generally tax-deferred, meaning taxes are not paid on the accumulated interest until the cash value is withdrawn.

The Role of Dividends in Cash Value Growth

Some whole life insurance policies, particularly those issued by mutual insurance companies, pay dividends to policyholders. These dividends represent a share of the company’s profits and can be used to increase the cash value of the policy. Policyholders typically have several options for how to use their dividends, including adding them to the cash value, purchasing additional paid-up insurance, reducing premiums, or receiving them as cash. Choosing to add dividends to the cash value accelerates its growth, compounding the effect over time. For instance, a policyholder receiving a $500 dividend could choose to add it to their cash value, immediately increasing the balance and generating additional interest in subsequent years. The amount of dividends paid, if any, varies depending on the insurer’s profitability and the specific policy’s performance.

Impact of Policy Fees and Charges on Cash Value

Various fees and charges are associated with whole life insurance policies, and these directly affect the accumulation of cash value. These charges can include administrative fees, mortality and expense charges, and surrender charges (if the policy is surrendered before a certain period). These deductions are usually deducted from the cash value account, reducing its growth. For example, an annual administrative fee of $50 would directly reduce the cash value by that amount each year. Similarly, surrender charges can be substantial, particularly if the policy is terminated early, significantly impacting the net cash value received. Understanding these charges is essential for accurately assessing the policy’s true cost and potential for cash value growth.

Comparison of Whole Life Insurance Policy Designs and Cash Value Accumulation Features

Different whole life insurance policies have varying cash value accumulation features. The design of the policy significantly impacts the rate of cash value growth and the overall benefits.

| Policy Type | Cash Value Growth | Dividend Options | Fees & Charges |

|---|---|---|---|

| Traditional Whole Life | Generally slower growth, steady and predictable | Often available, with various usage options | Moderate to high, depending on insurer and policy features |

| Variable Whole Life | Potentially higher growth, but also higher risk due to market fluctuations | May or may not be available, depending on the policy | Moderate to high, including investment management fees |

| Indexed Whole Life | Growth linked to a market index, offering potential for higher returns with limited downside risk | May or may not be available, depending on the policy | Moderate to high, often including indexing fees |

| Universal Life | Flexible premiums and death benefit, cash value growth depends on credited interest rate | Dividends typically not available | Moderate, with potential for higher charges depending on policy adjustments |

Accessing Whole Life Insurance Cash Value

Accessing the cash value accumulated within your whole life insurance policy offers financial flexibility, but understanding the methods and tax implications is crucial for making informed decisions. This section Artikels the various ways you can access your cash value and the potential tax consequences.

Methods for Accessing Cash Value

Policyholders have several options for accessing the cash value built up in their whole life insurance policies. These methods differ in their impact on the policy and the associated tax implications. The primary methods are policy loans, withdrawals, and policy surrenders.

Policy Loans

A policy loan allows you to borrow against the accumulated cash value of your policy. This is generally considered the most advantageous method as it doesn’t reduce the death benefit or cash value, provided the loan and interest are repaid. Interest accrues on the loan, and this interest is typically added to the loan balance, increasing the total amount owed. Failure to repay the loan could lead to the policy lapsing, and the death benefit would be reduced or eliminated.

Withdrawals

Withdrawals involve taking a portion of your cash value directly from the policy. Unlike loans, withdrawals directly reduce both the cash value and the death benefit. However, withdrawals are generally tax-free up to the amount of your basis in the policy (the premiums paid minus any prior withdrawals). Withdrawals exceeding the basis are subject to income tax.

Surrenders

Surrendering the policy means completely terminating the contract and receiving the cash value. This is generally the least desirable option unless the policy is no longer needed or affordable. Similar to withdrawals, any amount exceeding your basis is subject to income tax. Furthermore, you will lose the future growth potential of the cash value and the death benefit protection.

Tax Implications of Accessing Cash Value

The tax implications of accessing your whole life insurance cash value depend heavily on the method used and the amount withdrawn relative to your basis (the total premiums paid less any prior withdrawals and dividends). Loans generally have no immediate tax consequences, although interest accrued is taxable as ordinary income if not paid. Withdrawals and surrenders exceeding the policy’s basis are subject to ordinary income tax on the excess amount. However, the death benefit paid to beneficiaries is generally tax-free.

Beneficial Scenarios for Accessing Cash Value

Accessing cash value can be advantageous in various situations. For example, a policy loan could provide funds for a down payment on a house, covering unexpected medical expenses, or financing a child’s education without selling assets or incurring high-interest debt. A partial withdrawal might be suitable for supplementing retirement income or covering smaller, unforeseen expenses. However, it is crucial to carefully consider the long-term implications of each method before making a decision.

Policy Loan Access Flowchart

The following flowchart illustrates the process of accessing cash value via a policy loan:

[Descriptive Text of Flowchart]

Start -> Apply for Policy Loan (submit application to insurer) -> Insurer Reviews Application (verifies eligibility and loan amount) -> Loan Approved (funds disbursed to policyholder) -> Loan Disbursement (policyholder receives funds) -> Regular Interest Payments (interest accrues and is added to loan balance) -> Loan Repayment (policyholder repays loan, including interest) -> Policy Maintained (policy remains in force with full death benefit) -> End

Risks and Considerations

While whole life insurance with cash value offers potential long-term benefits, it’s crucial to understand the associated risks and limitations before investing. Failing to fully grasp these aspects could lead to disappointment or financial strain. Careful consideration of several key factors is essential for making an informed decision.

Potential Risks of Whole Life Insurance Cash Value

Whole life insurance policies, while offering a cash value component, are fundamentally insurance products. The primary risk lies in the possibility of paying significantly more in premiums than the eventual death benefit received, particularly if the policy is surrendered early. Other risks include the potential for lower-than-expected cash value growth, high fees, and the inflexibility of the policy compared to other investment options. These factors need careful evaluation against individual financial goals and risk tolerance.

Impact of Market Fluctuations on Cash Value Growth

The impact of market fluctuations on cash value growth varies depending on the specific policy. Some whole life policies invest a portion of the premiums in market-linked investments, meaning cash value growth is subject to market performance. In periods of market decline, the cash value growth may be slower or even experience a temporary decrease. Conversely, periods of strong market performance can lead to faster cash value accumulation. It’s crucial to understand the investment strategy employed by the specific policy to assess the potential impact of market volatility. For example, a policy that invests heavily in equities will be more susceptible to market downturns than one that invests primarily in bonds.

Policy Fees and Charges

Understanding the various fees and charges associated with a whole life insurance policy is paramount. These fees can significantly impact the overall cost and the rate of cash value growth. Common charges include administrative fees, mortality charges, and surrender charges (penalties for early withdrawal). These fees vary significantly between insurers and policy types, so comparing policies based on their total cost, rather than just the premium amount, is essential. For instance, a policy with a lower premium might have higher fees, ultimately making it more expensive in the long run.

Situations Where Whole Life Insurance May Not Be Suitable

Whole life insurance with cash value is not a one-size-fits-all solution. It may not be the most suitable option for individuals with limited financial resources or those prioritizing short-term financial goals. For example, someone needing a large sum of money in the near future might find the limited liquidity and high fees of whole life insurance to be detrimental. Similarly, individuals who are comfortable with higher risk and are seeking faster returns might find other investment vehicles, such as mutual funds or stocks, more appropriate. Furthermore, younger individuals with longer life expectancies may find term life insurance, which is significantly cheaper, to be a more efficient way to secure a death benefit. A financial advisor can help assess whether whole life insurance aligns with your specific financial situation and goals.

Final Conclusion

In conclusion, whole life insurance with cash value presents a compelling opportunity to build long-term wealth while securing your family’s future. While it involves careful consideration of policy features, fees, and potential risks, the potential for tax-advantaged growth and access to funds makes it a worthwhile investment for many. By understanding the nuances of cash value accumulation and access, you can confidently determine if this type of insurance is the right fit for your individual financial strategy.

FAQ Overview

Can I borrow against my whole life insurance cash value without paying taxes?

Yes, you can typically borrow against your cash value tax-free. However, interest accrues on the loan, and failure to repay it could impact your death benefit or lead to policy lapse.

What happens to my cash value if I die?

Upon death, the death benefit is typically paid out to your beneficiaries, usually after deducting any outstanding loans against the cash value.

Is whole life insurance with cash value a good investment?

Whether it’s a “good” investment depends on your individual financial goals and risk tolerance. It offers a guaranteed minimum return, but the growth rate may be lower than other investment options. It’s best to consult a financial advisor.

How does inflation affect my whole life insurance cash value?

The cash value growth may not always outpace inflation. This is a key consideration, and it’s essential to factor in inflation when assessing the long-term value of your policy.