Securing your family’s financial future is a paramount concern, and whole life insurance often plays a significant role in those plans. However, understanding the true cost of whole life insurance can be complex, involving more than just the annual premium. This guide delves into the intricacies of whole life insurance costs, examining the various factors that influence premium amounts, the impact of cash value accumulation, and comparisons with alternative insurance options. We aim to equip you with the knowledge needed to make informed decisions about this long-term financial commitment.

From the initial premium payment to the long-term growth of cash value, we will explore the complete cost picture. We will also analyze how different policy types, individual circumstances, and market fluctuations can significantly impact the overall expense. By the end of this guide, you’ll have a clearer understanding of what you’re paying for and whether whole life insurance aligns with your financial goals.

Defining Whole Life Insurance Cost

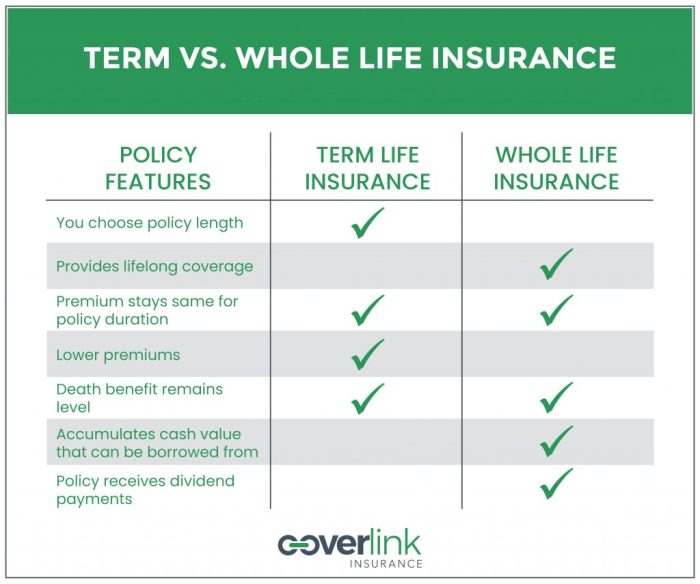

Understanding the cost of whole life insurance involves examining its various components and the factors that influence them. Whole life insurance provides lifelong coverage and typically includes a cash value component that grows over time. The premium you pay is not just for death benefit coverage; it also contributes to the growth of this cash value.

Whole Life Insurance Premium Components

Whole life insurance premiums are comprised of several key elements. A significant portion covers the mortality risk—the insurer’s cost of paying out death benefits. Another portion goes towards administrative expenses, including underwriting, claims processing, and maintaining the insurer’s infrastructure. Finally, a portion contributes to the cash value accumulation within the policy. The precise allocation varies among insurers and policy types.

Factors Influencing Whole Life Insurance Premiums

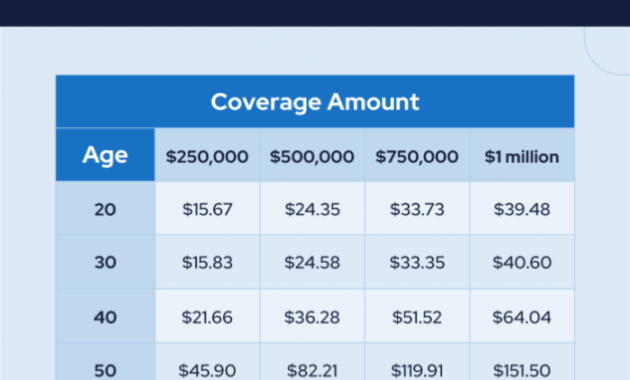

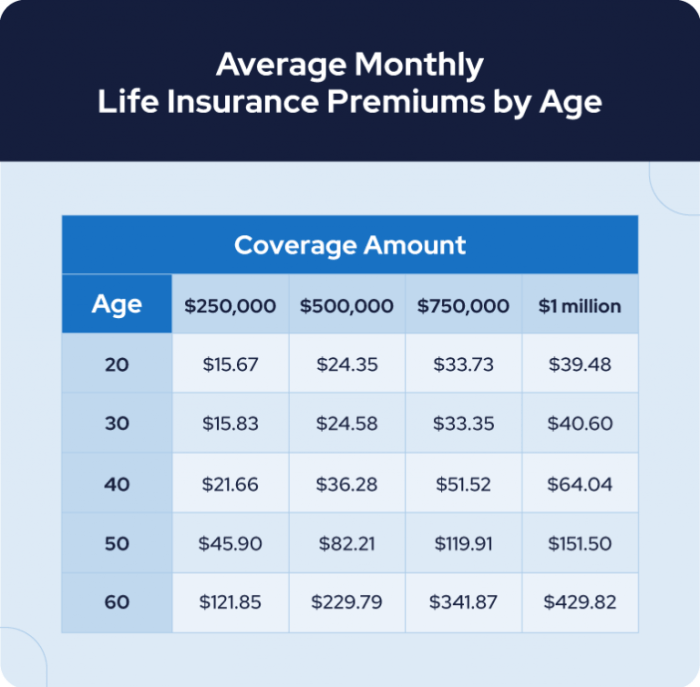

Several factors significantly influence the amount of your whole life insurance premiums. Your age at the time of policy purchase is a major determinant, with younger individuals generally receiving lower premiums due to their longer life expectancy. Your health status plays a crucial role; individuals with pre-existing conditions or health risks typically face higher premiums to reflect the increased risk for the insurer. The specific type of whole life insurance policy selected also impacts cost. Policies with higher death benefits or additional features, such as accelerated death benefits or long-term care riders, naturally command higher premiums. Finally, the insurer’s own financial strength and operational efficiency also influence the premium.

Premium Component Contribution to Overall Cost

The interplay of these components determines the overall premium. For instance, a younger, healthy individual purchasing a basic whole life policy will have a lower premium primarily because the mortality risk is lower and the cash value accumulation is spread over a longer period. Conversely, an older individual with health concerns purchasing a policy with substantial death benefits and riders will see a much higher premium due to increased mortality risk, higher administrative costs associated with the riders, and the need for a quicker cash value build-up.

Comparison of Whole Life Insurance Premium Structures

The following table illustrates how premium structures can differ across various whole life insurance types. Note that these are average annual costs and can vary significantly based on the factors discussed previously.

| Policy Type | Premium Type | Average Annual Cost (Example) | Factors Affecting Cost |

|---|---|---|---|

| Level Term Life | Level Premium | $500 | Age, health, coverage amount |

| Variable Whole Life | Flexible Premium | $1,000 – $2,000+ | Age, health, investment performance, coverage amount |

| Universal Whole Life | Flexible Premium | $750 – $1,500+ | Age, health, interest rates, coverage amount |

| Single Premium Whole Life | Lump Sum | Varies greatly based on lump sum amount | Age, health, lump sum amount |

Cash Value Accumulation and Cost

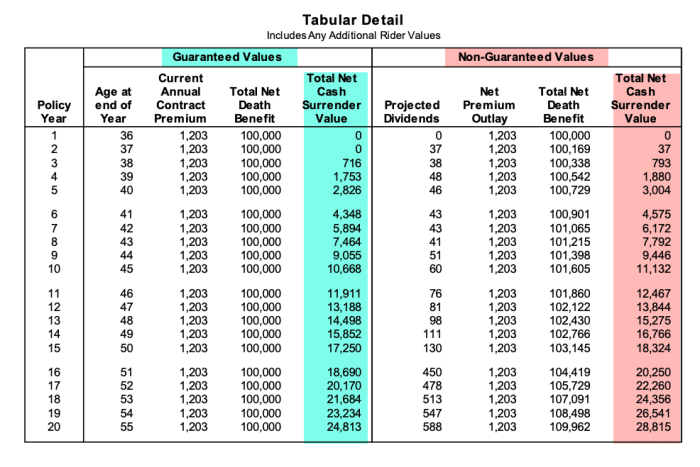

Whole life insurance isn’t just about death benefits; a significant feature is the cash value component that grows over time. Understanding how this cash value accumulates and impacts the overall cost is crucial for evaluating the policy’s long-term value. This section will explore the growth of cash value, its effect on overall cost, and illustrate different growth scenarios.

The cash value in a whole life policy grows tax-deferred, meaning you won’t pay taxes on the earnings until you withdraw them. This growth is primarily driven by the policy’s interest rate, which is typically a fixed or guaranteed rate, although some policies offer variable rates linked to market performance. A portion of your premium payment goes towards building this cash value, while another portion covers the death benefit and administrative costs. Over time, the cash value can accumulate substantially, potentially offsetting a portion of the premiums paid, effectively lowering the net cost of the insurance over the long term.

Cash Value Growth and its Impact on Cost

The rate at which your cash value grows significantly impacts the overall cost of your whole life policy. A higher growth rate means your cash value accumulates faster, potentially leading to a lower net cost over the life of the policy. Conversely, a lower growth rate will result in slower accumulation and a higher net cost. This is because a larger portion of your premiums will be used to cover the death benefit and administrative expenses rather than building cash value.

Illustrative Scenarios of Cash Value Growth

Let’s consider two scenarios to illustrate the impact of different cash value growth rates. In Scenario A, we assume a conservative growth rate of 4% per year. In Scenario B, we assume a more aggressive growth rate of 6% per year. Both scenarios assume an initial premium payment of $1,000 that contributes to cash value. In reality, the amount contributing to cash value will vary depending on the specific policy and premium structure. Over a 20-year period, the difference in accumulated cash value can be significant, directly impacting the overall cost of the insurance.

Projected Cash Value Growth at Different Interest Rates

The following table projects cash value growth over 20 years with varying interest rates, assuming an initial cash value of $1,000 and annual contributions to cash value remain consistent. Remember that these are projections, and actual results may vary based on the specific policy terms and the insurer’s performance.

| Year | Interest Rate (Annual) | Beginning Cash Value | Interest Earned | Ending Cash Value |

|---|---|---|---|---|

| 1 | 4% | $1,000 | $40 | $1,040 |

| 1 | 6% | $1,000 | $60 | $1,060 |

| 10 | 4% | $1,480.24 | $59.21 | $1,539.45 |

| 10 | 6% | $1,790.85 | $107.45 | $1,898.30 |

| 20 | 4% | $2,191.12 | $87.65 | $2,278.77 |

| 20 | 6% | $3,207.14 | $192.43 | $3,400.00 |

Illustrating Cost Scenarios

Understanding the cost of whole life insurance requires examining specific examples to see how premiums, cash value growth, death benefits, and riders interact. These examples will illustrate the range of possibilities and help clarify the long-term financial implications.

Example 1: High-Premium Policy with Significant Cash Value Growth

Let’s consider a hypothetical 35-year-old male purchasing a $500,000 whole life policy with an annual premium of $5,000. This policy includes a paid-up additions rider, which allows a portion of the cash value to purchase additional paid-up insurance. We will assume a consistent annual cash value growth rate of 5% (this is an assumption and actual returns may vary significantly). Over 30 years, the premiums paid would total $150,000. The projected cash value at the end of 30 years, based on our 5% growth assumption and the impact of the paid-up additions rider, could reach approximately $300,000. The death benefit remains a constant $500,000 throughout the policy term. The total cost, considering the premiums paid and the cash value accumulated, provides a clearer picture of the policy’s long-term financial performance. This example showcases a scenario where the cash value growth significantly offsets the cost of premiums.

Example 2: Lower-Premium Policy with Reduced Cash Value Accumulation

Now, let’s examine a different scenario. The same 35-year-old male purchases a $500,000 whole life policy with a lower annual premium of $2,500. This policy does not include any riders. We assume a more conservative annual cash value growth rate of 3%. Over 30 years, the premiums paid would total $75,000. The projected cash value at the end of 30 years, based on our 3% growth assumption, might reach approximately $120,000. The death benefit remains $500,000. This illustrates a scenario with a lower upfront cost, but significantly less cash value accumulation compared to the higher-premium example.

Visual Representation of Cost Projections Over Time

A graph depicting the cost projections over 30 years would have three lines: one for premium payments, one for cash value growth, and one for the death benefit. The x-axis would represent the policy year (from year 1 to year 30), and the y-axis would represent the dollar amount (in thousands or millions, depending on the scale). The premium payment line would be a straight, horizontal line reflecting the consistent annual premium. The cash value growth line would start at zero and gradually increase over time, reflecting the compounding effect of interest and the accumulation of cash value. This line would curve upward, showcasing the exponential growth potential. The death benefit line would be a straight, horizontal line at the level of the death benefit amount, remaining constant throughout the 30-year period. The intersection points of these lines illustrate the relationship between premium payments, cash value accumulation, and the death benefit. For example, the point where the cash value line intersects the premium payment line would show when the accumulated cash value equals the total premiums paid. This visual representation offers a clear and concise summary of the policy’s financial performance over time. A clear visual aids understanding of the policy’s cost and value proposition.

Wrap-Up

Ultimately, the cost of whole life insurance is a multifaceted equation influenced by numerous variables. While the initial premium might seem substantial, the long-term accumulation of cash value and the guaranteed death benefit offer a compelling financial strategy for many. However, a thorough understanding of these costs, including potential fees and the impact of market conditions, is crucial for making an informed decision that aligns with your individual financial objectives and risk tolerance. Careful consideration of your personal circumstances and a comparison with alternative insurance options are essential steps in determining whether whole life insurance represents the right investment for you.

User Queries

What are the common hidden fees associated with whole life insurance?

Some policies may include charges like administrative fees, surrender charges (penalties for early withdrawal), and mortality and expense risk charges. It’s crucial to review the policy details carefully to understand all associated fees.

Can I borrow against my whole life insurance policy’s cash value?

Yes, many whole life policies allow you to borrow against the accumulated cash value. However, interest will accrue on these loans, and failing to repay them could reduce the death benefit or even lead to policy lapse.

How does inflation affect the long-term cost of whole life insurance?

Inflation erodes the purchasing power of money over time. While the death benefit remains fixed in nominal terms, its real value may decrease due to inflation. Consider this factor when evaluating the long-term value of the policy.

What happens to my cash value if I cancel my whole life insurance policy?

If you cancel your policy, you will typically receive the accumulated cash value, minus any surrender charges that may apply. The amount received will depend on the policy’s terms and the length of time the policy has been in effect.