Navigating the complexities of a workers’ compensation insurance policy can feel daunting. This guide aims to demystify this crucial aspect of employer responsibilities, providing clear explanations of coverage, claims processes, and compliance requirements. We’ll explore the various factors influencing premium costs, common policy exclusions, and effective dispute resolution methods, empowering you with the knowledge to manage your workers’ comp insurance effectively.

From understanding the different types of coverage available to mastering the claims process and navigating potential disputes, this comprehensive resource serves as your go-to guide for all things related to workers’ compensation insurance. We’ll break down complex concepts into easily digestible information, ensuring you have a firm grasp of your rights and responsibilities.

Policy Coverage

A standard workers’ compensation insurance policy provides a crucial safety net for employees injured on the job, covering medical expenses and lost wages. Understanding the specifics of this coverage is vital for both employers and employees. This section details the typical inclusions, limitations, and variations found in these policies.

Types of Coverage Included

Workers’ compensation policies generally include several key types of coverage. These typically encompass medical benefits, which cover all reasonable and necessary medical treatment related to the work injury. Lost wage benefits compensate employees for income lost due to the inability to work. In addition, death benefits may be payable to the dependents of an employee who dies as a result of a work-related injury or illness. Rehabilitation benefits often cover physical therapy, vocational training, and other services designed to help injured workers return to work.

Circumstances Under Which Benefits Are Paid

Benefits are usually paid when an employee sustains an injury or illness directly resulting from their work. This requires demonstrating a causal link between the work environment and the injury. The injury doesn’t need to occur during work hours; it can also include injuries sustained commuting to and from work, depending on the specifics of the policy and the circumstances. The employee must generally report the injury to their employer promptly.

Situations Where Coverage Might Be Denied or Limited

Coverage can be denied or limited in several situations. For example, if the injury was self-inflicted, caused by intoxication, or resulted from willful misconduct, coverage may be denied. Similarly, pre-existing conditions can complicate claims, and benefits might be limited to the portion of the injury directly attributable to the work incident. Failure to report the injury promptly can also negatively impact claim approval. Furthermore, if an employee is found to have intentionally misrepresented facts related to the injury, benefits may be denied or reduced.

Comparison of Coverage Offered by Different Insurers

While the core components of workers’ compensation insurance are largely standardized by state law, variations exist among insurers. These differences can manifest in the level of customer service provided, the speed of claim processing, the extent of optional coverage offered, and the overall cost of the policy. Some insurers may offer more comprehensive rehabilitation services or specialized programs for specific industries. Others may focus on proactive risk management strategies to help businesses prevent workplace injuries. Direct comparison of policies and insurer reputations is crucial before selecting a provider.

Summary of Key Coverage Elements and Their Limitations

| Coverage Type | Description | Limitations | Example |

|---|---|---|---|

| Medical Benefits | Covers all reasonable and necessary medical treatment related to the work injury. | May exclude experimental treatments or those deemed unnecessary by the insurer’s medical review. | A worker injured in a fall receives coverage for surgery, physical therapy, and medication. |

| Lost Wage Benefits | Compensates for income lost due to inability to work. | Limited by state law, usually a percentage of pre-injury wages and a maximum duration. | A worker with a broken leg receives a percentage of their salary while unable to work. |

| Death Benefits | Paid to dependents if the employee dies from a work-related injury or illness. | Specific amounts and eligibility criteria are determined by state law. | A surviving spouse and children receive benefits after a worker’s fatal workplace accident. |

| Rehabilitation Benefits | Covers physical therapy, vocational training, etc., to aid return to work. | Limited to treatments and programs deemed necessary and appropriate by the insurer. | A worker receives physical therapy and job retraining after a serious back injury. |

Premium Calculation

Understanding how workers’ compensation insurance premiums are calculated is crucial for businesses to effectively manage their risk and budget. The process involves a complex interplay of factors related to both the employer and their employees, ultimately aiming to reflect the likelihood of workplace accidents and the potential associated costs.

Several key methods and data points are employed by insurers to determine the appropriate premium for each policy. These methods ensure a fair and accurate reflection of the risk involved, allowing for appropriate pricing that balances the needs of both the insurer and the insured.

Factors Influencing Premium Costs

Numerous factors influence the cost of a workers’ compensation insurance policy. These factors are carefully considered by insurers to accurately assess risk and price the policy accordingly. A higher risk profile typically translates to a higher premium.

Methods Used to Determine Premiums

Insurers primarily utilize a system based on the employer’s payroll and an assigned classification code that reflects the risk associated with the type of work performed. This classification code is determined by a detailed analysis of the nature of the business, the types of jobs performed, and the inherent hazards involved. The premium is then calculated by multiplying the employer’s payroll by a rate determined by the classification code and the insurer’s assessment of risk. Some insurers may also use more sophisticated actuarial models that incorporate additional data points and risk factors.

Key Data Points Required for Risk Assessment

Insurers require several key data points to accurately assess the risk associated with a particular business. These data points help insurers understand the likelihood of workplace accidents and the potential severity of resulting claims.

- Employer’s payroll: The total wages paid to employees is a fundamental factor, as higher payroll generally correlates with a higher potential for claims.

- Industry classification code (NAICS code): This code categorizes the business based on its primary activity, providing a standardized measure of risk inherent in that industry.

- Employee demographics: Factors such as age, experience, and job role can influence the likelihood of workplace accidents.

- Past claims history: A history of previous workers’ compensation claims is a strong indicator of future risk. Frequent or high-cost claims will generally result in higher premiums.

- Safety programs and measures: The implementation of robust safety programs and measures can significantly reduce premiums by demonstrating a commitment to workplace safety.

- Loss control measures: This includes the steps taken by the employer to prevent accidents and injuries, such as safety training, equipment maintenance, and hazard mitigation.

Industry and Job Role Impact on Premiums

Different industries and job roles carry varying levels of risk, directly impacting premium costs. For example, construction workers face a significantly higher risk of injury compared to office workers, leading to substantially higher premiums for construction companies. Similarly, industries with a history of high accident rates will face higher premiums than those with better safety records. A company involved in manufacturing heavy machinery would likely pay more than a software development firm.

Factors Affecting Premiums: Employee-Related and Employer-Related

The factors affecting workers’ compensation premiums can be categorized into employee-related and employer-related factors. Understanding these distinctions helps businesses focus their efforts on mitigating risks and potentially reducing their insurance costs.

- Employee-Related Factors:

- Number of employees

- Employee experience and training

- Job duties and inherent risks

- Age and health of employees

- Employer-Related Factors:

- Safety programs and training

- Workplace safety measures and equipment

- Claims history

- Industry classification

- Payroll amount

- Loss control measures implemented

Policy Exclusions

Workers’ compensation insurance policies, while designed to protect employees injured on the job, do not cover every conceivable scenario. Understanding the policy exclusions is crucial for both employers and employees to manage expectations and avoid disputes regarding claim eligibility. These exclusions are carefully defined to limit the insurer’s liability to reasonable and predictable workplace risks.

Common Exclusions in Workers’ Compensation Policies

Several common exclusions exist across most workers’ compensation policies. These exclusions are based on factors such as the nature of the injury, the employee’s actions, or pre-existing conditions. The rationale behind these exclusions is to prevent abuse of the system and to maintain the financial viability of the insurance program. They also help to ensure that the focus remains on legitimate workplace injuries.

Examples of Excluded Claims

Claims are frequently denied due to policy exclusions. For instance, injuries resulting from an employee’s intentional self-harm or willful misconduct are typically excluded. Similarly, injuries sustained while an employee is engaging in illegal activities or violating company policy are often not covered. Pre-existing conditions that are aggravated by a workplace injury might only be partially covered, or not at all, depending on the policy’s specific wording. Finally, injuries sustained outside the scope of employment, such as during a personal errand, are generally not covered.

Variations in Exclusions Among Insurers

While many exclusions are standard across the industry, there can be subtle differences in the wording and scope of exclusions offered by different insurers. Some insurers might offer broader coverage in certain areas, while others might have stricter limitations. For example, one insurer might exclude injuries resulting from horseplay more broadly than another. It is crucial to carefully review the specific policy wording to understand the exact limitations of coverage.

Table of Common Exclusions

| Exclusion | Description | Example | Impact on Claim |

|---|---|---|---|

| Intentional Self-Harm | Injuries intentionally inflicted upon oneself. | An employee deliberately cuts themselves. | Claim denied. |

| Willful Misconduct | Injuries resulting from deliberate disregard for safety rules. | An employee ignores safety protocols and is injured. | Claim denied or partially denied. |

| Intoxication/Drug Use | Injuries sustained while under the influence of alcohol or drugs. | An employee is injured while intoxicated at work. | Claim denied. |

| Pre-existing Conditions | Aggravation of a pre-existing condition, depending on policy wording. | An employee with a pre-existing back condition suffers a back injury at work. | Claim may be partially or fully denied; benefits might be limited to the portion directly caused by the work injury. |

| Off-the-Clock Injuries | Injuries sustained outside of work hours and not related to employment. | An employee is injured while commuting to work. | Claim denied. |

| Injuries from Illegal Activities | Injuries incurred while participating in illegal activities. | An employee is injured while stealing company property. | Claim denied. |

Compliance and Regulations

Workers’ compensation insurance is heavily regulated at the state level, meaning the specific requirements and penalties vary significantly depending on your business location. Understanding and adhering to these regulations is crucial for employers to avoid legal repercussions and ensure the well-being of their employees. Failure to comply can result in substantial financial penalties and damage to your company’s reputation.

State-Specific Workers’ Compensation Regulations

Each state has its own unique set of laws governing workers’ compensation insurance. These laws dictate aspects such as eligibility criteria for benefits, the types of injuries covered, the process for filing claims, and the level of benefits provided. For instance, some states might have stricter requirements for reporting injuries, while others may have different benefit levels for specific types of injuries. Employers must familiarize themselves with the specific regulations in their state to ensure full compliance. These regulations are typically available on the state’s Department of Labor or Workers’ Compensation agency website.

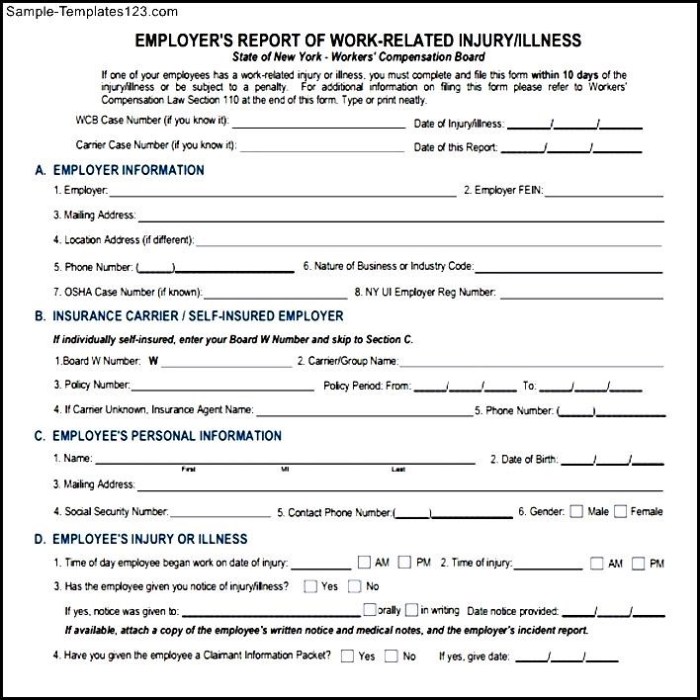

Employer Responsibilities Regarding Compliance

Employers bear the primary responsibility for ensuring compliance with state workers’ compensation regulations. This includes securing the appropriate insurance coverage, accurately classifying employees for insurance purposes, maintaining detailed records of employee injuries and illnesses, and promptly reporting all workplace accidents and injuries to the relevant authorities. Further, employers are responsible for providing a safe working environment and implementing safety programs to minimize workplace hazards and prevent injuries. Failure to do so can lead to increased premiums and potential legal action.

Penalties for Non-Compliance

The penalties for non-compliance with workers’ compensation regulations can be severe and vary by state. These can include substantial fines, back-payment of premiums, and even criminal charges in some cases. In addition to financial penalties, non-compliance can also lead to negative publicity, damage to the company’s reputation, and difficulty obtaining future insurance coverage. For example, a company failing to secure proper insurance could face significant fines and be held liable for all medical and wage-replacement costs associated with employee injuries.

Common Compliance Issues and Their Resolution

Several common compliance issues arise for employers. One frequent problem is misclassifying employees, leading to inaccurate premium calculations and potential underinsurance. Another common issue is the failure to promptly report workplace injuries, which can delay or deny benefits to injured employees and result in penalties. Finally, inadequate safety training and implementation of safety protocols can increase the risk of workplace accidents and lead to higher insurance premiums. Addressing these issues requires thorough employee classification, a robust injury reporting system, and a proactive approach to workplace safety, including regular safety training and inspections.

Obtaining and Maintaining Workers’ Compensation Insurance Compliance

The process for obtaining and maintaining workers’ compensation insurance compliance generally involves several steps. First, employers must determine their state’s specific requirements. Next, they need to secure appropriate insurance coverage from a licensed insurer, ensuring that all employees are properly classified. Regular audits of safety practices and injury reporting procedures are essential to maintain compliance. Staying informed about changes in state regulations through the relevant state agency’s website and professional development opportunities is also crucial. Finally, maintaining detailed records of all workplace accidents, injuries, and insurance documentation is vital for demonstrating compliance during audits or investigations.

Dispute Resolution

Disputes can arise in workers’ compensation claims regarding eligibility, the extent of benefits, or the duration of payments. Several methods exist to resolve these disagreements fairly and efficiently, minimizing the need for costly and time-consuming litigation. Understanding these options is crucial for both employees and employers.

Methods of Dispute Resolution

Workers’ compensation disputes can be resolved through various methods, each with its own advantages and disadvantages. These typically range from informal negotiation to formal legal proceedings. The choice of method often depends on the complexity of the issue and the willingness of both parties to cooperate.

The Role of Mediators and Arbitrators

Mediators facilitate communication and negotiation between the injured worker and the insurer. They act as neutral third parties, helping the parties reach a mutually agreeable settlement. They do not impose a decision but guide the discussion towards a resolution. Arbitrators, on the other hand, have the authority to make a binding decision. After hearing evidence and arguments from both sides, they issue a final ruling that is legally enforceable. The key difference is that mediation is non-binding, while arbitration is binding.

Common Dispute Scenarios and Resolutions

Several common disputes arise in workers’ compensation. For example, a dispute might center on whether an injury is work-related. If the insurer denies the claim, the employee can appeal through the designated state agency. Another common dispute involves the extent of disability benefits. If the insurer offers a lower benefit amount than the employee believes is justified, mediation or arbitration could be pursued. A disagreement over the duration of temporary disability benefits might also necessitate dispute resolution. In such cases, medical evidence and vocational rehabilitation assessments often play crucial roles in determining the appropriate benefit period. A successful resolution might involve a compromise on the benefit amount or a reevaluation of the employee’s medical condition.

Comparison of Dispute Resolution Methods

| Method | Binding? | Cost | Time | Formality |

|---|---|---|---|---|

| Negotiation | No | Low | Short | Informal |

| Mediation | No | Moderate | Moderate | Semi-formal |

| Arbitration | Yes | High | Long | Formal |

| Litigation | Yes | Very High | Very Long | Formal |

Handling a Workers’ Compensation Dispute

A step-by-step process for handling a workers’ compensation dispute might look like this:

- Claim Denial: The insurer denies the initial claim, citing reasons such as insufficient evidence of work-related injury or pre-existing conditions.

- Internal Appeal: The employee files an internal appeal with the insurer, providing additional medical evidence or documentation.

- State Agency Appeal: If the internal appeal is unsuccessful, the employee appeals to the relevant state workers’ compensation agency.

- Mediation: The state agency may recommend mediation as a way to resolve the dispute outside of formal hearings.

- Arbitration: If mediation fails, the dispute may proceed to arbitration, where a neutral arbitrator will hear evidence and make a binding decision.

- Litigation: As a last resort, the employee may file a lawsuit in court to challenge the insurer’s decision. This is usually a lengthy and costly process.

Outcome Summary

Securing adequate workers’ compensation insurance is not merely a legal obligation; it’s a demonstration of commitment to employee well-being and responsible business practices. By understanding the intricacies of your policy, from coverage details to dispute resolution processes, you can proactively manage risk, ensure compliance, and foster a safer, more supportive work environment. This guide has provided a foundational understanding; remember to consult with legal and insurance professionals for personalized advice tailored to your specific circumstances.

Questions and Answers

What happens if my employee doesn’t report a workplace injury immediately?

Prompt reporting is crucial. Delayed reporting can complicate the claims process and potentially affect the outcome, potentially impacting benefits eligibility. Employers should have clear procedures for reporting injuries.

Can I choose my own doctor for a workers’ compensation claim?

This depends on your state’s regulations. Some states allow employees to choose their physician, while others designate a network of approved healthcare providers. Check your state’s workers’ compensation laws for specifics.

What if my workers’ compensation claim is denied?

If your claim is denied, understand the reasons provided and explore your options. This may involve appealing the decision, seeking legal counsel, or pursuing alternative dispute resolution methods.

How often are workers’ compensation premiums reviewed?

Premium reviews are typically conducted annually or at other intervals specified in your policy. Factors like claims history and payroll changes influence premium adjustments.

What types of injuries are typically *not* covered under workers’ compensation?

Injuries resulting from intentional self-harm, intoxication, or actions outside the scope of employment are often excluded. Specific exclusions vary by policy and state regulations.