Workers’ compensation insurance in New Jersey is a crucial aspect of employment law, providing a safety net for employees injured on the job and outlining responsibilities for employers. Understanding this system is vital, whether you’re an employer striving for compliance or an employee seeking rightful benefits. This guide delves into the intricacies of NJ workers’ compensation, clarifying rights, responsibilities, and the processes involved in navigating claims and ensuring fair compensation.

From understanding eligibility criteria and the types of injuries covered to exploring employer obligations and employee rights, we’ll provide a clear and concise overview of the New Jersey workers’ compensation system. We will also examine the role of the New Jersey Department of Labor and Workforce Development in overseeing this crucial aspect of workplace safety and dispute resolution. Finally, we’ll discuss the factors influencing insurance premiums and strategies for managing costs effectively.

Understanding NJ Workers’ Compensation Insurance

Workers’ compensation insurance in New Jersey is a crucial aspect of employment law, designed to protect employees injured on the job. It provides a safety net for workers facing medical expenses and lost wages due to work-related injuries or illnesses, while also offering employers a degree of liability protection. This system operates under a strict set of rules and regulations, ensuring fair compensation for eligible workers.

Purpose and Scope of NJ Workers’ Compensation

The primary purpose of New Jersey’s workers’ compensation system is to provide medical benefits and wage replacement to employees who suffer work-related injuries or illnesses. This covers a broad spectrum of situations, from accidents on the job site to illnesses caused by workplace conditions. The scope extends to nearly all employers in the state, with limited exceptions for certain types of businesses and self-employed individuals. The system aims to ensure that employees receive prompt and adequate care without needing to pursue lengthy and costly legal battles. This benefits both the employee and the employer by providing a defined process for handling work-related injuries.

Types of Injuries and Illnesses Covered

New Jersey workers’ compensation covers a wide range of injuries and illnesses stemming from work-related activities. This includes acute injuries such as fractures, burns, lacerations, and strains sustained during an accident on the job. It also encompasses occupational diseases, which are illnesses resulting from prolonged exposure to hazardous substances or conditions in the workplace. Examples include asbestos-related illnesses, carpal tunnel syndrome, and hearing loss caused by prolonged exposure to loud noises. Furthermore, mental health conditions arising from workplace stressors, such as post-traumatic stress disorder (PTSD) following a traumatic work event, may also be covered under certain circumstances. The specific definition of “work-related” is subject to interpretation and may require investigation by the Division of Workers’ Compensation.

Eligibility Requirements for Workers’ Compensation Benefits

To be eligible for workers’ compensation benefits in New Jersey, an employee must meet several key requirements. First, the injury or illness must be work-related, meaning it arose out of and in the course of employment. This requires a demonstrable link between the work environment and the injury or illness. Second, the employee must have been employed by a covered employer. Third, the employee must report the injury or illness to their employer promptly. Failure to report the injury within a reasonable timeframe may jeopardize eligibility for benefits. Finally, the employee must cooperate with the employer and the insurance carrier in the investigation and treatment of their injury or illness. The burden of proof lies with the employee to demonstrate the work-related nature of their injury or illness.

Types of Workers’ Compensation Insurance Policies in NJ

Several types of workers’ compensation insurance policies are available to New Jersey employers, each offering varying levels of coverage and cost. The specific policy chosen depends on factors such as the size and nature of the business, the number of employees, and the level of risk associated with the work performed.

| Policy Type | Coverage | Cost | Suitability |

|---|---|---|---|

| Standard Policy | Covers most workplace injuries and illnesses. | Varies based on risk assessment. | Suitable for most businesses. |

| Monopolistic State Fund | Provides coverage through the state’s workers’ compensation fund. | Premiums set by the state. | May be required for certain high-risk industries. |

| Self-Insurance | Employer assumes the financial risk of workers’ compensation claims. | Requires significant financial reserves. | Suitable for large companies with substantial financial resources. |

| Excess Insurance | Provides additional coverage beyond a primary policy. | Higher premiums. | Used to cover catastrophic losses. |

Employee Rights and Benefits Under NJ Workers’ Compensation

New Jersey’s Workers’ Compensation system protects employees injured on the job, providing crucial medical care and financial support during recovery. Understanding your rights and the benefits available is essential for navigating the claims process effectively. This section details employee rights, the claims process, available benefits, and common challenges encountered.

Employee Rights in NJ Workers’ Compensation Claims

Employees injured while performing their job duties in New Jersey have the right to file a workers’ compensation claim regardless of fault. This means that even if the employee contributed to the accident, they are still entitled to benefits. Importantly, employers cannot retaliate against an employee for filing a claim. This protection extends to preventing actions such as demotion, termination, or harassment. Employees also have the right to choose their own physician within the network approved by their employer’s insurance carrier, and to receive reasonable accommodations to facilitate their return to work. Finally, employees have the right to legal representation throughout the claims process.

Filing a Workers’ Compensation Claim in NJ

The process for filing a claim begins by promptly reporting the injury to the employer. This should be done as soon as possible after the incident. The employer is then required to file a “First Report of Injury” with their workers’ compensation insurance carrier. The employee should also seek medical attention from a physician. The physician will provide documentation outlining the injury and any necessary treatment. This medical documentation, along with the employer’s report, forms the basis of the claim. The claim is then processed by the insurance carrier, who will review the documentation and determine the eligibility for benefits. Disputes can arise during this process, potentially requiring intervention from the Division of Workers’ Compensation.

Benefits Available Under NJ Workers’ Compensation

Workers’ compensation in New Jersey offers a range of benefits to injured employees.

- Medical Benefits: Coverage for all reasonable and necessary medical expenses related to the work injury, including doctor visits, hospital stays, surgery, physical therapy, and prescription medications.

- Temporary Disability Benefits (TBD): Provides partial wage replacement while the employee is unable to work due to the injury. The amount is typically two-thirds of the employee’s average weekly wage, subject to statutory maximums and minimums.

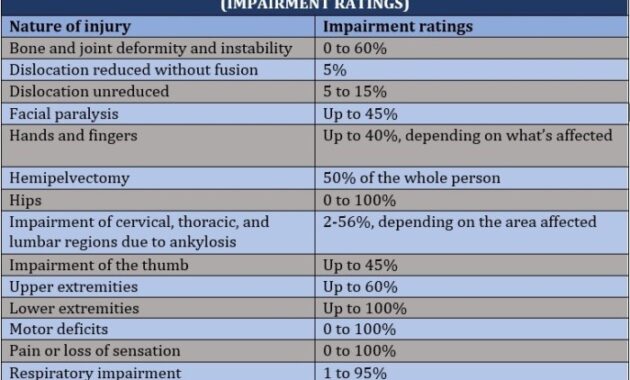

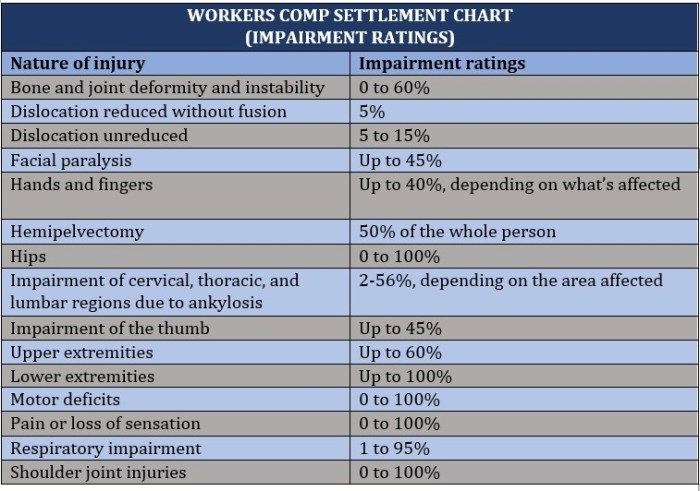

- Permanent Disability Benefits (PDB): If the injury results in permanent impairment, benefits may be awarded to compensate for the ongoing loss of earning capacity. The amount and duration of these benefits depend on the severity of the impairment and are determined by a physician’s evaluation and the Division of Workers’ Compensation.

These benefits are designed to help employees recover financially and medically following a work-related injury. The specific amount of each benefit will vary based on the individual circumstances of the case.

Common Challenges in Filing NJ Workers’ Compensation Claims

- Denial of Claims: Insurance companies may deny claims based on various reasons, such as disputing the cause of the injury or the extent of the disability. This often requires legal intervention to overturn the denial.

- Delayed Payments: Processing claims can take time, and delays in receiving benefits are unfortunately common. This can cause significant financial hardship for injured workers.

- Difficulties Returning to Work: Even after medical treatment, employees may struggle to return to their previous job due to physical limitations. Negotiating modified work duties or alternative employment can be challenging.

- Dealing with Insurance Adjusters: Insurance adjusters may attempt to minimize the extent of the injury or the amount of benefits owed. It is crucial to maintain clear and detailed documentation throughout the process.

- Navigating the Legal System: The workers’ compensation system can be complex, requiring legal expertise to navigate the intricacies of the law and the claims process.

The Role of the New Jersey Department of Labor and Workforce Development

The New Jersey Department of Labor and Workforce Development (NJDOL) plays a crucial role in administering and overseeing the state’s workers’ compensation system. It ensures fair and efficient processing of claims, protects the rights of both employees and employers, and strives to maintain a safe and productive work environment throughout the state. This involves a multifaceted approach encompassing regulation, dispute resolution, and the provision of vital resources and information.

The NJDOL’s responsibilities extend to establishing and enforcing regulations related to workers’ compensation insurance, ensuring compliance by employers, and providing guidance to both employees and employers on their rights and obligations under the law. They act as a central point of contact for resolving disputes and overseeing the appeals process. Furthermore, the department offers various educational resources and services designed to promote workplace safety and prevent workplace injuries.

Resources and Services Offered by the NJDOL

The NJDOL offers a range of resources and services to support both employers and employees navigating the workers’ compensation system. For employers, this includes assistance with understanding their obligations regarding insurance coverage, safety regulations, and claim management. Employees benefit from access to information about their rights, the claims process, and available benefits. These resources are readily available through the department’s website and various publications.

The Workers’ Compensation Dispute Resolution Process in NJ

Disputes arising from workers’ compensation claims are handled through a structured process involving various stages of review and appeal. Initially, attempts are made to resolve disagreements informally between the injured worker, employer, and insurer. If informal resolution fails, the claim may proceed to a formal hearing before an administrative law judge. Decisions made at this level can be further appealed to the New Jersey Appellate Division and ultimately the New Jersey Supreme Court. The NJDOL provides guidance and support throughout this process, ensuring fairness and adherence to legal procedures.

Key Contact Information and Online Resources

| Resource | Contact Information | Website/Online Resource | Description |

|---|---|---|---|

| NJDOL Workers’ Compensation Division | (Phone number will need to be obtained from the official NJDOL website) | [Insert official NJDOL Workers’ Compensation website address here] | Main point of contact for information and assistance. |

| Online Claim Filing System | N/A | [Insert link to the online claim filing system if available] | Allows for convenient electronic submission of workers’ compensation claims. |

| Publications and Forms | N/A | [Insert link to the publications and forms section of the NJDOL website] | Provides access to essential documents and informational materials. |

| Frequently Asked Questions (FAQ) | N/A | [Insert link to the FAQ section of the NJDOL website] | Answers common questions about workers’ compensation in New Jersey. |

Cost and Factors Affecting Workers’ Compensation Insurance Premiums in NJ

Workers’ compensation insurance premiums in New Jersey are not a fixed cost; they fluctuate based on a variety of factors. Understanding these factors is crucial for businesses to effectively manage their risk and budget. This section will explore the key elements influencing premium costs, industry rate variations, and strategies for cost reduction.

Factors Influencing Workers’ Compensation Insurance Premiums

Several interconnected factors determine the cost of workers’ compensation insurance in New Jersey. These factors are assessed by insurance carriers to determine the risk associated with insuring a particular employer. The higher the perceived risk, the higher the premium. Key factors include the employer’s industry classification, payroll, claims history, and the effectiveness of their safety programs. The New Jersey Department of Banking and Insurance plays a role in overseeing these rates and ensuring fair practices.

Workers’ Compensation Insurance Rates Across Different Industries in NJ

Workers’ compensation insurance rates vary significantly across different industries in New Jersey. Industries with higher rates of workplace injuries and illnesses, such as construction and manufacturing, generally face higher premiums. Conversely, industries with lower injury rates, such as office administration or retail, typically pay lower premiums. This reflects the inherent risks associated with different occupations. For example, a construction company will likely pay a substantially higher premium than a law firm due to the increased likelihood of workplace accidents involving heavy machinery and physical labor. Specific rate information is available through the New Jersey Department of Banking and Insurance and various insurance providers.

Strategies for Employers to Reduce Workers’ Compensation Insurance Premiums

Employers can implement several strategies to reduce their workers’ compensation insurance premiums. These strategies primarily focus on mitigating workplace risks and improving safety. Investing in comprehensive safety training programs, implementing robust safety protocols, and maintaining detailed records of safety measures can significantly reduce the likelihood of workplace accidents. Regular safety inspections, proactive hazard identification, and employee engagement in safety initiatives are also vital. Furthermore, promptly reporting and managing workplace injuries can positively influence premium calculations. Effective communication and a strong safety culture contribute significantly to lowering premiums over the long term.

Illustrative Example of Workplace Safety Programs Impacting Insurance Costs

Imagine two identical manufacturing companies, “Company A” and “Company B,” both employing 50 workers and operating in the same industry. Company A has a lax approach to safety, resulting in several lost-time injuries each year. Their safety training is minimal, and they lack a formal safety program. Company B, in contrast, invests heavily in a comprehensive safety program. This includes detailed safety training for all employees, regular safety inspections, the implementation of safety protocols, and a system for reporting and investigating accidents. Company B also actively encourages employee participation in safety initiatives. Over a five-year period, Company A experiences numerous workplace accidents, resulting in substantial workers’ compensation claims and a significantly higher premium each year. Company B, due to its proactive safety program, experiences far fewer accidents and consequently enjoys lower premiums. This illustrative example demonstrates the direct correlation between a strong safety program and reduced workers’ compensation costs. The cost savings from reduced claims far outweigh the initial investment in safety measures. The difference in premiums over five years would be substantial, highlighting the long-term financial benefits of prioritizing workplace safety.

Final Review

Successfully navigating the complexities of New Jersey workers’ compensation requires a thorough understanding of both employer responsibilities and employee rights. This guide has aimed to provide a comprehensive overview of the system, from initial policy filing to claim resolution. By understanding the key aspects discussed—eligibility, benefits, employer obligations, and the role of the NJ Department of Labor and Workforce Development—both employers and employees can better protect their interests and ensure fair treatment within the framework of New Jersey law. Remember, seeking professional legal advice is always recommended when facing specific challenges within this complex system.

Essential FAQs

What happens if my employer refuses to provide workers’ compensation insurance?

Failure to provide workers’ compensation insurance is a violation of New Jersey law and can result in significant penalties for the employer. Employees should report this to the New Jersey Department of Labor and Workforce Development.

Can I choose my own doctor for treatment under workers’ compensation?

While your employer might initially suggest a physician, you generally have the right to choose your own doctor for treatment under workers’ compensation, subject to certain guidelines. It’s advisable to clarify this with your employer and/or the insurance carrier.

What if my workers’ compensation claim is denied?

If your claim is denied, you have the right to appeal the decision. The appeal process involves filing specific paperwork and potentially presenting evidence to support your claim. Legal counsel is often recommended during this process.

How long does it take to receive workers’ compensation benefits?

The timeframe for receiving benefits varies depending on the complexity of the case and the specific circumstances. However, delays are common, and it is advisable to follow up regularly with the insurance carrier and your legal representative.