Workmen’s compensation insurance is a critical safety net for employees injured on the job, offering financial protection and medical benefits. This seemingly straightforward system, however, encompasses a complex interplay of legal responsibilities, claim processes, and benefit structures that vary significantly across jurisdictions. This guide delves into the intricacies of workmen’s compensation insurance coverage, providing clarity on employee and employer rights, claim procedures, and the factors influencing premium costs.

From defining the scope of coverage and eligibility criteria to navigating the claims process and understanding dispute resolution methods, we aim to equip both employees and employers with the knowledge necessary to confidently navigate this vital aspect of workplace safety and legal compliance. We’ll explore the different types of benefits available, employer responsibilities, and the potential consequences of non-compliance, providing a holistic understanding of this essential insurance coverage.

Definition and Scope of Workmen’s Compensation Insurance

Workmen’s compensation insurance, also known as workers’ compensation insurance, is a type of insurance that provides medical benefits and wage replacement to employees who suffer work-related injuries or illnesses. Its fundamental purpose is to protect both employees and employers from the financial burdens associated with workplace accidents and diseases. This system aims to ensure that injured workers receive necessary care and support while mitigating the potential for costly lawsuits against employers.

Workmen’s compensation insurance typically covers a wide range of injuries and illnesses. This includes acute injuries like fractures, burns, lacerations, and sprains resulting from accidents on the job. It also extends to illnesses that are directly caused or aggravated by the work environment, such as occupational diseases like asbestosis, carpal tunnel syndrome, or hearing loss. The specific coverage can vary slightly depending on the state and the specific policy. However, most policies provide coverage for medical expenses, lost wages, and rehabilitation services. In some cases, death benefits may also be provided to the dependents of a worker who dies as a result of a work-related injury or illness.

Types of Injuries and Illnesses Covered

The scope of covered injuries and illnesses is broad and encompasses a wide spectrum of workplace hazards. This includes physical injuries sustained from accidents such as falls, machinery malfunctions, or transportation incidents. It also includes illnesses stemming from prolonged exposure to harmful substances, repetitive motions, or stressful working conditions. For example, a construction worker who falls from a scaffold and breaks their leg would be covered, as would an office worker who develops carpal tunnel syndrome from repetitive typing. Furthermore, exposure to hazardous materials, such as asbestos or chemicals, leading to respiratory illnesses or cancers, would also fall under the umbrella of covered conditions. The specific determination of coverage often involves a detailed investigation by insurance providers to establish a direct link between the injury/illness and the work environment.

Occupations with High Risk and Premiums

Certain occupations inherently carry a higher risk of workplace injuries and illnesses, leading to increased insurance premiums for employers. These high-risk industries often involve physically demanding tasks, exposure to hazardous materials, or a greater chance of accidents. Examples include construction, mining, manufacturing, and logging, where workers face risks such as falls, heavy machinery operation, and exposure to harmful chemicals. Healthcare workers, particularly those in emergency medicine or surgery, also face elevated risks due to the nature of their work. The premium costs reflect the higher probability of claims in these fields, making it financially imperative for these employers to maintain comprehensive workers’ compensation insurance.

Comparison of Workmen’s Compensation Insurance Policies

The following table compares and contrasts different types of workmen’s compensation insurance policies, highlighting key differences between state-mandated and private options.

| Feature | State-Mandated Policy | Private Policy | Key Differences |

|---|---|---|---|

| Coverage | Minimum coverage required by state law | Can offer broader coverage than state minimums | Private policies often provide more comprehensive benefits and options |

| Cost | Premiums determined by state regulations | Premiums determined by insurer’s assessment of risk | Private policy premiums can vary significantly based on employer’s risk profile |

| Claims Process | Subject to state regulations and oversight | Managed by the private insurer | Private insurers may have different claim processing procedures and timelines |

| Availability | Mandatory in most states for covered employers | Available to employers who choose supplemental coverage | State-mandated policies are compulsory; private policies are optional additions |

Eligibility and Claim Process

Understanding the eligibility criteria and the claims process is crucial for both employers and employees to navigate the workmen’s compensation system effectively. This section details the requirements for eligibility and provides a step-by-step guide to filing a successful claim.

Employee Eligibility for Workmen’s Compensation Benefits

Eligibility for workmen’s compensation benefits typically hinges on several key factors. The employee must have sustained a work-related injury or illness. This means the injury or illness must have arisen out of and in the course of employment. The injury doesn’t need to occur at the workplace itself; it could happen during work-related travel or while performing work-related tasks. Furthermore, the employee must be considered an employee, not an independent contractor. The specific definition of “employee” can vary by jurisdiction, so it’s essential to consult the relevant state or federal regulations. Finally, the employee must report the injury or illness to their employer within a specified timeframe, usually within a few days, as per the regulations of their state. Failure to do so can impact their eligibility for benefits. Pre-existing conditions can complicate matters; while a pre-existing condition might not automatically disqualify a claim, the extent to which it contributes to the injury will be assessed.

Steps Involved in Filing a Workmen’s Compensation Claim

Filing a workmen’s compensation claim involves a structured process. The specific steps may vary slightly depending on the jurisdiction, but the general process remains consistent. Accurate and timely reporting is essential for a smooth claim process.

- Report the Injury: Immediately report the injury or illness to your employer, usually in writing. This initial report often serves as the foundation for the claim.

- Seek Medical Attention: Obtain medical treatment from a healthcare provider approved by your employer or the insurance carrier. This is crucial for documenting the injury and its treatment.

- Complete Claim Forms: Your employer will usually provide necessary claim forms. Complete these forms accurately and thoroughly, providing all requested information.

- Submit the Claim: Submit the completed claim forms and supporting documentation, such as medical reports, to the appropriate authority, often the employer’s insurance carrier.

- Follow Up: Follow up on the status of your claim regularly. Maintain open communication with your employer and the insurance carrier.

Employer and Employee Roles in the Claims Process

Both employers and employees play critical roles in the workmen’s compensation claims process. Effective communication and cooperation are key to a successful outcome.

Employer Responsibilities: Employers are typically required to maintain workmen’s compensation insurance, provide necessary claim forms, and facilitate the claims process. They should also maintain a safe work environment to minimize workplace injuries.

Employee Responsibilities: Employees are responsible for promptly reporting injuries, seeking appropriate medical care, and cooperating with the claims process by providing necessary information and attending medical evaluations.

Workmen’s Compensation Claim Process Flowchart

The following flowchart illustrates the typical steps involved in a workmen’s compensation claim:

- Injury Occurs: Employee sustains a work-related injury or illness.

- Report to Employer: Employee immediately reports the injury to their employer.

- Seek Medical Treatment: Employee seeks medical attention from an approved provider.

- Employer Files Claim: Employer files the claim with the insurance carrier.

- Insurance Carrier Reviews Claim: Insurance carrier reviews the claim and supporting documentation.

- Benefits Awarded (or Denied): Insurance carrier approves or denies benefits. If denied, there may be an appeals process.

- Payment of Benefits: If approved, the insurance carrier begins payment of benefits.

Benefits Covered

Workmen’s compensation insurance provides crucial financial and medical support to employees injured on the job. The specific benefits offered vary by state, but generally fall into several key categories designed to help injured workers recover and return to their lives. Understanding these benefits is essential for both employees and employers.

The primary goal of workmen’s compensation benefits is to provide comprehensive coverage for medical expenses and lost wages resulting from work-related injuries or illnesses. Beyond these core components, some jurisdictions also include provisions for death benefits to surviving dependents. The level of benefits, however, isn’t uniform across all states and territories, leading to significant variations in the financial assistance provided to injured workers.

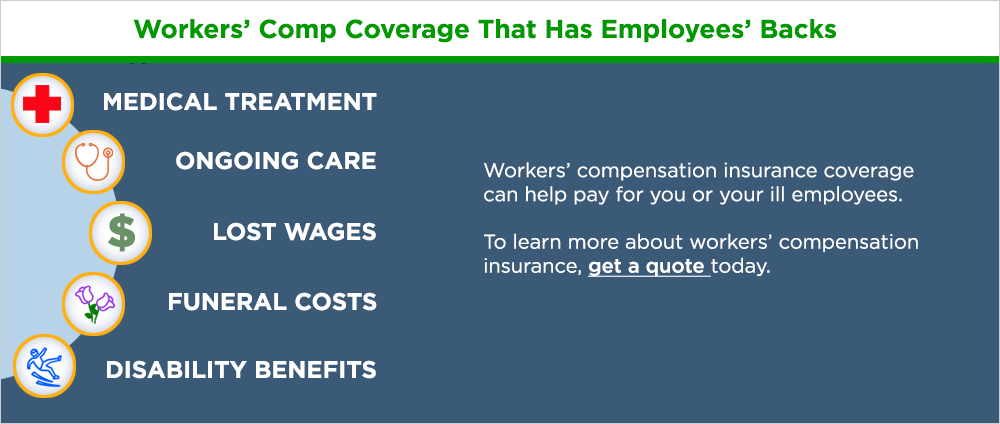

Types of Benefits

Workmen’s compensation typically covers three main categories of benefits: medical expenses, lost wages, and death benefits. Medical benefits cover all reasonable and necessary treatment related to the work injury, including doctor visits, hospital stays, surgery, physical therapy, and prescription medications. Lost wage benefits compensate for income lost due to the inability to work because of the injury. Death benefits provide financial support to the surviving spouse and dependents of a worker who dies as a result of a work-related injury.

Examples of Benefit Application

Consider these scenarios: A construction worker falls from a scaffold, sustaining a broken leg and requiring surgery and extensive physical therapy. This scenario would necessitate medical benefits to cover the cost of the surgery, hospitalization, and rehabilitation. Additionally, lost wage benefits would compensate for the worker’s inability to work during recovery. In a different scenario, a factory worker suffers a fatal heart attack due to prolonged exposure to hazardous chemicals at work. In this case, death benefits would be payable to the worker’s family.

Variations in Benefit Levels Across Jurisdictions

Benefit levels vary significantly across different states and jurisdictions. For instance, the maximum weekly benefit for lost wages can differ substantially. One state might cap weekly benefits at $1,000, while another might have a limit of $500. Similarly, the duration of lost wage benefits can vary, ranging from a few weeks to several years depending on the severity of the injury and the worker’s recovery progress. Furthermore, the availability and extent of death benefits also show considerable variation between jurisdictions. Some states may offer a lump-sum payment, while others might provide periodic payments to dependents. These differences highlight the importance of understanding the specific laws and regulations of the relevant jurisdiction.

Summary of Typical Benefits Covered

| Benefit Type | Description | Example | State Variation |

|---|---|---|---|

| Medical Expenses | Covers all reasonable and necessary medical treatment related to the work injury. | Surgery, physical therapy, medication | Coverage and reimbursement rates vary. |

| Lost Wages | Compensates for income lost due to inability to work. | Weekly payments during recovery period. | Maximum weekly benefit and duration vary significantly. |

| Death Benefits | Provides financial support to surviving dependents. | Lump-sum payment or periodic payments to spouse and children. | Availability and amount vary widely. |

Employer Responsibilities

Securing and maintaining workers’ compensation insurance is a crucial legal and ethical responsibility for employers. Failure to do so can result in significant financial and legal repercussions, impacting both the business and its employees. This section details the legal obligations of employers concerning workers’ compensation, the process of obtaining coverage, potential penalties for non-compliance, and best practices for accident prevention.

Legal Responsibilities of Employers Regarding Workmen’s Compensation Insurance

Employers are legally obligated to provide workers’ compensation insurance coverage for their employees. This is a statutory requirement, and the specific regulations vary by jurisdiction. The core responsibility centers on ensuring that employees injured on the job receive the medical care and financial support they need, regardless of fault. This includes reporting workplace injuries promptly and cooperating fully with investigations. The specifics of these legal obligations are usually defined in state or provincial legislation.

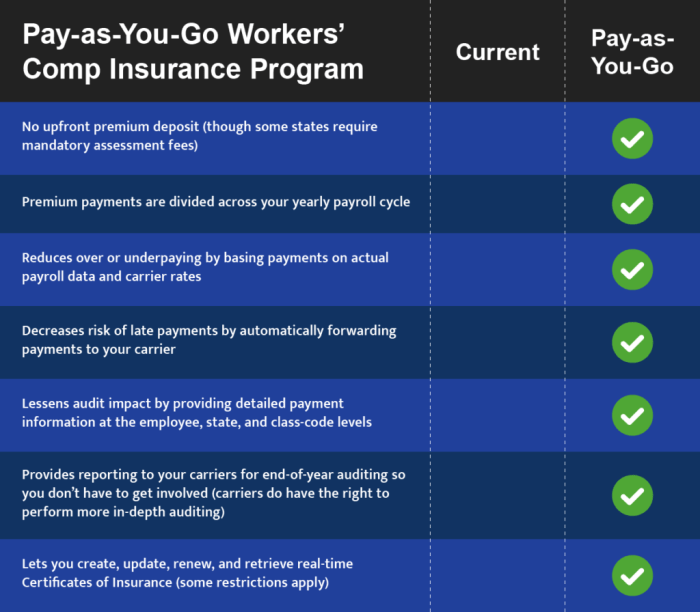

Securing Workmen’s Compensation Insurance

The process of obtaining workers’ compensation insurance typically involves contacting an insurance provider specializing in this type of coverage. Employers will need to provide information about their business, the number of employees, the type of work performed, and the level of risk involved. Based on this information, the insurer will assess the risk and provide a quote for premiums. The process might involve completing applications, providing payroll records, and undergoing a workplace safety inspection. Once the policy is in place, the employer is obligated to maintain adequate coverage throughout the employment period.

Penalties for Non-Compliance with Workmen’s Compensation Laws

Non-compliance with workers’ compensation laws carries significant penalties. These can range from substantial fines to legal action, including potential criminal charges in some cases. The penalties vary depending on the jurisdiction and the severity of the violation. For example, an employer who fails to secure coverage might face significant fines for each employee not covered, along with back-payment of premiums and potential legal fees associated with defending against claims filed by injured workers. In some cases, the employer may be subject to imprisonment. The financial implications can be devastating for a business.

Best Practices for Minimizing Workplace Accidents and Claims

Proactive measures are crucial in minimizing workplace accidents and subsequent workers’ compensation claims. Implementing a robust safety program is paramount. This includes regular safety training for employees, providing appropriate safety equipment, and conducting regular workplace inspections to identify and address potential hazards. Establishing clear safety protocols and procedures, along with encouraging a strong safety culture within the workplace, significantly reduces the likelihood of accidents. Regular employee feedback and open communication about safety concerns are also essential components of a proactive safety program. Investing in preventative measures is far more cost-effective than dealing with the consequences of workplace accidents. For example, investing in ergonomic workstations can reduce musculoskeletal injuries, while providing appropriate safety gear can prevent injuries from hazardous materials or machinery. A well-structured safety program can demonstrably reduce both the frequency and severity of workplace incidents, resulting in lower workers’ compensation costs and a safer work environment.

Employee Rights and Responsibilities

Understanding your rights and responsibilities regarding workers’ compensation is crucial for both employees and employers. This section clarifies the employee’s role in the process, outlining their entitlements and obligations to ensure a fair and efficient claims process. It also highlights scenarios where benefits might be denied.

Employee Rights Regarding Workers’ Compensation Claims

Employees have several key rights when filing a workers’ compensation claim. These rights protect them from employer retaliation and ensure they receive the benefits they are entitled to under the law. These rights vary slightly by jurisdiction, so consulting with a legal professional or reviewing your state’s specific workers’ compensation laws is advisable. Crucially, employees have the right to file a claim, receive medical treatment from approved providers, and be compensated for lost wages and medical expenses resulting from a work-related injury or illness. They also have the right to representation during the claims process, and to appeal a denied claim. Finally, employers cannot retaliate against employees for filing a legitimate claim.

Employee Responsibilities Regarding Workplace Safety and Injury Reporting

Employees have a responsibility to maintain a safe work environment and report injuries promptly. This involves following safety regulations, using provided safety equipment correctly, and reporting any unsafe conditions to their supervisors. Prompt reporting of injuries is vital for proper medical treatment and claim processing. Delayed reporting can lead to complications in establishing a direct link between the injury and the workplace. Furthermore, fabricating an injury or intentionally misleading information during the claim process can lead to denial of benefits.

Examples of Situations Resulting in Denial of Workers’ Compensation Benefits

Several circumstances can lead to a denial of workers’ compensation benefits. For instance, if an injury was self-inflicted, occurred outside of work hours and unrelated to work duties, or resulted from gross negligence or willful misconduct on the part of the employee, benefits might be denied. Similarly, failing to report an injury promptly or providing false information during the claim process can also result in denial. A common example would be an employee who sustained a weekend sports injury and falsely attributes it to a workplace incident. Another example would involve an employee ignoring safety regulations, leading to a preventable accident, resulting in the denial or reduction of benefits.

Employee Rights and Responsibilities: A Summary

It is essential for employees to understand their rights and responsibilities within the workers’ compensation system. The following list summarizes key aspects:

- Right to File a Claim: Employees have the right to file a workers’ compensation claim for work-related injuries or illnesses.

- Right to Medical Treatment: Employees are entitled to receive necessary medical treatment from approved providers.

- Right to Wage Replacement: Employees are entitled to receive compensation for lost wages due to the injury.

- Right to Legal Representation: Employees have the right to seek legal representation during the claims process.

- Right to Appeal: Employees can appeal a denied claim through the appropriate channels.

- Responsibility for Workplace Safety: Employees must follow safety regulations and report unsafe conditions.

- Responsibility for Prompt Reporting: Employees must promptly report any work-related injuries or illnesses.

- Responsibility for Honesty and Accuracy: Employees must provide accurate and truthful information during the claims process.

Dispute Resolution

Disputes regarding workmen’s compensation claims are unfortunately common. Differences of opinion can arise between employers and employees concerning the eligibility of a claim, the extent of the injury, or the appropriate level of benefits. Several methods exist to resolve these disagreements, ranging from informal negotiations to formal legal proceedings. The goal is always to reach a fair and equitable resolution that adheres to the relevant laws and regulations.

Common Methods for Resolving Disputes

Disputes over workmen’s compensation claims are typically resolved through a combination of informal and formal processes. Informal methods often involve direct negotiation between the injured worker, their employer, and the insurance carrier. If this fails, more formal processes such as mediation, arbitration, and litigation may be necessary.

Mediation

Mediation involves a neutral third party, a mediator, who facilitates communication and negotiation between the disputing parties. The mediator does not make a decision but helps the parties reach a mutually agreeable settlement. Mediation is often less expensive and time-consuming than arbitration or litigation and can preserve working relationships. A successful mediation results in a written agreement outlining the terms of the settlement.

Arbitration

Arbitration involves a neutral third party, an arbitrator, who hears evidence and testimony from both sides and then renders a binding decision. Arbitration is more formal than mediation and generally follows established rules of procedure. The arbitrator’s decision is legally binding, meaning both parties are obligated to comply with it. Arbitration can be quicker and less expensive than litigation, while still providing a formal and legally enforceable resolution.

Litigation

If mediation and arbitration fail, the dispute may proceed to litigation in a court of law. A judge will preside over the case, hear evidence, and make a final decision. Litigation is the most expensive and time-consuming method of dispute resolution but is sometimes necessary to ensure a fair and just outcome. Judges base their decisions on applicable laws, regulations, and the evidence presented by both sides.

Examples of Common Disputes and Their Resolutions

A common dispute might involve an employee claiming a work-related injury that the employer disputes. For example, an employee might claim a back injury from lifting heavy boxes, while the employer argues the injury was unrelated to work. Mediation might be attempted first, with the mediator helping both sides understand each other’s perspectives and potentially finding common ground. If mediation fails, arbitration could determine if the injury is work-related and the appropriate level of benefits. If the parties disagree with the arbitrator’s decision, litigation could be the final step. Another common dispute might center on the extent of disability. An employee might claim total disability, while the employer and insurer argue for partial disability. This might be resolved through a medical examination by an independent physician, whose opinion could influence the outcome of mediation or arbitration.

Presenting a Strong Case for a Workmen’s Compensation Claim

Building a strong workmen’s compensation claim involves meticulous documentation and a clear presentation of facts.

- Report the Injury Promptly: Immediately report the injury to your supervisor and seek medical attention. Delayed reporting can weaken your claim.

- Gather Evidence: Collect any relevant documentation, including medical records, witness statements, photographs of the accident scene, and any relevant company policies or safety manuals.

- Maintain Accurate Records: Keep detailed records of all medical treatments, lost wages, and expenses related to the injury.

- Seek Legal Counsel: Consulting with a workmen’s compensation lawyer can provide invaluable guidance throughout the process. A lawyer can help ensure all necessary forms are completed accurately and timely, and can represent your interests during negotiations, mediation, arbitration, or litigation.

- Be Honest and Consistent: Provide accurate and consistent information to your employer, the insurance company, and any medical professionals involved in your case. Inconsistencies can damage your credibility.

Cost and Premium Factors

Workmen’s compensation insurance premiums are not a fixed cost; they vary significantly based on several interconnected factors. Understanding these factors is crucial for both employers, who need to budget effectively, and employees, who benefit from a safer work environment fostered by adequate insurance coverage. This section details the key elements that determine the cost of these premiums.

Factors influencing the cost of workmen’s compensation insurance premiums are multifaceted and often intertwined. These factors encompass aspects of the business itself, the nature of the work performed, and the claims history of the employer.

Industry and Occupation Classification

Different industries and occupations inherently carry varying levels of risk. High-risk industries, such as construction or mining, where the potential for serious injuries is greater, will generally pay significantly higher premiums than lower-risk industries like office administration. Similarly, within a single industry, occupations with higher injury rates will lead to higher premiums. For example, a construction company employing roofers will likely pay more than a company specializing in interior design. This classification is based on detailed statistical data collected by insurance providers and government agencies reflecting historical injury rates and claim costs for specific jobs and industries. The more hazardous the work, the higher the premium.

Payroll

The premium calculation often involves a significant component based on the total payroll of the company. Higher payrolls typically translate to higher premiums, reflecting the increased potential for claims due to a larger workforce. This is a straightforward relationship: more employees mean a statistically higher chance of workplace accidents and resulting claims. This isn’t necessarily a punitive measure; it’s a reflection of risk assessment based on statistical probabilities.

Claims History

An employer’s past claims experience is a critical factor. A company with a history of frequent or high-cost claims will typically face higher premiums. This reflects the increased risk the insurer perceives. Conversely, a company with a strong safety record and few claims may qualify for discounts or lower premiums. This incentivizes employers to prioritize workplace safety, as it directly impacts their insurance costs. Insurance companies meticulously track this data to assess risk accurately.

Pricing Models of Insurance Providers

Different insurance providers employ various pricing models. Some may emphasize a more experience-rated approach, heavily weighting the employer’s claims history. Others may use a more community-rated approach, averaging the risk across a broader pool of employers within a specific industry. A few providers may offer customized packages, incorporating specific safety measures implemented by the employer into the premium calculation. These differences in pricing models mean that shopping around for the best rate is essential for businesses.

Hypothetical Premium Calculation

Let’s consider a hypothetical scenario: a small construction company with a $500,000 annual payroll, operating in a high-risk classification. Assume the base rate for this classification is $10 per $100 of payroll. Further, assume the company has a relatively clean claims history, qualifying for a 10% discount.

The base premium would be calculated as follows:

($500,000 / $100) * $10 = $50,000

Applying the 10% discount:

$50,000 * 0.9 = $45,000

Therefore, the estimated annual premium for this hypothetical company would be $45,000. However, this is a simplified example; actual premiums would involve more nuanced calculations, incorporating additional factors and potentially varying significantly based on the specific insurer and its pricing model.

Illustrative Case Studies

Understanding the application of workmen’s compensation insurance often benefits from examining real-world scenarios. The following case studies illustrate diverse situations, highlighting the complexities and nuances of claims processes and outcomes. Each case demonstrates the interplay between workplace environments, employee actions, employer responses, and the ultimate resolution of the claim.

Case Study 1: Repetitive Strain Injury in a Manufacturing Plant

This case involves Sarah Miller, a 35-year-old assembly line worker at a manufacturing plant. Over a period of six months, Sarah experienced increasing pain and discomfort in her wrists and hands due to repetitive movements required for her job. The plant’s management was aware of the repetitive nature of the work, but hadn’t implemented sufficient preventative measures like ergonomic assessments or regular breaks. Sarah’s doctor diagnosed her with carpal tunnel syndrome, a repetitive strain injury. Sarah filed a workmen’s compensation claim, citing the repetitive nature of her work as the cause of her injury. The employer initially contested the claim, arguing that Sarah hadn’t reported the discomfort sooner. However, medical evidence supported Sarah’s claim, and after an investigation, the claim was approved. Sarah received medical benefits to cover her treatment and temporary disability payments while she recovered. The employer was also required to implement ergonomic improvements to the assembly line to prevent similar injuries in the future.

Case Study 2: Workplace Accident Leading to Severe Injury

This case involves David Lee, a 40-year-old construction worker who suffered a serious leg injury when scaffolding collapsed at a construction site. The collapse was attributed to inadequate safety measures on the part of the employer, who failed to properly inspect and maintain the scaffolding. David suffered a compound fracture and required extensive surgery and rehabilitation. He filed a workmen’s compensation claim immediately after the accident. The employer, in this instance, readily accepted responsibility for the accident due to the clear evidence of negligence. David received comprehensive medical benefits, including surgery, physical therapy, and ongoing medical care. He also received temporary disability payments while he recovered and subsequently, permanent partial disability payments to compensate for his ongoing limitations. The employer’s insurance carrier covered all the associated costs.

Case Study 3: Denied Claim Due to Employee Negligence

This case involves Maria Rodriguez, a 28-year-old retail employee who injured her back while attempting to lift a heavy box without using proper lifting techniques. The employer had provided training on proper lifting techniques, but Maria admitted to not following the procedures. Maria filed a workmen’s compensation claim, but the claim was denied. The investigation revealed that Maria’s injury was directly caused by her failure to follow established safety protocols. While the employer had a responsibility to provide training, Maria’s disregard for safety procedures contributed significantly to her injury. The denial was based on the principle that workmen’s compensation generally does not cover injuries resulting solely from an employee’s own negligence. Maria was advised to explore other avenues for compensation, such as pursuing a personal injury claim, although the likelihood of success would depend on the specific circumstances and legal jurisdiction.

Conclusive Thoughts

Securing adequate workmen’s compensation insurance coverage is not merely a legal obligation; it’s a fundamental aspect of responsible business practice and a cornerstone of employee well-being. By understanding the intricacies of this system – from eligibility requirements and benefit structures to dispute resolution processes and cost factors – employers can proactively mitigate risks, ensure compliance, and foster a safer, more supportive work environment. Employees, in turn, can confidently navigate the claims process and protect their rights should workplace injuries occur. This comprehensive guide serves as a valuable resource for both parties, promoting a clearer understanding and facilitating smoother interactions within the workmen’s compensation system.

Quick FAQs

What happens if my employer doesn’t have workmen’s compensation insurance?

In most jurisdictions, it’s illegal for employers to operate without workmen’s compensation insurance. If your employer is uninsured and you’re injured on the job, you may have legal recourse to pursue compensation directly from them, which can be a more complex and potentially lengthy process.

Can I be fired for filing a workmen’s compensation claim?

Generally, no. Retaliatory actions against employees who file legitimate workmen’s compensation claims are illegal in most places. However, it’s crucial to document everything thoroughly.

How long does a workmen’s compensation claim take to process?

Processing times vary greatly depending on the complexity of the claim, the jurisdiction, and the insurance provider. It can range from a few weeks to several months or even longer in some cases.

What if I disagree with the decision on my workmen’s compensation claim?

Most jurisdictions provide avenues for appealing a denied or unsatisfactory claim, such as mediation, arbitration, or legal action. It’s advisable to seek legal counsel to understand your options and navigate the appeals process.